The XRP price is positioned at a pivotal level that will determine the next trend to play out from here. This was highlighted by crypto analyst, The Alchemist Trader, in a TradingView post that shared notable insights into the current price action of the cryptocurrency. The crypto analyst also explained that there are technical points that will determine the next move, and depending on how bears and bulls perform, there could either be a lot of gains or major losses.

The Three Key Points To Watch

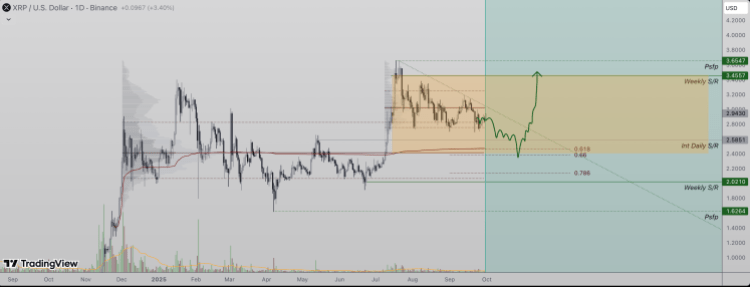

With the XRP price already showing a lot of weakness, The Alchemist Trader explains that the altcoin is now consolidating near the value area low of its local trading range. This sits around the $2.8 level that the price has been moving around over the last few weeks.

The price trading at this value area low also shows that there are a lot of sellers in the market pushing down the price. It had previously pushed the price back toward a critical support level at $2.7, and this has set the stage for either the next bounce or decline. This is because this level holds a lot of liquidity, meaning it is an equal opportunity point for both bears and bulls.

Given this trend, the crypto analyst has outlined three key technical points that investors should watch for the XRP price. The first of these is the possibility of the XRP price making consecutive lower highs and pushing it toward the value area low, a bearish signal.

Next on the list is that a breakdown from there could push the price toward the Point of Control (POC), as well as the 0.618 Fibonacci and VWAP confluence. Then, last but not least, is the fact that the liquidity at the current levels could mean that there is a sharp wick before the price begins to reverse.

How The XRP Price Could Play Out From Here

As mentioned above, one of the first things to watch out for is the test of the value area low. From here, if the XRP price were to break down, then it would signal that the decline would deepen from here. It would push the target toward the Point of Control (POC) and deeper support levels. Reaching these levels would mean a possible 25% decline toward $2.33.

However, in the event that this support holds firmly, then the analyst sees the XRP price bouncing back into its trading range. The price could wick down first, but this would end in an eventual stabilization and continuation. In this case, the target is placed at $3.5, possibly setting the price on a campaign for new all-time highs.