Franklin Templeton is expanding its Benji Technology Platform to the BNB Chain, making it clear once again that crypto’s integration into mainstream finance is getting serious.

The global investment firm, with $1.6T in assets under management, launched the Benji Technology Platform to experiment with the tokenization of traditional fund shares.

Each $BENJI token represents one share in the Franklin OnChain US Government Money Fund. $BENJI tokens – already available on Ethereum, Avalanche, Stellar, and Polygon – will now be minted on the BNB Chain as well.

But why’s that driving traffic to Maxi Doge ($MAXI), sending its meme coin presale close to $2.5M and placing it as one of the best altcoins of the year? Let’s find out.

Franklin Templeton’s BNB Expansion Shows the RWA Market is Booming

BNB Chain is known for its low fees and high speed, especially among users in Asia’s emerging markets.

For $BENJI tokens, BNB integration unlocks access to a large crypto user base who are already active in the DeFi, NFT, and meme coin spaces.

While Franklin Templeton established its brand with legacy fund infrastructures, like many, it has begun experimenting with blockchain tokenization for multiple reasons.

First, blockchain offers better transparency through digital ownership records, while staying compliant. Being automated by smart contracts, the tokens require lower administrative costs and make fewer errors.

Real-time settlement is also a major upgrade compared to slow mutual fund transfers.

Another reason is the growing demographic of crypto-native investors, who don’t have faith in traditional investment channels. Blockchain integration helps the company tap into them through crypto wallets and dApps.

The third – and more important – reason is that there really isn’t a choice. The RWA tokenization market is exploding, set to reach $3.5T by 2030 in a baseline scenario – and $10T in a bullish scenario, according to a Binaryx report.

By launching tokenized real-world funds on the blockchain, the company positions itself as a pioneer in the space. As governments across the world embrace crypto, the move gives it strong credibility.

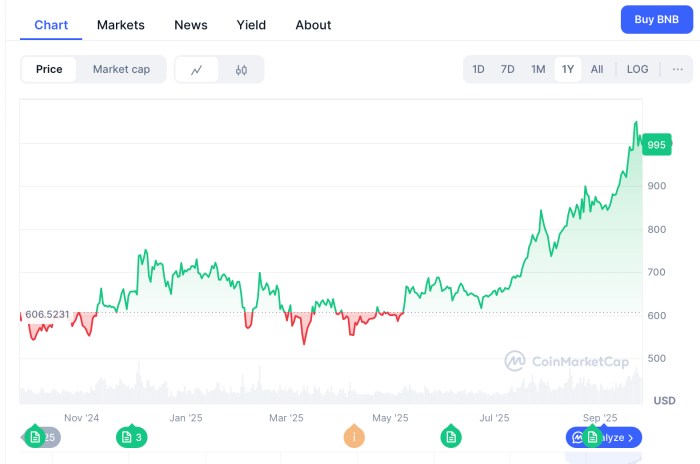

$BNB, on the other hand, has climbed around 66% in just a year. Growing adoption, especially in traditional finance, could send the token further up the charts in the coming years.

For faster gains, however, investors are turning to Maxi Doge ($MAXI) this season. The viral meme coin is on its way to smashing through the $2.5M milestone, as the market awaits an Uptober rally.

Maxi Doge Ignites Meme Coin Mania With Gym-Bro Vibes

Maxi Doge ($MAXI) is the latest in the Doge universe to spark interest.

He is $DOGE’s better-looking, beefed-up cousin. If he’s not at the gym, you will find him glued to the screen, testing his luck with 1000X leverage trades.

Maxi Doge thrives on community humor, and it’s unapologetic about that. The absurd yet relatable branding and over-exaggerated metaphors have already won it a large audience across social media, proving the potential of pure meme energy.

Maxi Doge thrives on community humor, and it’s unapologetic about that. The absurd yet relatable branding and over-exaggerated metaphors have already won it a large audience across social media, proving the potential of pure meme energy.

Unlike most new meme coins that pretend to offer utility only to disappoint investors after the TGE, Maxi Doge makes no promises. And this transparency is exactly what sets it apart from the crowd of meme coins.

At the same time, it offers multiple channels of rewards through staking, $MAXI contests, and exciting partner events.

For investors eyeing high-risk, high-reward cryptos ahead of the Uptober rally, Maxi Doge is a clear choice. It has all the right elements to ignite a meme coin mania, especially given the growing presale FOMO. That could well make $MAXI one of the top new tokens to invest in now.

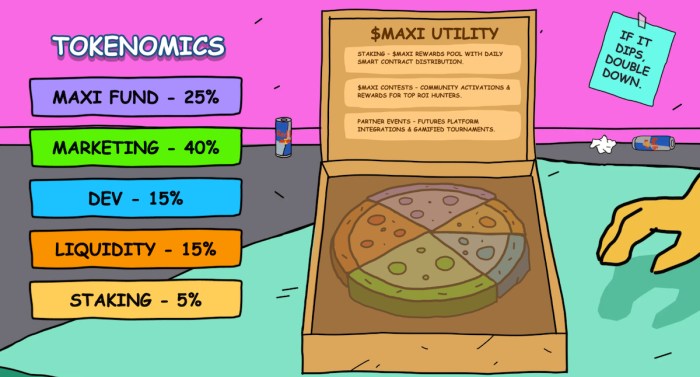

The fair tokenomics adds to the project’s appeal, with equal focus on short-term hype and long-term growth.

The fair tokenomics adds to the project’s appeal, with equal focus on short-term hype and long-term growth.

For instance, 40% of the tokens are allocated for marketing, while 25% goes to Maxi Fund. While the project has yet to announce what the Maxi Fund actually is, it is expected to fuel partnerships and integrations after the token matures.

Having raised close to $2.5M already, the presale hints at an early sell-out. Investors have just over a day left to buy $MAXI at $0.000259 before the next price surge.

The dynamic passive income program, currently offering a triple-digit APY of 134%, is another good reason to join the presale early.

Ready to jump in? Visit the official Maxi Doge ($MAXI) presale website today.

By Aaron Walker, NewsBTC – www.newsbtc.com/news/franklin-templetons-benji-bnb-expansion-fuels-fomo-around-maxi-doge