At the ongoing Consensus 2024 conference, Ripple CEO Brad Garlinghouse expressed strong confidence in the approval of a spot XRP exchange-traded fund (ETF) in the United States, alongside potential spot ETFs for other major altcoins like Solana and Cardano. His statement comes at a pivotal time as regulatory perspectives on crypto seem to be shifting.

Ripple CEO Is Optimistic About A Spot XRP ETF

Garlinghouse criticized the current US regulatory environment for its lack of clarity, specifically targeting the Securities and Exchange Commission (SEC) for its opaque policies. “The US, being the world’s largest economy, falls into the bottom decile of regulatory clarity,” Garlinghouse remarked. He highlighted the challenges posed by the SEC’s reluctance to classify digital assets clearly, including Ethereum and others as securities.

Despite these hurdles, the recent approval of multiple spot Ethereum ETFs by the SEC marks a significant change, suggesting a softening of the agency’s previously rigid stance. “I think it’s just a matter of time, and it’s inevitable there’s gonna be an XRP ETF, there’s gonna be a Solana ETF, there’s gonna be a Cardano ETF, and that’s great,” said Garlinghouse, reflecting a broader industry anticipation of expanded crypto-based financial products.

Meanwhile, Garlinghouse acknowledged that the approval process for these ETFs will involve considerable regulatory scrutiny, but he ultimately described these challenges as mere “speed bumps” on the path to approval. The Ripple CEO also spoke out against “maximalism” in the crypto community and emphasized that each project has its own strengths and niche. He expressly wished other crypto heavyweights such as Cardano and Solana the best of luck.

Notably, the Ripple CEO’s comments come in the wake of the SEC’s recent unexpected approval of 19b-4 filings for Ethereum ETFs, which are presumably poised to begin trading in June. This follows the successful launch of Bitcoin ETFs earlier in January, spearheaded by BlackRock’s iShares Bitcoin Trust, which has amassed $20 billion in assets under management.

Cathie Wood, CEO of Ark Invest, recently noted that the approvals were likely influenced by crypto’s emerging role as a significant issue in the upcoming US presidential elections. The political implications of crypto regulation have become more pronounced, with pro-crypto lawmakers urging the SEC to broaden its ETF approvals to include other tokens.

In response to the growing demand and shifting regulatory environment, British multinational bank Standard Chartered and others have also predicted that altcoins such as XRP and Solana could soon have their own ETFs in the US. This sentiment is supported by recent legislative efforts, such as the passage of the FIT21 bill by the House of Representatives, aimed at providing more clarity in the crypto industry.

Garlinghouse emphasized the importance of getting the regulatory posture right in the United States, noting that Ripple has increasingly hired outside the US, focusing on locations like London, Geneva, and Singapore, where regulatory frameworks are more favorable.

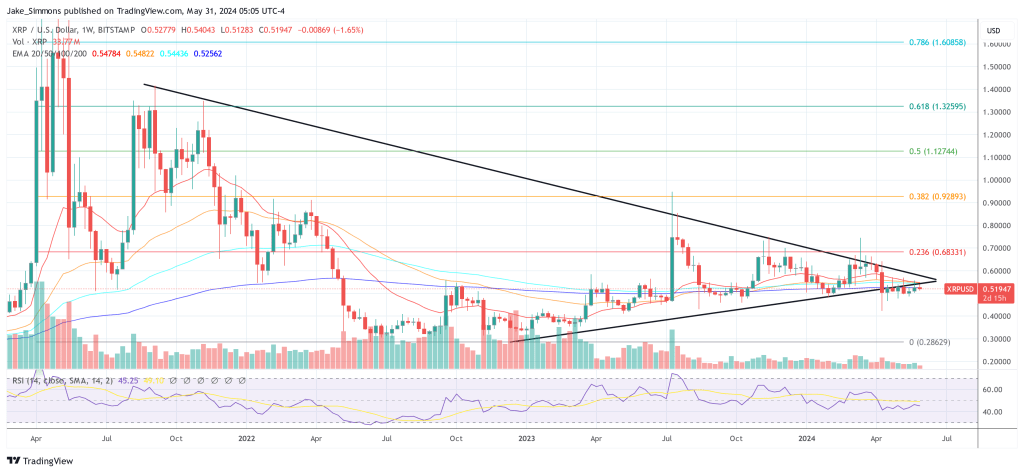

At press time, XRP traded at $0.51947.