A cluster of long-idle Bitcoin moved back into circulation Wednesday, raising fresh questions about selling pressure as prices slide from recent highs.

Sleeping Coins Stir After Years

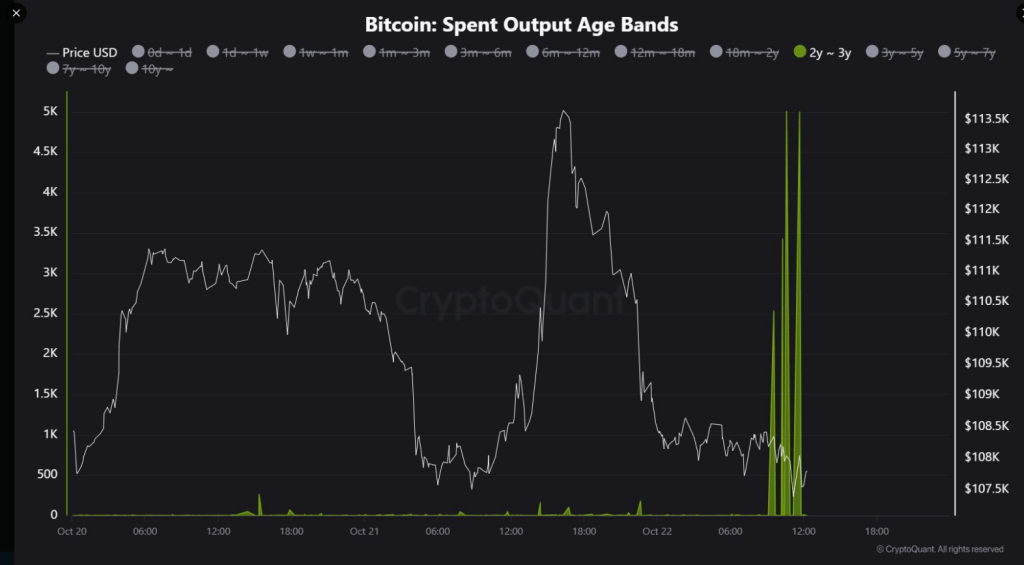

According to CryptoQuant analyst JA Maartun, exactly 15,965 BTC that had been idle for about three years were shifted earlier in the day. The coins moved while Bitcoin traded below $110,000, and at roughly $108,000 a coin the batch is worth about $1.724 billion.

CryptoQuant’s on-chain records show these addresses had little to no activity since late 2022 and early 2023, and the funds were sent to undisclosed destinations.

Market watchers flagged the timing. Old coins waking up during a pullback can signal profit-taking, or simply internal reshuffles between private accounts and trading venues.

Reports have disclosed that such moves sometimes reflect tax planning, exchange custody changes, or large holders adjusting positions — but the exact motive here is not public.

15,965 BTC aged 2–3 years just moved on-chain

This cohort has been dormant since late 2022–2023—until now. pic.twitter.com/vw2z0fjHvv

— Maartunn (@JA_Maartun) October 22, 2025

New Whales Underwater

Data from market trackers point to pressure on newer large holders who bought near recent highs. Those so-called new whales carry an average cost of $113,000 per BTC, leaving many positions underwater while prices trade below that level. The unrealized losses tied to these wallets are approaching $7 billion, according to the same datasets.

At the same time, accumulation by other big wallets continues. Analysts reported that about 26,500 BTC have flowed into accumulation addresses in recent days, a sign that some large players are adding quietly during the dip.

This mix of selling and buying creates a tug-of-war in price action. Short-term dynamics are fragile. Support around $107,000–$108,000 is one level traders are watching closely. If that zone holds, a bounce is possible; if it fails, further downside toward $100,000 could follow.

Price Targets Spark Debate

The big movements have intensified debate over how high Bitcoin might go next. According to public comments, the CEO of Galaxy Digital said reaching $250,000 by year-end would require “a heck of a lot of crazy stuff.”

Other market figures keep more bullish targets in play: Fundstrat’s Tom Lee and BitMEX’s Arthur Hayes have each voiced conviction in $200,000–$250,000 outcomes, pointing to potential policy moves and inflows as drivers.

Institutional numbers are part of the backdrop. Galaxy Digital reported a record quarter with $29 billion in revenue, a figure that supporters cite as evidence of growing institutional involvement in the market. That growth is part of why some investors remain confident even as short-term charts wobble.

Open Interest Falls, Risk Eases

Meanwhile, on-chain analytics provider Glassnode shows open interest has dropped by about 30%, reducing some of the excess speculative pressure that can amplify moves.

Lower open interest often cools violent swings and makes price trends easier to read, at least until fresh catalysts arrive.

Featured image from Pexels, chart from TradingView