A senior VanEck executive has reignited a long-running debate over XRP’s real-world utility, questioning both the relevance of the XRP Ledger and the economic case for holding the token—just as a new spot ETF has posted the strongest launch numbers of any fund this year.

Matthew Sigel, head of digital assets research at VanEck, took direct aim at supporters on X, opening with a post that combined sarcasm and skepticism. “Dear XRP maxis,” he wrote, “I may never understand what your ‘blockchain’ actually does, but I’ll always respect the passion required to pretend it does something. So keep hustling!”

XRP Utility Debate Reignites

The tone set the stage for a thread that pushed beyond memes into pointed questions about developer activity and value accrual. In a follow-up post, Sigel asked: “Genuine question: has any developer ever woken up and said, ‘Time to build… on XRP’? Would love citations.”

Hours later, he underscored the lack of detailed responses from the community with a terse update: “Zero replies so far”. The challenge is clear. In a market where developer traction and on-chain activity are often treated as proxies for network value, Sigel is not just criticizing the narrative, but demanding evidence that ledger is actually a target platform for builders.

When an supporter pointed to Ondo Finance launching its OUSG tokenized Treasury fund on the XRP Ledger as proof the ecosystem is active, Sigel shifted the discussion to token economics.

“Cool initiative, but does any of this actually accrue value to XRP token holders? I’m not aware of any fee capture, revenue share, burn, or economic linkage. I think maybe I’m not smart enough to understand but I’ll keep trying to learn and update my views!”

The exchange also touched on the fortunes created around the token and the controversies attached to them. After one user sarcastically wrote that XRP had “funded a whole company [Ripple] on nothing and got a few billionaires out of it,” Sigel replied: “Like the one who funded Greenpeace’s ‘Change the Code’ campaign to pressure Bitcoin into abandoning PoW? Quite a legacy.”

The remark alludes to the well-known funding of Greenpeace’s anti–proof-of-work campaign by a Ripple co-founder, a move that has long polarized Bitcoin and XRP communities.

When another commenter accused him of trying to “hold ppl back” from investing in the token and dismissed Bitcoin as “completely speculative,” Sigel contrasted the two assets in terms of institutional adoption and state-level engagement.

He argued that “retail investors like University Endowments, Sovereign Wealth Funds, and today a Central Bank” are now in bitcoin, and claimed that “12 countries are now mining Bitcoin with direct government support, thanks to its synergies with the electrical grid,” before adding, “Anyway by all means, invest away in XRP. I’m not stopping you.”

The thread drew in Solana Foundation’s Vibhu Norby, who has previously clashed with the XRP community but here offered a more reconciliatory, if still critical, framing.

“XRP is a SoV coin similar to Bitcoin with cheaper fees wrapped in 13 years of payments mythology. Instead of Satoshi, the collective unconscious of the XRP Army centers around a company (which btw happens to be very well run). The XRPL has minimal usage for transactions compared to smart contract blockchains, but it is not important to its value just like Bitcoin has minimal transactions compared to smart contract blockchains but it is not important to its value,” Norby commented.

All of this unfolded against a striking market backdrop. Canary Capital’s spot ETF XRPC, began trading on November 13 and generated around $58 million in first-day volume, including $26 million in its first hour—enough to make it the biggest ETF debut of 2025 so far and narrowly surpass the launch-day volume of Bitwise’s Solana ETF, BSOL. The two funds now define the upper tier of single-asset ETF launches this year, with the next-best newcomer more than $20 million behind in day-one trading.

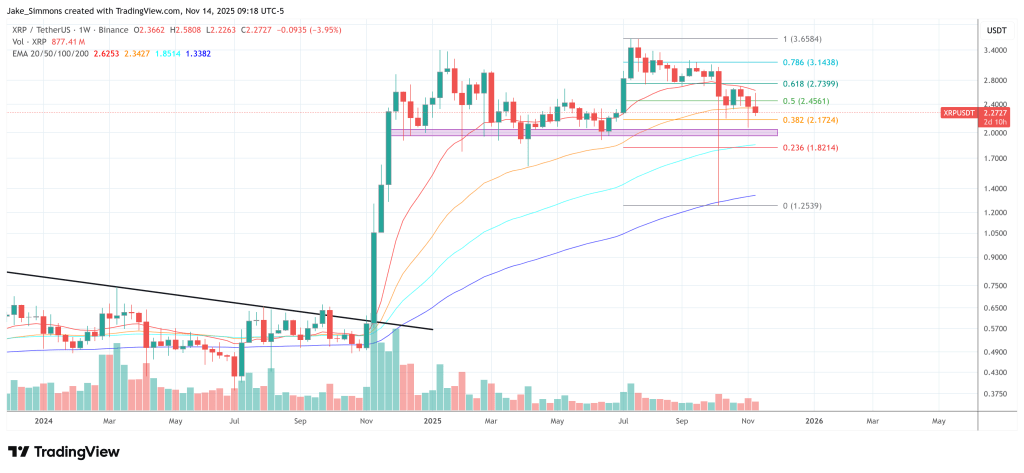

At press time, XRP traded at $2.27.