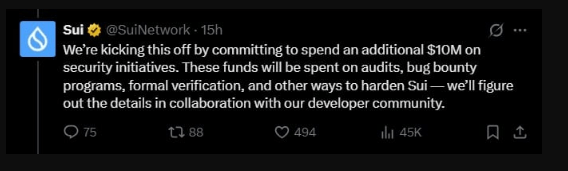

Sui Network has rolled out a $10 million fund to boost security across its system. The move comes after the Cetus Protocol hack that cost users $223 million.

Based on reports, the money will go toward audits, bug bounties and new developer tools. It’s a major shot across the bow at future attacks, but it raises questions about how those funds will be decided and spent.

The Money And The Plan

According to Sui’s team, the $10 million security fund isn’t just a pool of cash. It’s a shared resource that developers and community members will help guide. Bug bounties will be offered to anyone who finds serious flaws.

Doubling down on Sui security. A thread

The root cause of the Cetus incident was a bug in a Cetus math library, not a vulnerability in Sui or Move. But the impact on users is the same. We need to take a holistic perspective and step up our game on supporting ecosystem…

— Sui (@SuiNetwork) May 26, 2025

Audits will dig into both core code and popular dApps. And new tools aim to make it easier for builders to catch problems before they hit mainnet.

Governance Tensions On Display

According to reports, Sui is also asking token holders to vote on whether to return some of the frozen assets to Cetus users. That plan has stoked debate.

Critics say letting validators swing such decisions could put too much power in a small group. Sui’s Foundation has promised to stay neutral, but opinions are split on what “neutral” really means.

Incentives To Catch The Hacker

Cetus has put up a $6 million white‐hat bounty to recover stolen funds. Sui has added another $5 million reward for any tip that leads to the hacker’s capture.

That’s $11 million on the table for a single exploit. It sounds big. But some security experts wonder if the process will slow down or if critical details will get lost in legal wrangling.

Price Rebound

Since the hack, SUI’s price slid about 15%. It went from roughly $4.28 to a low near $3.50. At press time, it was on recovery mode, up 6% and trading at $3.72.

What Comes Next For DeFi On Sui

Total value locked (TVL) has begun inching up again. Bridged TVL, which tracks assets coming in from other blockchains, has seen a noticeable bump. Yet DEX volume and app revenue haven’t fully bounced back to pre‐hack figures.

Featured image from Unsplash, chart from TradingView