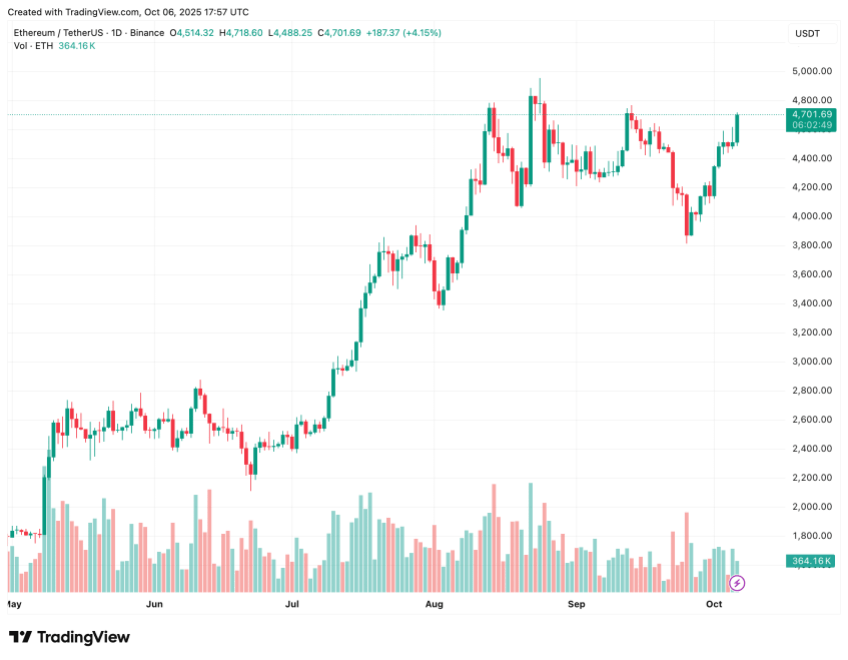

As Ethereum (ETH) steadily approaches its all-time high (ATH), some industry leaders believe that the second-largest cryptocurrency by market capitalization is not entirely benefiting from organic demand. Rather, it is being “propped up” by Korean investors looking to make a quick buck.

Ethereum Being Held Up By Korean Investors?

In an X post earlier today, crypto entrepreneur Samson Mow made some interesting observations on ETH’s current price trajectory. The crypto executive attributed ETH’s current heightened price to Korean retail investors.

Specifically, Mow stated that approximately $6 billion worth of Korean retail capital is supporting Ethereum prices. Mow blamed ETH influencers who are reportedly traveling to South Korea to market the digital asset to retail investors.

In addition, the founder of AQUA Wallet said ETH investors are not fully aware of the ETH/BTC chart, and are under the false impression that they are buying the “next Strategy.” He cautioned that it will not end well for ETH investors.

To recall, Strategy is the leading public company when it comes to the amount of Bitcoin (BTC) held on its balance sheet. According to data from Coingecko, Strategy currently holds 640,031 BTC, worth more than $48 billion at prevailing market prices.

When it comes to Ethereum-based treasury firms, BitMine leads the pack, holding more than 2.5 million ETH worth approximately $12.4 billion. Other firms like SharpLink Gaming (838,728 ETH), Coinbase ((136,782 ETH), Bit Digital (120,306 ETH), and ETHZilla (102,246 ETH) round up the top five in the list.

There are several signs that the Ethereum trading market in South Korea may be reaching overbought levels. For instance, the ETH “Kimchi premium” surged to 1.93 on October 5, a significant surge from -2.06 observed in July 2025 when the cryptocurrency traded below $3,000.

For the uninitiated, the Kimchi premium refers to the price difference where cryptocurrencies trade at higher prices on South Korean exchanges compared to global markets. This premium arises from strong local demand, limited capital flow out of Korea, and regulatory barriers that prevent easy arbitrage between Korean and international exchanges.

On-Chain Data Suggest Strong Demand For ETH

In contrast to Mow’s opinion, on-chain data shows that both institutional and retail demand for ETH is not showing any signs of slowing down. BitMine continues to stack ETH despite it trading close to its ATH territory.

At the same time, ETH-based exchange-traded funds (ETFs) continue to attract an increasing amount of inflows. Recently, US-based spot ETH ETFs attracted record inflows worth $547 million. At press time, ETH trades at $4,701, up 4.4% in the past 24 hours.