Monero’s privacy chain endured its deepest-ever chain reorganization in the last 24 hours, when 18 consecutive blocks were replaced, briefly “rewriting” roughly 36 minutes of ledger history and invalidating about 118 already-confirmed transactions. Multiple independent monitors flagged the event late Sunday into Monday, describing a rollback spanning block heights 3,499,659 through 3,499,676 before nodes converged on a new best chain. With Monero targeting two-minute blocks, an 18-block reorg translates to ~36 minutes of history—an extraordinary depth for a mature proof-of-work network.

Monero Hit By Record 18 Block Reorg

“The attack against Monero is back. Hours ago XMR experienced an 18-block reorg. If you accept XMR make sure to wait for more than the usual 10 confs,” warned independent monitor OrangeFren as alerts circulated across crypto social channels. The post, amplified by several industry accounts, captured the immediate operational takeaway for merchants and services: raise confirmation thresholds until conditions normalize.

The incident comes a month after the controversial AI-oriented project Qubic claimed to have marshaled a majority of Monero’s hashrate, a campaign that coincided with a six-block reorg in August and led to temporary deposit suspensions at some exchanges. Security researchers at the time cautioned that the August event did not, by itself, prove sustained 51% dominance—streaks of mining “luck” can produce short, probabilistic reorganizations—but they also warned that persistent hashrate concentration raises the ceiling on how deep such reorgs can go. Monday’s 18-block episode materially raises that ceiling.

Community voices reacted with a mix of alarm and realism. SlowMist founder Yu Xian commented via X: “If no one in the Monero community takes the issue of block reorganization seriously, then this Sword of Damocles will always hang over Monero’s head… It may not necessarily carry out a double-spend attack, but having this capability… It doesn’t even have to strictly exceed 51% of the hash power…”

Qubic founder Sergey Ivancheglo, who is known by the alias “Come-from-Beyond”, posted via X: “Monero will stay because Qubic wanted it to stay.”

#Monero will stay because #Qubic wanted it to stay.https://t.co/49MZzF5WaI pic.twitter.com/qd7wPVoDOu

— Come-from-Beyond (@c___f___b) September 14, 2025

At a technical level, a chain reorg occurs when two valid histories compete and the network ultimately converges on the one with the most accumulated proof-of-work, discarding the other and any transactions exclusive to it. In Monero’s design, two-minute target block intervals and dynamic block sizing aim to keep throughput smooth while preserving privacy primitives like ring signatures and stealth addresses.

In practice, however, a miner or pool with outsized hashpower can—at least in bursts—privately extend a side chain and then release it, “out-working” the public tip and forcing nodes to reorganize. That is what appears to have happened here, with a depth that exceeded the de facto 10-confirmation comfort zone commonly used by wallets and exchanges.

The August–September sequence has re-opened a contentious debate inside Monero about defenses. Proposals span the spectrum: “rolling 10-block checkpoints” that finalize recent blocks to cap reorg depth; adopting elements akin to Dash’s ChainLocks to bolt on a finality layer; “detective mining” incentives to counter selfish-mining strategies at the pool level; and even merge-mining concepts that would piggyback Monero’s security on a larger PoW base.

Each trade-off is sharp: checkpoints and ChainLocks introduce degrees of centralization or new trust assumptions, while pool-level changes may be unevenly adopted. The community has not yet coalesced around a specific fix, but the urgency has unmistakably increased.

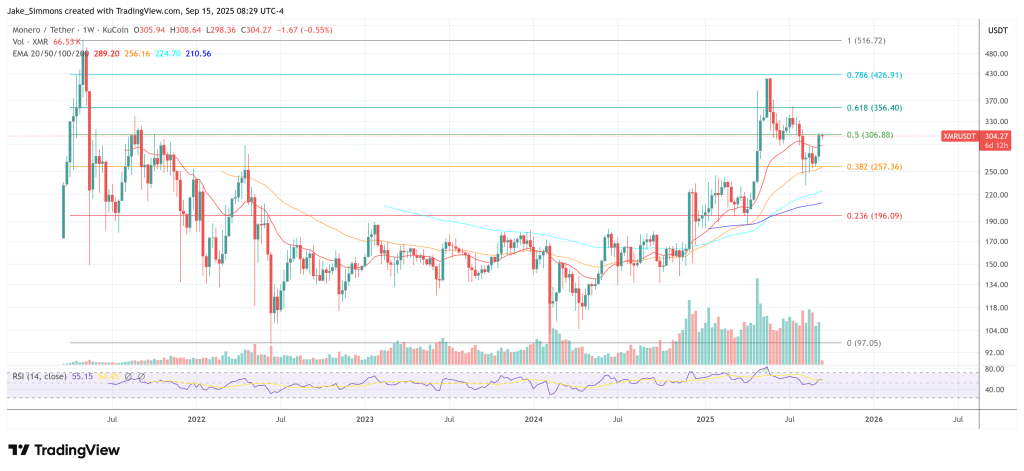

Markets treated the event with surprising resilience. Within hours, XMR rallied between roughly 5% and 7%, trading above $300 on some venues.