Shiba Inu, known as the “Dogecoin Killer,” is eagerly anticipating a significant price leap. Market analyst Ashish has sparked excitement with a bold prediction: a 600% surge that could catapult the meme coin to an impressive $0.000075.

This bullish forecast comes after what Ashish describes as a nearly two-year-long slumber within a consolidation pattern. December 2023 saw Shiba Inu finally break free from this price purgatory, breaching a crucial resistance trendline. The breakout ignited a rally that culminated in a 370% surge, reaching a 2024 high of $0.000045 in early March.

However, the party wasn’t meant to last. A correction ensued, prompting Ashish to establish strategic buying zones between $0.000022 and $0.000025.

Shiba Inu: Enter The Flag Pattern

Ashish’s crystal ball sees a bullish flag pattern emerging on the 1-hour chart, hinting at a potential “second leg up.” This technical indicator suggests a period of consolidation following a sharp price increase, often acting as a precursor to another upward movement.

Despite a slight price dip today, Shiba Inu appears to have room for growth. The daily Relative Strength Index (RSI) currently sits at nearly 48, indicating that the coin is neither overbought nor oversold. This neutral territory suggests potential for upward movement, aligning with Ashish’s prediction of a second leg up.

SHIB Price Forecast

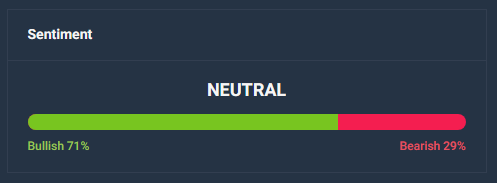

Meanwhile, CoinCodex’s current Shiba Inu price prediction forecasts a rise of 220%, potentially reaching $0.00008089 by June 24, 2024. CoinCodex’s technical indicators currently show a Neutral sentiment, while the Fear & Greed Index stands at 76, indicating Extreme Greed. Over the past 30 days, Shiba Inu has seen 12 out of 30 green days (40%) with a price volatility of 4.40%.

Given these metrics, it’s clear that Shiba Inu’s market behavior is capturing significant investor interest. The Extreme Greed reading on the Fear & Greed Index suggests a high level of enthusiasm, which, while positive for potential price gains, also warrants caution due to the possibility of rapid sentiment shifts.

The coin’s moderate volatility and the occurrence of green days indicate a steady, albeit unpredictable, upward momentum. This combination of factors makes Shiba Inu a fascinating asset to watch in the coming months.

As of today, the overall sentiment for the Shiba Inu price prediction is neutral. This assessment is supported by technical analysis indicators, where 20 indicators are showing bullish signals, while eight are signaling bearish trends.

This balanced sentiment reflects the inherent volatility and speculative nature of cryptocurrencies. The fact that a significant number of indicators are bullish suggests there is optimism about Shiba Inu’s short-term potential, possibly driven by recent market activities or positive news.

Featured image from Top Gear, chart from TradingView