Quick Take

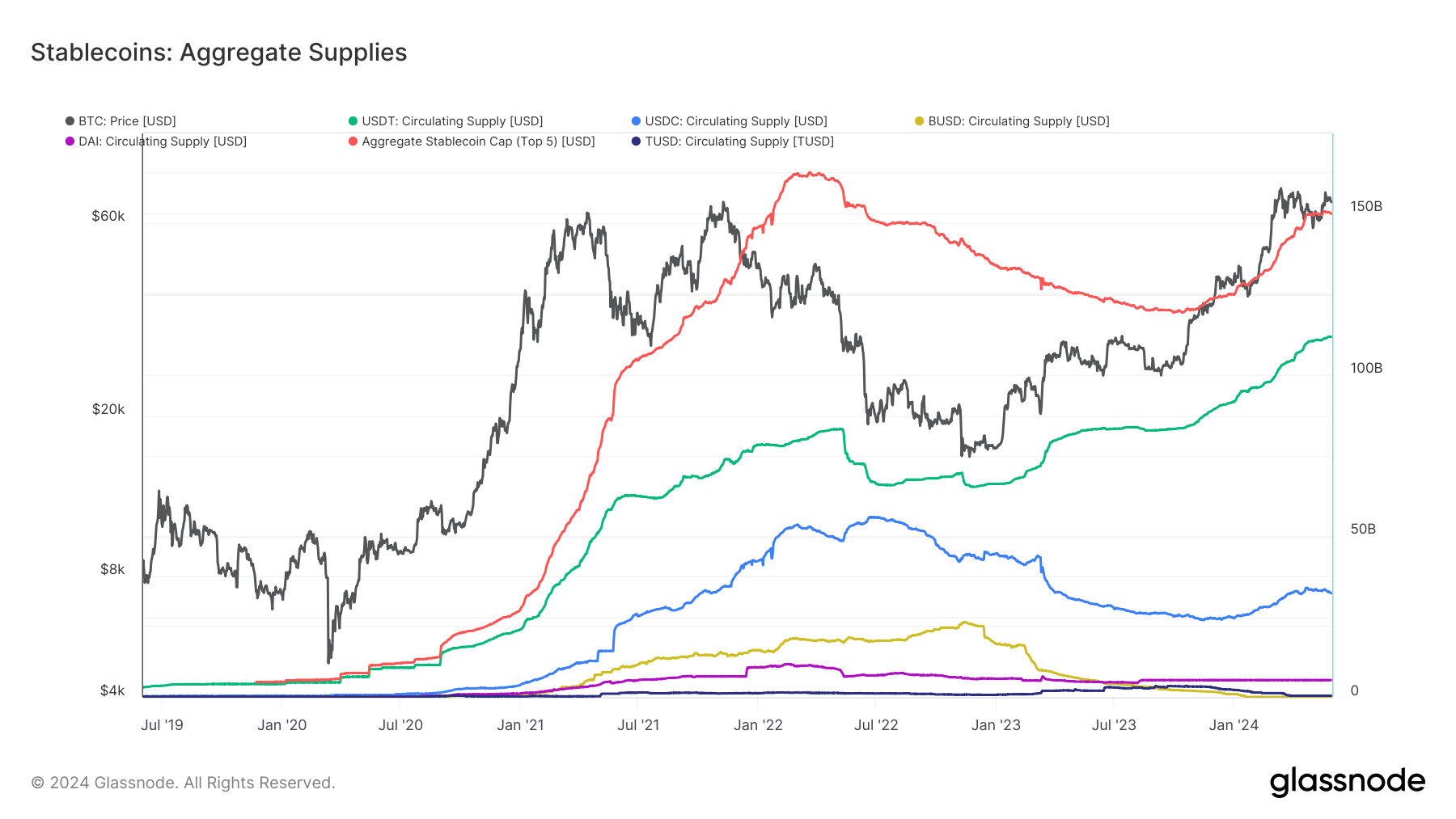

According to Glassnode data, the stablecoin market continues to grow, with the combined market capitalization of the top five stablecoins surpassing $150 billion.

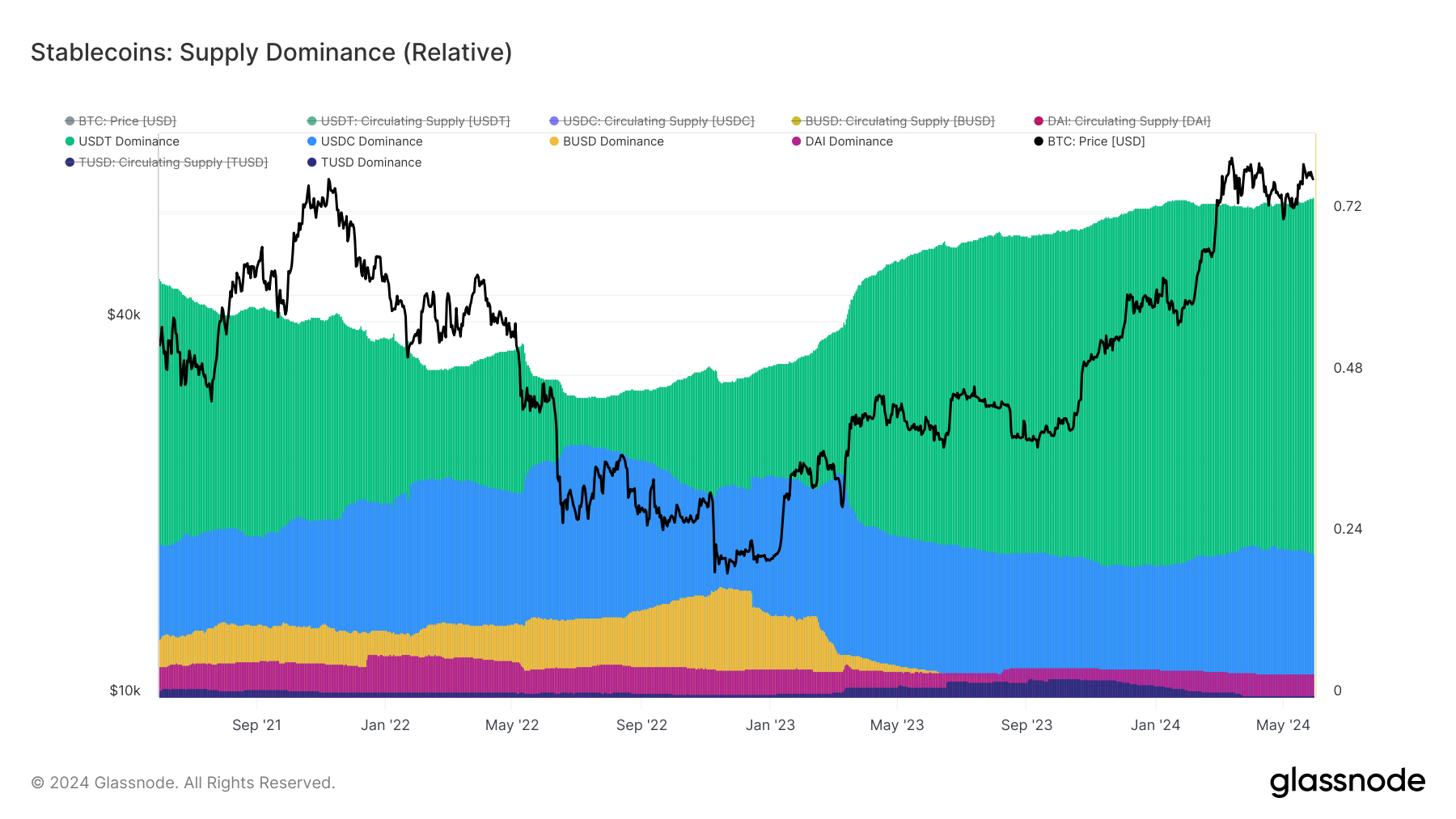

Leading the pack is Tether (USDT), which alone boasts a market cap of $112 billion — solidifying its dominance with nearly 75% market share, a level not seen since January 2021. Tether’s significant holdings in US Treasuries highlight its crucial role in the acquisition of US debt.

Glassnode data shows that USDC, the second-largest stablecoin, has a market cap of $32.2 billion. However, its market share has declined from a peak of almost 38% in July 2022 to 22% currently. This shift indicates changing trends within the stablecoin ecosystem, as investors show a growing preference for USDT.

Following USDC, DAI holds a market cap of $5.3 billion, maintaining its position as a reliable decentralized stablecoin. TrueUSD (TUSD) and Binance USD (BUSD) round out the top five with market caps of $503 million and $70 million, respectively.

The expanding market cap of these stablecoins highlights their increasing importance in the digital asset economy, providing liquidity in the market. As Tether’s dominance grows, its influence on the broader financial landscape, especially in terms of US debt acquisition, becomes ever more significant.

The post Tether asserts almost 75% dominance in stablecoin market appeared first on CryptoSlate.