Even though Ethereum is facing bearish action after a pullback from its all-time high a few days ago, the second-largest crypto asset is still holding remarkably well above the $4,000 price mark. There has been a notable bullish response from ETH investors in the midst of the waning price action, as indicated by a rise in demand.

Demand For Ethereum Is Returning

Ethereum has continued its downward trend as the broader crypto market exhibits bearish action. Despite the continued negative pressure on price, Darkfost, an author and market expert, has disclosed a resurgence in sentiment among Ethereum investors on the largest crypto platform, Binance.

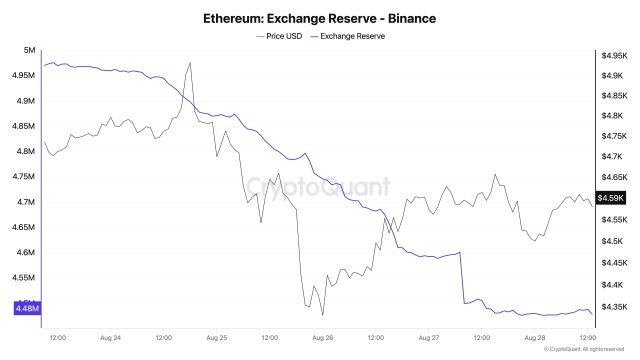

Darkfost highlighted that Ethereum’s market dynamics are shifting once again as fresh data reveals a sharp decline in reserves held on Binance. While demand for the leading altcoin has gained substantial traction in the broader crypto sector, the number of ETH on the crypto platform declined by about 10%.

This significant decline implies that investors are removing ETH from centralized platforms, a behavior frequently linked to long-term accumulation and growing confidence. During this period, increased market activity has been driven by rising demand, suggesting a potential supply squeeze that would intensify Ethereum’s next significant price rise.

In less than a week, the number of ETH on the crypto exchange declined by 10 % from 4,975,000 ETH to 4,478,000 ETH, particularly between August 23 and 27. According to the on-chain expert, this kind of decline in Binance‘s Ethereum reserves, along with the fact that the trend has continued for several days, is an obvious indication of high consumer demand.

When reserves on crypto exchanges decrease like this, investors would rather take their ETH out of the platforms. After this move, these investor either store their coins in personal wallets or carry out their tasks in DeFi in order to earn profits.

Offering a key takeaway, Darkfost noted that the consistent rate of this decline indicates that there has been a high demand for ETH in recent days, while Binance’s internal transfers might have contributed to the surge.

Large Capitals Are Flowing Into ETH

As the bull market extends, Ethereum is experiencing robust inflows, signaling growing institutional confidence. Following a prolonged period of stagnation, data from the leading analytics firm CryptoRank indicate a notable increase in inflows, as Ethereum gains widespread recognition among institutional investors.

Given that institutional participants are increasingly choosing long-term investing plans over short-term speculation, this renewed momentum demonstrates ETH’s resistance to significant market corrections.

At the time of writing, the price of ETH remains bearish and was trading at $4,398, demonstrating a nearly 4% decline in the last 24 hours. Investors’ sentiment has turned negative, as data from CoinMarketCap shows that its trading volume has reached a 10% decline in the past.