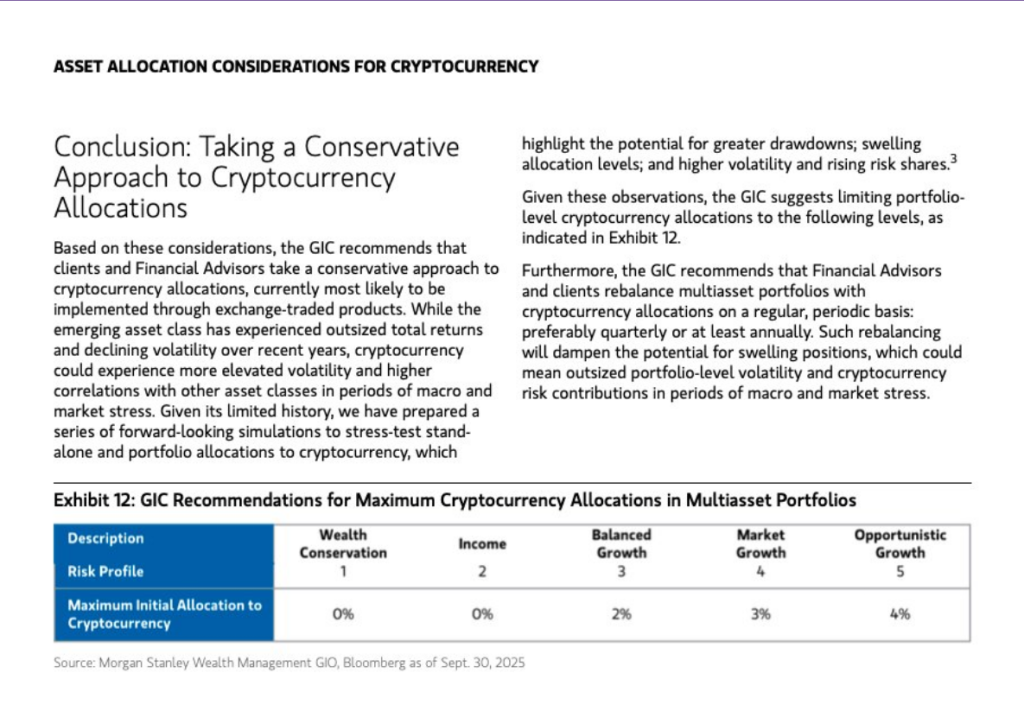

According to Morgan Stanley’s wealth unit, some clients should hold only a small slice of cryptocurrencies in their portfolios. The firm’s guidance suggests a cautious approach: up to 2% for more measured portfolios and up to 4% for those seeking higher growth.

For accounts built around income or capital preservation, the guidance points to 0% crypto exposure.

Small Stakes, Careful Rules

The bank tells its advisors that crypto belongs in the “speculative” part of a plan. Based on reports, the recommended exposure is meant to be modest and controlled.

Morgan Stanley prefers clients access crypto through exchange-traded products rather than buying every coin directly. That keeps custody and reporting simpler, the guidance says. It also means brokers can use ETFs and ETPs to give clients exposure without requiring them to manage wallets.

This is huge.

New Special Report from Morgan Stanley GIC:

“we aim to support our Financial Advisors and clients, who may flexibly allocate to cryptocurrency as part of their multiasset portfolios.”

GIC guides 16,000 advisors managing $2 trillion in savings and wealth for… pic.twitter.com/RBWFxlRNkS

— Hunter Horsley (@HHorsley) October 5, 2025

How To Manage The Exposure

Rebalancing is part of the advice. Reports show the firm recommends checking and trimming positions on a set schedule so that a crypto stake does not balloon during a rally.

Advisors are told to match allocations to client goals, not to follow price moves. The guidance is clear: this is not for people who need steady income. It is for clients who can tolerate wide swings and who understand the risk of losing their full investment.

NEW: MORGAN STANLEY IS MONTHS AWAY FROM OFFERING CRYPTO TRADING THROUGH E-TRADE, CALLS IT ‘TIP OF THE ICEBERG’ – PER CNBC pic.twitter.com/YIE8Qte7R8

— DEGEN NEWS (@DegenerateNews) September 23, 2025

A Move Toward More Access

Morgan Stanley is also working on ways to make crypto easier to trade for some of its clients. Based on reports, the firm has a deal to let E*Trade customers trade cryptocurrencies via a partner platform.

Initial support is expected for Bitcoin, Ethereum and Solana. That shift would expand access while keeping many of the operational and custody functions with a regulated provider.

Market Reaction And Industry Context

Analysts and advisors reacted as expected. Some welcomed the clarity and the firm’s limits. Others said the guidance still leaves open big questions about regulation and long-term risk.

The move reflects a wider trend among big wealth managers that are opening controlled doors to digital assets while still warning clients about volatility and legal uncertainty.

Large wealth firms set norms for many investors. When a major bank offers concrete percentages, it can shape what advisors recommend across the market.

Based on Morgan Stanley’s view, crypto will likely remain a niche allocation for the foreseeable future. The firm’s language stresses caution and individual fit.

Investors who want exposure will find managed options and clearer paths to trade. But the bottom line is unchanged: only those who can accept big swings should consider putting money into these assets.

Featured image from Unsplash, chart from TradingView