Macro Highlights

- U.S inflation is too high for rate relief but mostly in line with expectations

- ECB raised a further 50bps taking their deposit facility rate to 3%

- Silicon Valley Bank files for chapter 11 bankruptcy

- Credit Suisse and First Republic Bank continue to be provided with liquidity

- Fed initiated stealth QE as balance sheet grows

Bitcoin Highlights

- Bitcoin hits $27,000, up roughly 60% YTD

- Bitcoin open interest has dropped by 15% in the past two weeks

- BTC dominates against Ethereum

- Bitcoin self-custody surges

Stealth QE and bailouts

Stealth bailouts

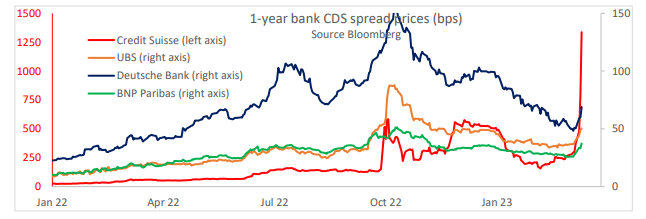

Credit Suisse grabbed a liquidity lifeline thrown by the Swiss National Bank and borrowed up to 50 billion CHF, the equivalent of 6.25% of the Swiss GDP. Credit Suisse’s share price has tanked roughly 20% this week while its default swaps continue to blow out.

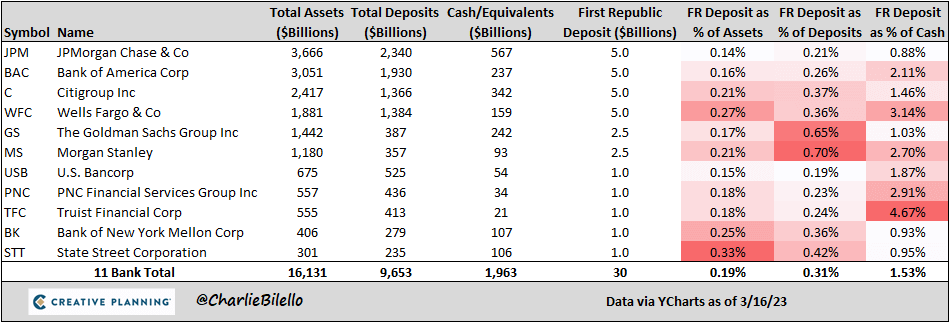

It’s not just Credit Suisse who were provided a lifeline; First Republic Bank’s (FRB) share price has dropped 78% in the past month. News was announced that 11 big banks were helping FRB as they pledged $30 billion. However, the stock continued to slide into Friday’s session.

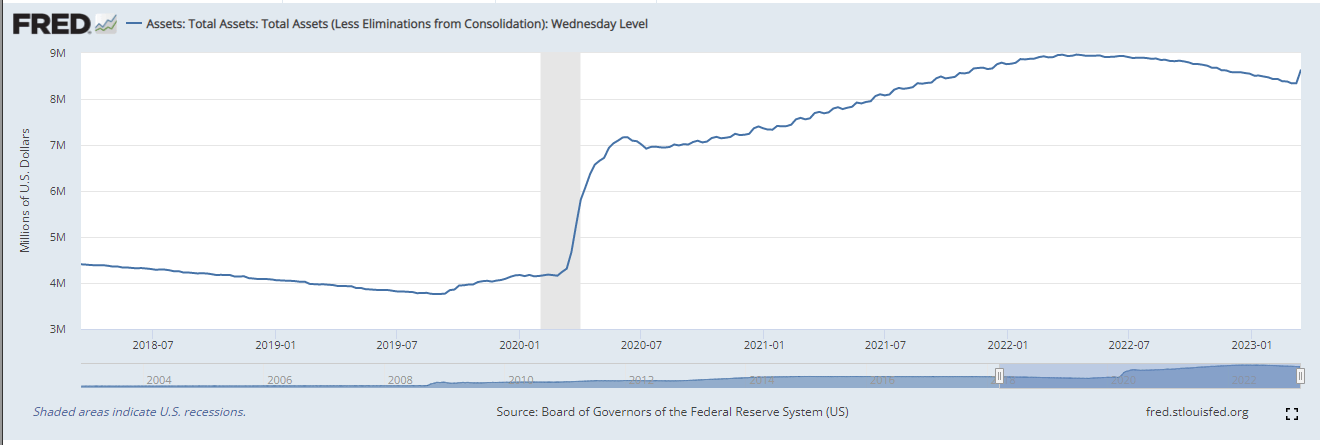

Stealth QE

The fed balance sheet has increased by over $300 billion this week, which has jumped to $8.69 trillion, wiping out half the quantitative tightening the fed has been doing for the past year.

The increase in the balance sheet is from the program BTFP; in layman’s terms, this allows institutions to swap devalued assets for full-value cash. In addition, the fed’s discount window went parabolic to $148 billion this week, the highest level since 2008. Again, in layman’s terms, distressed banks call for fed liquidity.

Balance sheet growth

- Approximately +$148.3 billion – net discount window borrowing.

- Approximately, +$11.9 billion – the new Bank Term Funding Program

Subtotal: $160.2 billion

- Approximately +$142.8 billion – borrowing for banks seized by FDIC Total:

This totals = $303 billion

ECB hikes 50bps ignores forward guidance

ECB hiked 50bps for the third consecutive session, increasing its deposit facility rate to 3%. Just six months ago, the deposit rate was at 0. Lagarde and the ECB remain firm in their “commitment to fight inflation.”, which is “projected too high for too long.”

Forward guidance was removed, and no understanding of future moves, instead reiterated, “the elevated level of uncertainty reinforces the importance of a data-dependent approach”.

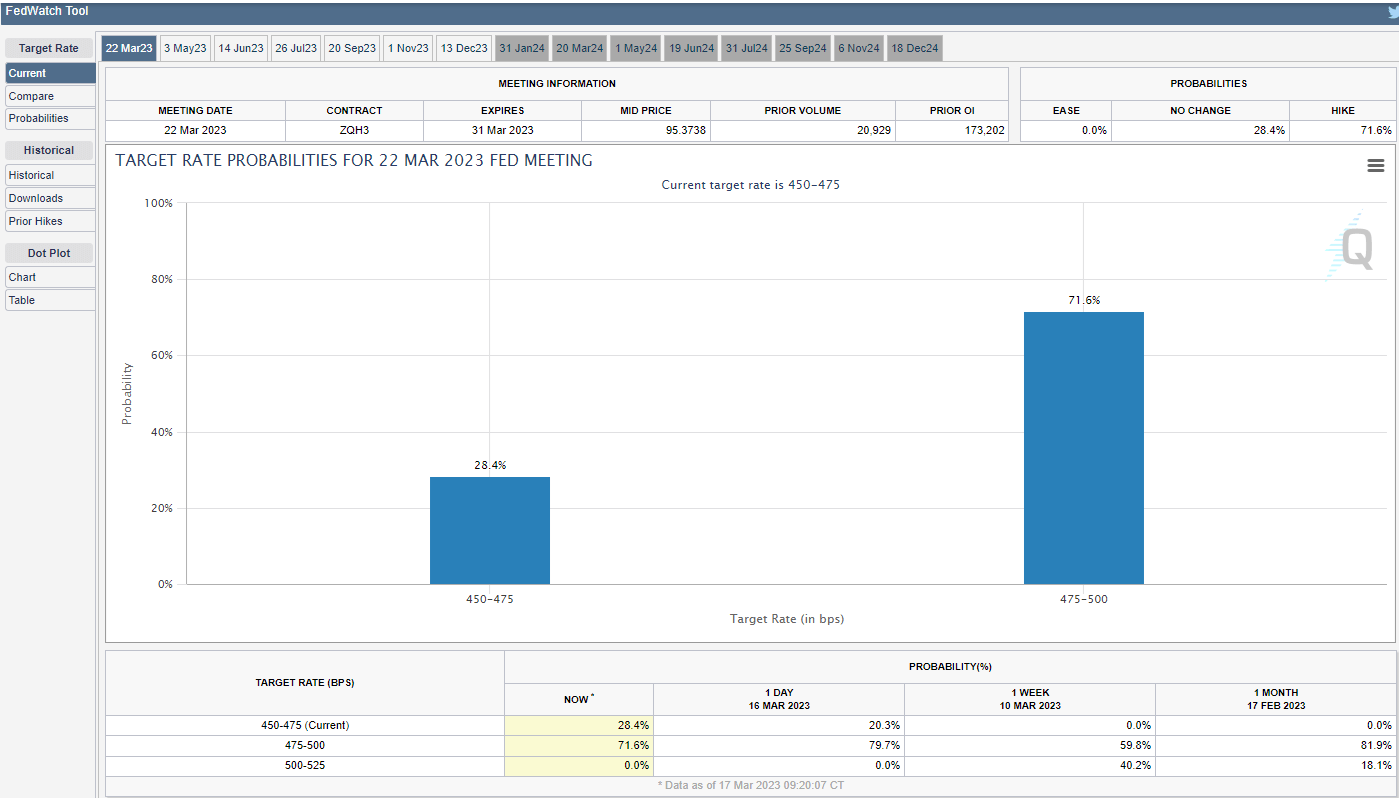

All eyes on the FOMC next week

The next FOMC meeting is on March 22, and markets are expecting a 25bps rate hike, and assuming nothing else major breaks, I think we will get it. After that, it’s anyone’s guess for the future path of the fed funds.

Powell goes into the meeting with a massive choice in either trying to contain inflation or saving a fragile financial system.

The post MacroSlate Weekly: Bitcoin shines through banking failures, bailouts appeared first on CryptoSlate.