The cryptocurrency market has once again stumbled, with Bitcoin, Ethereum, and XRP prices plunging after what seemed like a promising rebound. Despite a strong lineup of bullish narratives, ranging from interest rate cuts in October to expanding regulatory clarity, the momentum has weakened considerably. This brings into question the crypto industry’s outlook before the end of the year.

Technical Breakdown Weakens Market Confidence

The sharp pullback began with technical cracks that appeared across Bitcoin, Ethereum, and XRP charts. The past 24 hours have seen Bitcoin, which had recently climbed above $103,000, resuming what looks like another downtrend that threatens a break below $100,000.

According to a recent outlook from The DeFi Report, the rally looks good on paper for Bitcoin and other top cryptocurrencies. However, technical analysis shows that the leading cryptocurrency is currently below several key moving averages, including the 50, 100, and 200-day indicators. These moving averages often act as dynamic support zones, and breaking below them tends to signal that bullish momentum is fading.

Ethereum has also followed this downward trend, falling back under its support at $3,400. XRP’s case has been similar, with the cryptocurrency slipping back below $2.3.

The technical deterioration across these leading assets is relaying a more cautious stance among traders, many of whom now see the market’s structure as vulnerable to further downside.

Fading Demand And Institutional Outflows

Although there are still bullish stories, ranging from pro-crypto policy direction under the Trump administration to tokenization efforts by traditional financial institutions, the inflow of fresh capital has slowed down.

Spot Bitcoin ETFs, which were once the primary source of institutional interest, have seen notable outflows, erasing billions of dollars in value since early October. In terms of net flows and AUM, the Bitcoin ETFs have been among the most successful financial products in history. However, since October 10th, the ETFs have seen $1.4b of net outflows.

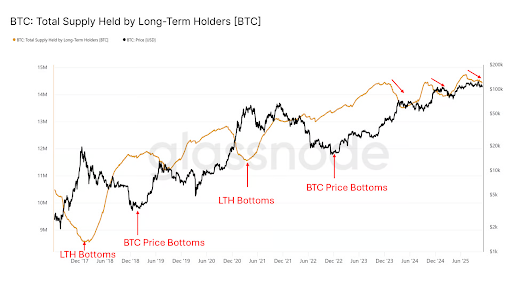

On-chain data further supports this narrative of cooling demand. Long-term holders are reducing their holdings, and the majority of these are being absorbed by short-term holders, as evidenced by data from Glassnode.

When it comes to market sentiment, optimism is still dominating much of the conversation across social media. Michael Nadeau, founder of The DeFi Report, noted that a large segment of investors are hopeful despite the recent downturn. Investors seem to be gravitating towards bullish reports, looking for something to hold on to.

At the time of writing, Bitcoin is trading at $101,720, down by another 1.3% in the past 24 hours. Ethereum is also down by about 1% in the same timeframe, trading at $3,330. XRP is feeling the brunt the most, down by 4.5% in the past 24 hours and trading at $2.2