The post Why Bitcoin Price is Crashing Today? When Can BTC Price See Reversal? appeared first on Coinpedia Fintech News

The cryptocurrency market faced another dip today as Bitcoin price movements dragged altcoins lower. Despite the decline, many analysts say these fluctuations are part of a broader Bitcoin trading range, not a market collapse.

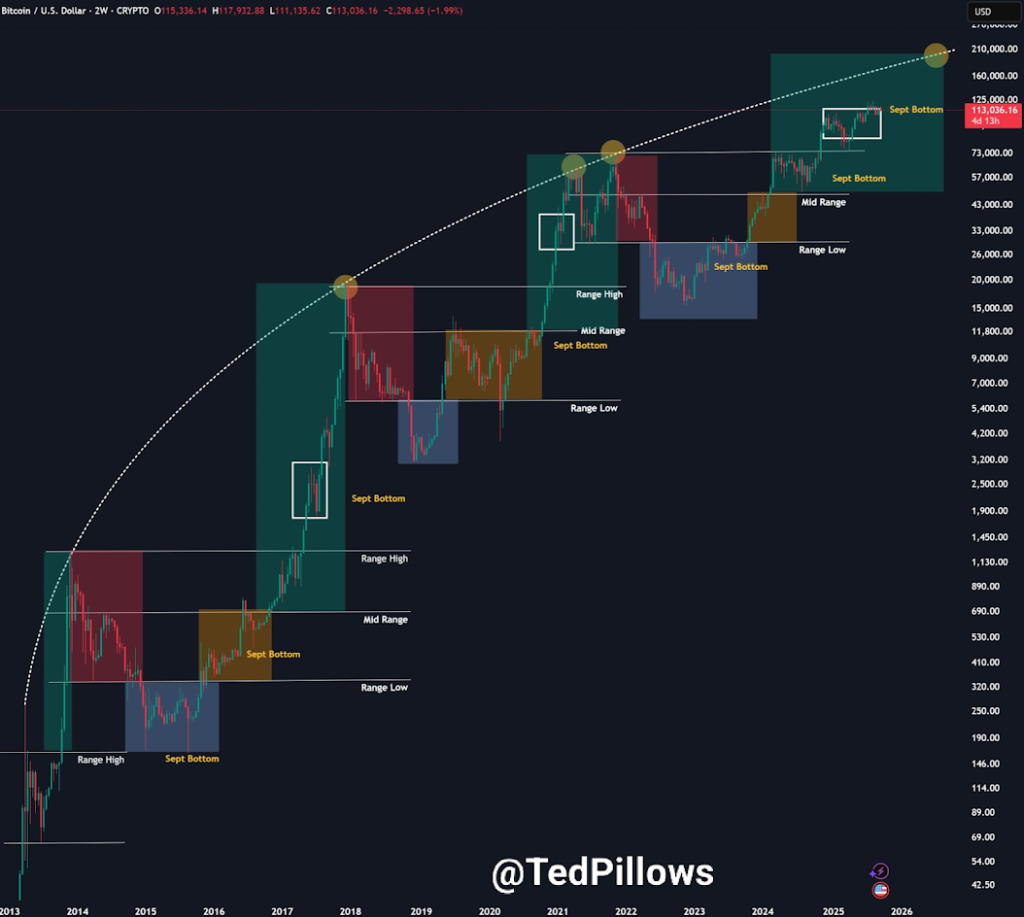

Investors often describe the process as “five steps forward, two steps back,” highlighting the cyclical nature of Bitcoin and crypto markets.

Bitcoin Liquidation Hints at Short-Term Sell-off

In two days, roughly $17.5 billion in Bitcoin options are set to expire, with a max pain point at $107,000. Historically, Bitcoin often moves toward max pain during large options expirations.

“$BTC usually bottoms in September. A big leg down may happen before a reversal, especially with this massive options expiry,” noted a crypto trader.

Recent market activity shows a Bitcoin liquidity sweep that liquidated over-leveraged longs between $109,000 and $111,000. The next cluster of liquidity lies around $107,000–$108,000, which could trigger further short-term volatility.

“Deeper liquidity sweeps often spark aggressive shorting but can set up a sharp reversal once cleared,” analysts warned.

This setup highlights the importance of monitoring Bitcoin liquidity levels and price reversal signals in September 2025.

Bitcoin Four-Year Cycle Extended to Five-Year Cycle – Raoul Pal

Raoul Pal, founder of Global Macro Investor, suggests that Bitcoin’s historic four-year cycle, driven by halving events, may now have stretched into a five-year Bitcoin market cycle.

“U.S. debt maturity extensions in 2021–22 pushed the average weighted maturity from four years to 5.4 years,” Pal said. “This could shift the Bitcoin cycle peak to Q2 2026 instead of 2025.”

This insight may help investors adjust strategies for long-term Bitcoin price cycles and anticipate future market highs.

Bitcoin Closely Follows ISM Business Cycle

Pal emphasized Bitcoin’s tight correlation with the ISM Purchasing Managers’ Index (PMI), a major indicator of U.S. economic trends:

- Above 50: Economic expansion

- Below 50: Economic contraction

“Currently, the ISM is below 50, marking the longest contraction streak in decades,” Pal said. “Periods when the ISM was below 50, like 2015–16 and 2019–20, historically preceded major Bitcoin bull runs.”

This means that Bitcoin price movements often mirror U.S. economic cycles, creating opportunities for strategic investment.

High Interest Rates Delay Bitcoin Recovery and Cycle Rebound

The Federal Reserve’s sustained high interest rate environment has put pressure on Main Street while Wall Street benefits from asset debasement.

Pal noted, “Interest rates need to decline to roll over U.S. debt and restore economic expansion. Until then, Bitcoin tends to follow the ISM’s contractionary trend.”

Investors monitoring the Bitcoin market recovery under high interest rates should expect limited short-term upside until economic conditions improve.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The market dipped due to a short-term sell-off, potentially influenced by a large $17.5 billion Bitcoin options expiry. This created volatility, liquidating over-leveraged positions.

High interest rates slow economic growth, which can delay Bitcoin’s bull market. A sustained recovery often requires lower rates to stimulate expansion and risk-on investment.

Not necessarily. Current volatility is seen as a normal correction. Historical data links Bitcoin bull runs to economic recovery phases, which may be ahead, suggesting potential for future growth.

Analysis suggests the classic 4-year cycle may be extending. The next major peak could now be in Q2 2026, influenced by broader U.S. economic debt cycles.