Pepe (PEPE) has observed a plunge of 15% in the last few days, which has led to Litecoin (LTC) overtaking the memecoin in terms of market cap.

PEPE Has Ended Its Recent Bullish Run With A Drawdown Of 15%

PEPE was having an excellent May as its price was on a steep upwards trajectory, but the asset has slipped up in these last few days of the month as it has gone through a drawdown.

The below chart shows how the memecoin’s performance has looked like over the past month.

PEPE had kicked off the month trading around $0.0000061 and by the start of this week, the cryptocurrency had nearly tripled its value as it breached the $0.0000170 mark.

Since this peak on Monday, though, the frog-themed coin has suffered a notable drop. At present, the coin is trading around 0.0000143, implying that its value is down more than 15% compared to the high.

Earlier in the past day, it had looked even worse for the PEPE investors as its price had fallen under $0.0000132. The asset has rebounded since this low, but it’s unclear whether this recovery will last.

From the chart, it’s clear that, although this plunge has been notable, the holders who bought at the start of the month would still be holding large profits. More particularly, their holdings would be is up over 134% in this period.

A consequence of the latest downtrend has been a change in position for the memecoin on the top cryptocurrencies by market cap list.

It wasn’t that long ago that Pepe was trading blows with Polygon (MATIC), but after the drop, the asset’s market cap is now only the 21st largest in the sector. Though, the gap to Litecoin in 20th isn’t that much right now, so it’s possible the coin can re-enter the top 20 if its rebound continues.

The Internet-Frog-Based Token Is Still The Most Profitable Memecoin

Despite the setback PEPE might have seen in its rally, data from the market intelligence platform IntoTheBlock suggests the asset is still on top in terms of the total percentage of holders that are carrying unrealized profits.

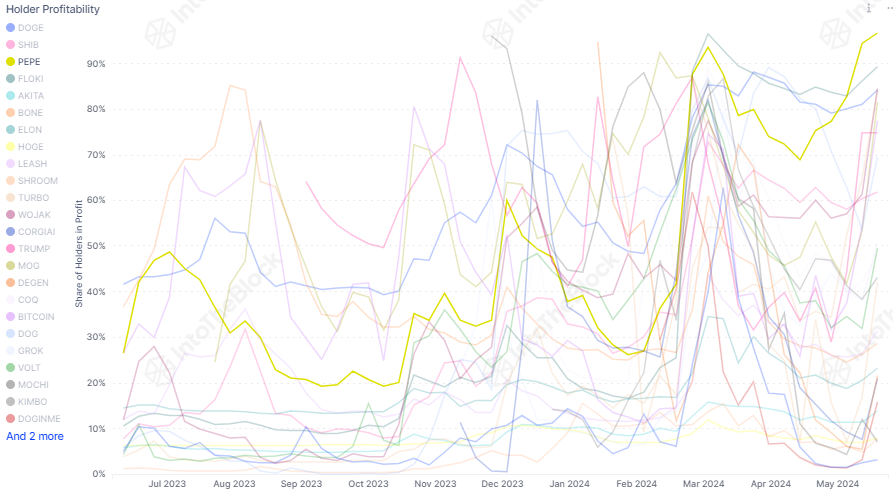

Below is a chart that shows the trend in this metric for the major memecoins in the sector over the past year.

With a holder profitability ratio of more than 90%, PEPE is on the top of the memecoins list in terms of this metric, above the likes of Dogecoin (DOGE) and Shiba Inu (SHIB).

Generally, selloffs become more probable to take place the higher this ratio’s value becomes as investors look to harvest their profits. Thus, the recent high profitability may be why the asset has suffered a crash recently.