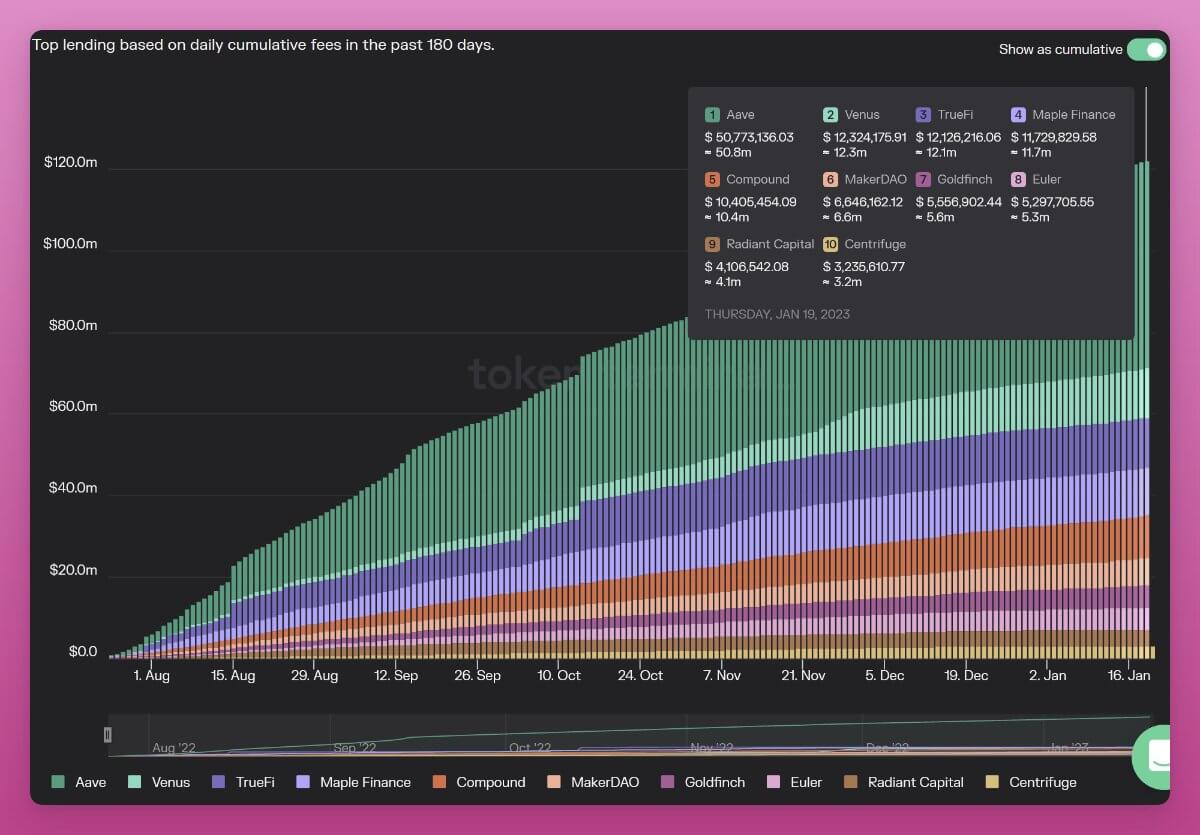

Four Real-World Asset (RWA) lending protocols ranked among the top ten Defi lending protocols that collect the largest sum of 180-day cumulative interest fees paid by users, according to crypto influencer Defilgnas’ recent analysis.

TrueFi (TRU), Maple Finance, Goldfinch (GFI), and Centrifuge (CFG) are ranked third, fourth, seventh, and tenth, respectively, according to @Defilgnas.

As of Jan. 24, TrueFi owns the third-largest incremental interest fees collected in the past 180 days with $12.1 million. Maple Finance follows TrueFi as a close fourth with $11.7 million. Goldfinch and Centrifuge also make it into the top ten with $5.6 million and $3.2 million, respectively.

In addition, MakerDAO, which ranks sixth on the list with $6.6 million, is also generating 57% of its total revenue from RWAs.

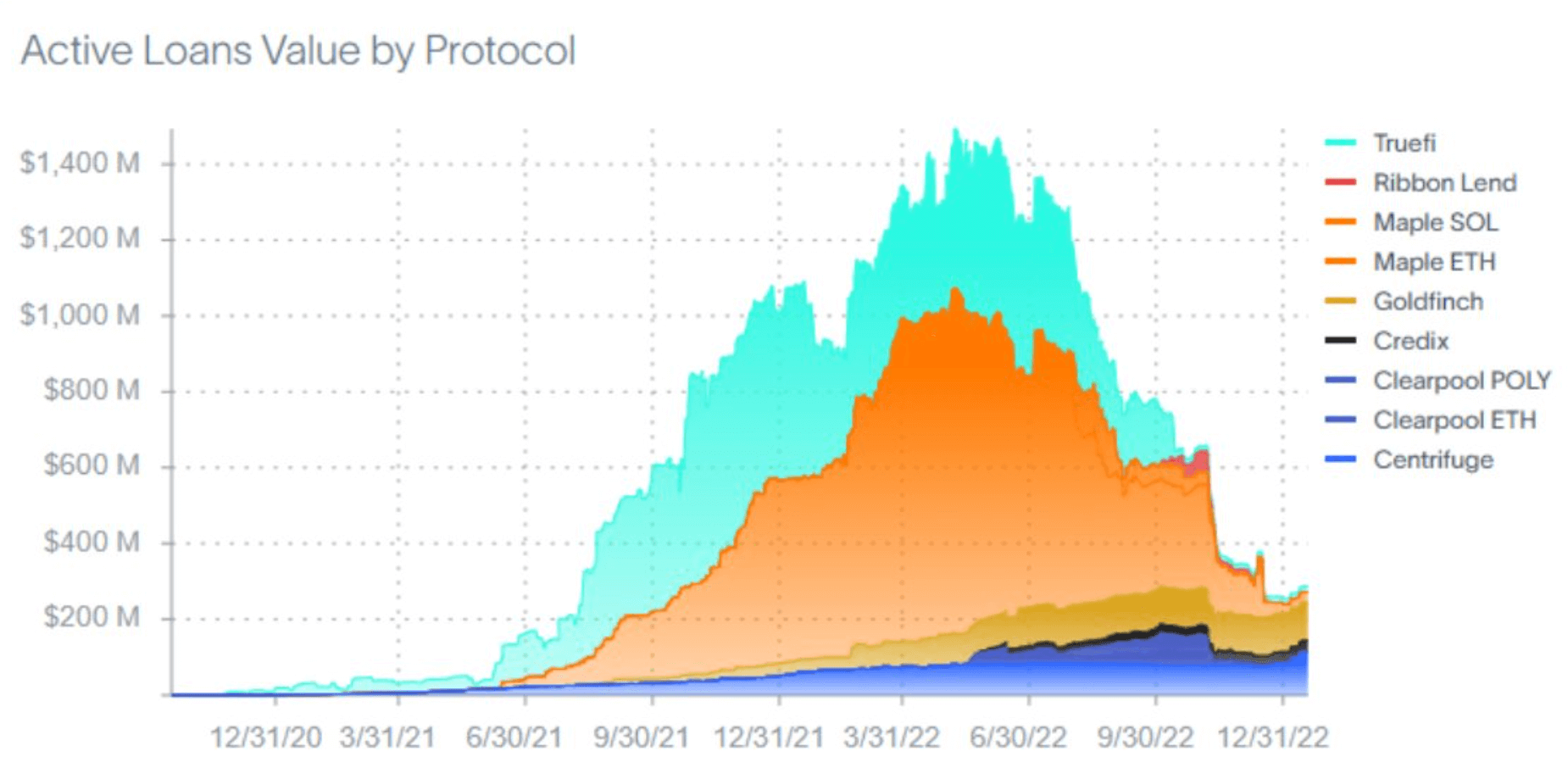

Active loans worth $326M

The cumulative value of the active loans of these four RWA protocols also adds up to $326 million, according to data.

The chart includes Clearpool, Ribbon Lend, and Credit, in addition to TrueFi, Maple Finance, Goldfinch, and Centrifuge. Altogether, the total value of active loans given by these nine protocols sits at $361 million.

TrueFi, Maple Finance, Goldfinch, and Centrifuge account for 90.3% of this sum, with a collective amount of $326 million.

Maple Finance contributes the most considerable bulk to this with $127 million worth of active loans. Goldfinch, Centrifuge, and TrueFi also add $103 million, $77 million, and $19 million, respectively.

The chart above doesn’t include Maker Dao’s active RWA loans, which stand at around $620 million.

The post Four RWA lending protocols rank among top 10 lending apps with largest collected interest appeared first on CryptoSlate.