Raoul Pal says two of crypto’s most-watched legacy altcoins—XRP and Dogecoin—are coiling for their next act. In a new X thread framed as “the Crypto Waiting Room,” the Real Vision and GMI co-founder argues that a broad swath of the market is consolidating before another leg higher, with capital already “full ported” into Ethereum and rotation risk building for assets lower down the stack.

XRP And Dogecoin Are In The ‘Waiting Room’

“Let’s talk about the Crypto Waiting Room… many key parts of the crypto ecosystem are in the waiting room ready to launch,” Pal wrote, opening a chart-dense series that he says draws on Global Macro Investor’s probabilistic framework. He placed Total3—the market excluding Bitcoin and Ethereum—“ready to launch from the waiting room,” while stressing that “OTHERS (Outside of Top 10… purest form of Alts season where all shit rises) [is] still in the waiting room but longer to launch.”

He added, “ETH… Full Port. SOL… next to leave the waiting room… Sui in the waiting room, will follow SOL.” He was explicit on the two crowd favorites: “DOGE – in the waiting room. Will full port when OTHERS does…” and “XRP… in the process of Full Porting…”

Pal’s “waiting room” metaphor is shorthand for a market structure he says rhymes with past cycles: liquidity first concentrates in the highest-quality, most institutionally accepted assets, then rotates down the risk curve as momentum broadens.

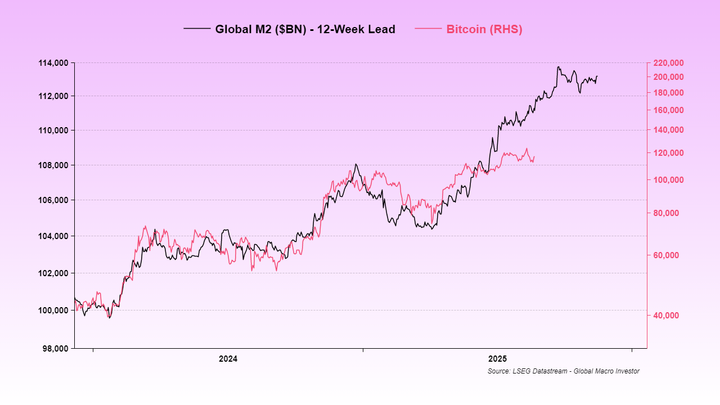

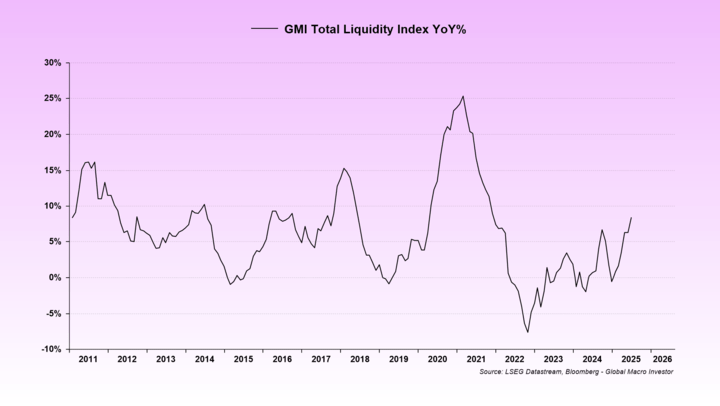

“People need to learn patience. The path is clear… but never, ever expect tick for tick perfection. It’s the pattern that counts,” he cautioned with regards to the infamous M2 money supply chart, emphasizing that GMI’s approach is to seek “rhythm and rhymes of markets” rather than one-for-one chart overlays. “As ever, at GMI we are working with probabilistic frameworks and contextualisation… we use a framework of around 1,000 key charts which we then simplify and simplify.”

The macro pillar of the thesis is liquidity. “The rate of change is only going to rise in the key metric of Total Global Liquidity… US, EU, China and Japan all need to roll debts,” Pal wrote, calling that confluence “an absurdly bullish backdrop, along with the reg changes, DAT’s and sovereign accumulation along with Wall Street acceptance.” In his timeline, the current crypto cycle “extends into Q1 2026 and possibly Q2 2026 due to slow business cycle forcing more liquidity for longer.” Or, as he put it more colloquially: “wen banana? We’ve been in it since Aug 2024 and the acceleration phase lies ahead.”

Technically, the “waiting room” framing aligns with what long-horizon charts of XRP and Dogecoin have been telegraphing. Multi-year weekly structures on both assets show a repeating cadence of broad, descending consolidations that ultimately resolve into impulsive upside, followed by new, tighter coils beneath prior cycle highs.

The current phase features exactly that kind of triangular compression: XRP’s post-spring surge has bled into a small symmetrical triangle under its 2025 peak, while Dogecoin’s 2021–2024 falling channel gave way to a higher base that is now narrowing into a wedge. Pal’s point is not that breakouts are guaranteed or imminent on a given candle, but that the setup is consistent with earlier “pre-rotation” conditions.

The investor also invoked cycle analogs without over-promising precision. “And it looks similar to 2017…” he noted, before repeating that GMI is “not looking for perfect matches.” The probabilistic takeaway, he said, is that the market remains in an expansionary regime, with breadth likely to improve as non-BTC/ETH segments clear their bases. “The only question is… will your bags go up or do you have the wrong allocation? That is up to you my friends. Buy the ticket, take the ride.”

At press time, XRP traded at $2.84.