Solana opened August trading in a tight range just above $165. The coin has hovered near that level after a sharp run-up. Based on reports, big holders rotating profits and deeper DeFi ties are reshaping the outlook for SOL.

Solana Holds Critical Support Zone

According to on-chain data, SOL has formed what looks like a Golden Cross on its daily chart, where the 50-day moving average crossed above the 200-day line.

A pullback to around $160 has lined up with both the 200 EMA and a key trendline. Analysis shows that the $161–$166 area has become a firm floor.

If buyers defend that pocket, SOL could climb toward the first barrier near $189 and then test $206. Analyst Mary Emerald has penciled in a move up to $256, a gain of about 60% from today’s prices.

On its own, SOL has already jumped more than 50% from earlier lows this year. Prices still face pressure, though. The MACD histogram is negative and hasn’t shown a clear turn upward.

That hints that bears have some edge until momentum shifts. Keeping an eye on trading volume around $189 will be key. A strong break and close above that level could open the door to higher targets.

New Mobile Phone Starts Shipping In 50 Countries

Meanwhile, with the long-awaited Seeker phone now available in over 50 countries, traders are growing more optimistic about Solana’s price as they eye a possible breakout.

The handset combines Web3 functionality with a familiar smartphone experience, using hardware-level security to keep private keys and seed phrases completely separate from the app layer.

This development makes Solana a more appealing platform for developers, fuels a vibrant ecosystem and expands SOL’s role as a utility token.

Seekers officially start shipping today! Thank you for your support and belief in Solana Mobile since day one.

We’re sending tens of thousands of devices to 50+ countries around the world, so sit tight as your order makes its way through over the coming weeks. pic.twitter.com/dQtkWi26JB

— Seeker | Solana Mobile (@solanamobile) August 4, 2025

Forecasts Suggest Modest Gains Ahead

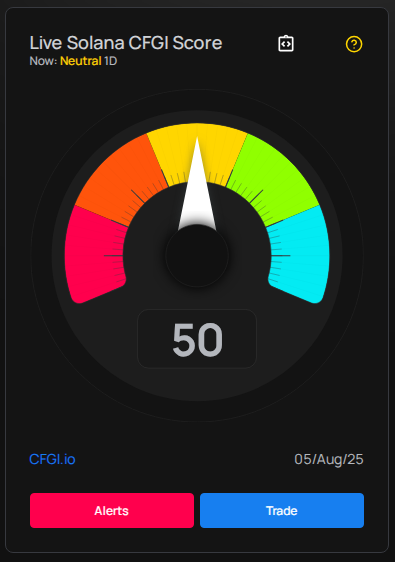

Based on the latest Solana price prediction, SOL is set to rise by 5.28% and reach $173 by September 5, 2025. Over the past 30 days, SOL has recorded 16/30 green days with 7.66% volatility. Current sentiment reads as neutral and the Fear & Greed Index sits at 50.

Looking at these metrics, a move toward $173 by early September seems likely if SOL can hold above $166. Failing that, a drop to $58 could prompt a deeper test of support.

If buyers can lock in gains around $165 and power SOL above $189 on solid volume, the path to $206—and maybe even $256—comes into view.

Until that happens, though, traders may want to wait for clearer signs that momentum has flipped.

Featured image from Nansen Research, chart from TradingView