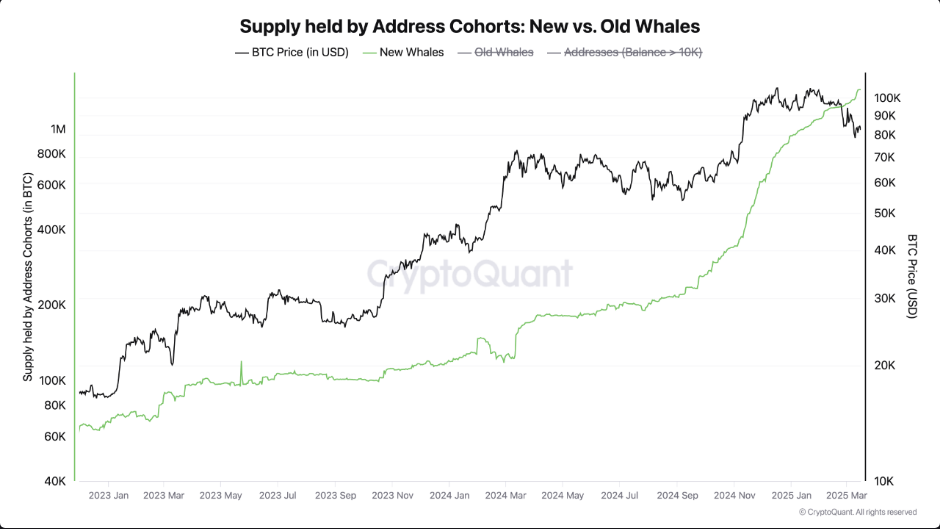

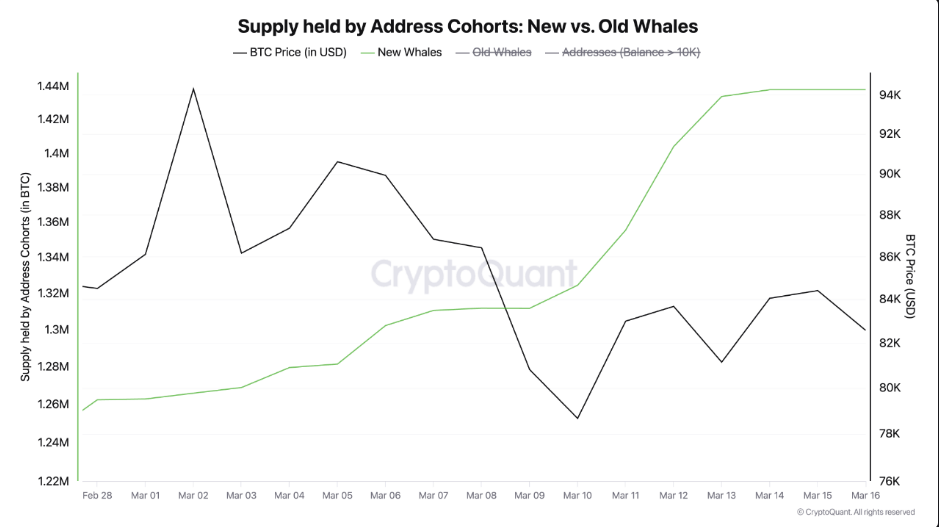

The latest wave of wealthy Bitcoin investors are enamored with the cryptocurrency. Since late November, they have been amassing more than a million Bitcoins between them. They took another 200,000 coins just last month.

According to research from CryptoQuant, these are not your normal long-term investors. The majority of these “new whales”—who each have at least 1,000 Bitcoin—are novices who have owned their holdings for less than six months. They won’t be here for long. Money is what they smell.

According to some market observers, when people see this kind of buying from major players, they’re not doing it to lose money. They anticipate a price spike in the near future, not three or five years from now, based on the swift holding pattern.

Market Shake-Up

On January 17, the open interest in Bitcoin futures reached an insane $33 billion. Then there was a crash. Approximately $10 billion worth of wagers were quickly wiped out between February 20 and March 4.

Why is this so? The finger is pointing at US President Donald Trump. The new administration’s position on cryptocurrency caused political turbulence that rocked the market. By the end of the day, futures bets saw a 14% decline in the 90-day change.

Get Ready For A Price Jump, History Says

We’ve already seen this flick. Experienced market observers are aware of the usual outcomes following these significant clearouts. Bitcoin has a tendency to rise, sometimes sharply.

Historically, Bitcoin’s price has been driven by the combination of large money buying in and hazardous investments being flushed out.

Is Bitcoin Going To Reach $160,000?

Some analysts are dusting up their crystal balls because whales are purchasing at unprecedented speeds and market leverage is at healthier levels.

Where will Bitcoin go next? A price projection of $150,000 or perhaps $160,000 is possible. That would surpass every prior record.

The basic math: prices often rise when millionaires purchase substantial portions of the finite supply of Bitcoin. Almost immediately, these new whales have altered the supply-demand equilibrium.

A cryptocurrency fund manager asserts they’re not buying just to sell at a loss—unlike retail investors, they see what’s coming before it happens.

Bitcoin owners may be in for a pleasant surprise if the current buying trend continues. The question is not if prices will increase, but rather how quickly and to what extent.

Featured image from Casa Blog, chart from TradingView