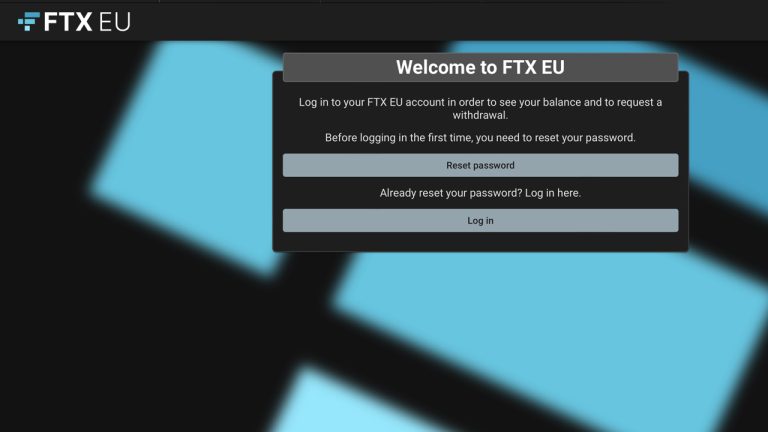

FTX’s European subsidiary, FTX Europe, has launched a new website, ftxeurope.eu, for users to withdraw funds from the now-defunct cryptocurrency platform. Withdrawal requests must be submitted through the new website and will be “subject to customary know-your-customer and anti-money-laundering checks.”

FTX’s European Arm Opens Withdrawals to Customers

According to a press release published on Friday, another division of FTX will allow withdrawals. FTX’s European subsidiary, FTX EU, has begun the process of returning segregated funds to customers in compliance with Cyprus law. The subsidiary was announced in March 2022. “We will interact with regulators in various European countries to maintain a safe and secure environment for cryptocurrency trading,” said Sam Bankman-Fried, then-CEO of the firm, at the time.

FTX EU’s announcement of allowing withdrawals comes after FTX Japan announced its plan to open withdrawals in mid-February 2023. Regarding the European subsidiary, the company stated that it would provide customers with a statement of their entitled fiat currency fund balances in compliance with Cyprus law. FTX EU was forced to return customer funds following the suspension of the company’s license by the Cyprus Securities and Exchange Commission.

Only FTX EU clients who registered an account after March 2022 are eligible for withdrawals, and some business partners will not be included. Additionally, customers must undergo formal know-your-customer (KYC) and anti-money-laundering (AML) verifications. “A customer’s withdrawal may be delayed if bank or other account details have not been sufficiently verified,” the firm stated. FTX EU also indicated that it had emailed FTX EU clients regarding the withdrawal process.

“Each FTX EU LTD customer will be entitled to withdraw their balance (in fiat currency) segregated in designated customer accounts,” the announcement explains. The new website requires users to reset their existing passwords and generate new ones for the withdrawal site. FTX EU’s website is also authorized and regulated by the Cyprus Securities and Exchange Commission.

What are your thoughts about FTX EU opening withdrawals to customers? Let us know in the comments section below.