Jan Happel and Yann Allemann, the co-founders of the on-chain analytics platform Glassnode, recently suggested that Solana (SOL) could make a significant move to the upside in its Ethereum pair. They alluded to the likelihood of Ethereum rising higher as another reason SOL will likely “soar.”

Solana To Make A 90% Move Against Ethereum

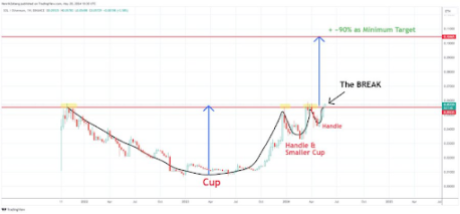

Happel and Allemann, through their shared X account (@Negentropic), highlighted a “clear Cup and Handle pattern” on the SOLETH chart, which suggests Solana will move 90% from its current price level. They also noted that the SOLETH ratio has been consolidating for some time now and looks ready for such a move to the upside.

Meanwhile, they also predict SOL will soar because they expect Ethereum “to move much higher.” Therefore, a rally for the second-largest crypto token could also spark a significant move for Solana. Interestingly, this move already looks to be in play, seeing that SOL enjoyed up to a 7% price gain on the back of Ethereum’s price rally in the last 24 hours.

Therefore, Solana could rise higher as ETH continues to enjoy an upward trend following reports that the Securities and Exchange Commission (SEC) could approve the pending Spot Ethereum ETF applications. A 90% move for Solana means the crypto token could come close to its current all-time high (ATH) of $260.

Crypto analyst Javon Marks had before now predicted that SOL could make such a move, noting that a price gain of 54% may already be in the pipeline. He further claimed that Solana achieving this price move would open up room for another price rally of 93%, which would send SOL’s price to $453.

How High Can SOL Rise In This Bull Run?

Crypto analyst Altcoin Sherpa has predicted that Solana could rise to as high as $500 by year-end, while crypto analyst Hansolar predicts that Solana could hit $600 in this market cycle. Crypto YouTuber Jake Gagain offered a more bullish prediction, stating that Solana will rise to $750, although he predicts that will happen next year.

Interstingly, Hansolar claimed that SOL could be the new Ethereum in this cycle. ETH is known to have been one of the biggest gainers in the last bull run, with its price more than tripling on its way to its current ATH of $4,891. Ethereum’s run then was thanks to its decentralized finance (DeFi) utility, with many DeFi projects utilizing the network.

Asset manager Franklin Templeton suggested that Solana will onboard the projects that will drive the next wave of crypto adoption. Therefore, Solana could undoubtedly enjoy the kind of run Ethereum did in 2021. This explains why the asset manager is bullish on SOL’s growth, as they predict it will eventually become the third-largest crypto token after Bitcoin and Ethereum.