The post 2025 AI Boom Could Trigger a Crash Like 1929 or 2008, Experts Warn appeared first on Coinpedia Fintech News

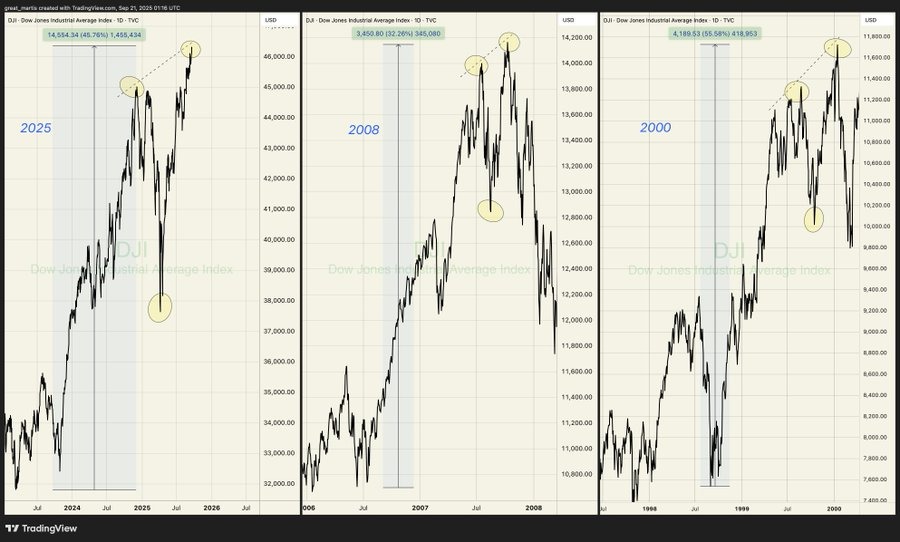

Are we heading toward another massive crash in 2025? One of the biggest questions spreading across the web. With the AI boom exploding in 2025, many experts are starting to see patterns that look shockingly similar to the past crashes, like the 1929 Great Depression, the Dot-Com Crash of 2000, and the 2008 financial crisis.

If history repeats, what will protect your money: Bitcoin, gold, or something else?

Historical Patterns Repeating Again

Historical patterns are starting to look the same again. Back in 1929 saw the Great Depression, radios were a new, hot technology, and everyone wanted one. People invested without thinking, and soon the entire market collapsed.

Similarly, in 2000, it was the Internet boom. Unknown tech startups with no profit suddenly became “million-dollar companies.” When reality hit, the dot-com bubble burst.

Later came 2008, the Financial Crisis, and people believed housing prices could never fall. Banks collapsed, the economy froze, and millions lost jobs.

Now in 2025, experts say AI stocks are growing the same way, too fast and too high. A new report from Deutsche Bank warns that the AI boom will burst soon, following the overvaluation of AI stocks.

AI Sector Overvaluation: Echoes of Past Bubbles

Many experts now say the AI tech sector is becoming too expensive, just like past bubbles. Big U.S. stocks, especially tech, are priced much higher than usual. For example, the S&P 500 is trading at 23 times its future earnings, and the famous Shiller CAPE ratio has crossed 40, a level last seen during the dot-com crash.

Major tech indexes are rising faster than their real profits, making them risky and open to sudden drops. Even Goldman Sachs CEO David Solomon recently warned that the market could fall by 10–20% within the next year.

Even legendary investor Warren Buffett is acting cautiously. His firm has built up a massive cash pile of $382 billion, a sign that he believes the market, especially AI-linked tech stocks, is too overheated right now.

Gold and Bitcoin as Safe Havens

When the economy starts looking weak, people move their money to safer places. Right now, gold & Bitcoin are among the top choices, recently hitting a new all-time high of $4,398 as more investors look for protection.

Veteran trader CasiTrades says gold and Bitcoin are the first places people run to during panic. Gold has survived every major crash in history, like 1929, 2000, and 2008, and Bitcoin often acts the same way because its supply is fixed.

Last year alone, Bitcoin jumped 121%, showing strong interest from investors who want something with limited supply. Currently, BTC is trading around $90,345, reflecting a 17% drop from its all-time high.

Even financial author Robert Kiyosaki says he is moving away from “fake money” and buying more gold and Bitcoin to protect himself from a financial crisis.