XRP has joined the recent crypto upswing after Bitcoin pushed back above the $100,000 mark. Prices have climbed into the upper end of the $2 region. That has some traders betting on much higher targets ahead. According to market observers, a mix of classic chart setups points to fresh peaks. But history also shows that big runs often come with sharp pullbacks.

XRP Builds On Bitcoin Rally

Based on reports, the rally began when Bitcoin broke through key resistance near $100,000. XRP followed suit by rising from around $0.50 in late 2024 to about $3.30 by January 2025. That was a gain of over 500%. Since February 2025, XRP has moved sideways around $2.40. Some traders see this as a quiet pause before the next leap. Others warn that holding a narrow range can trap buyers in false breakouts.

Parabolic Run May Set Stage

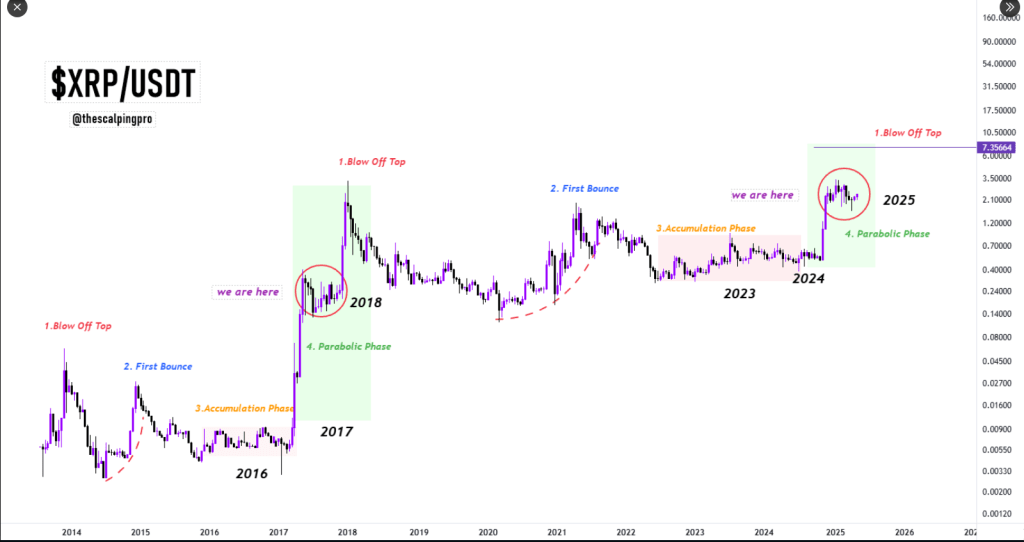

According to crypto analyst Mags, known as “the scalping pro,” this sideways action mirrors the 2017 cycle. Back then, XRP shot up from $0.0055 in March 2017 to $0.3988 in a parabolic phase. After six months of calm, the altcoin blasted to $3.40 in what he calls a blow‑off top. Now,

$XRP is going to $7

Shared XRP below $0.5 before it went 6x.

The current consolidation looks similar to what we saw back in 2017-18 before the blow off top.

Expecting something similar.

easy 2-3x from here.. https://t.co/GG8uHFwRvK pic.twitter.com/b9juSGSp5y

— Mags (@thescalpingpro) May 10, 2025

Mags expects history to echo again. He predicts an ultimate price of $7.30, about 200% above today’s levels. His chart outlines four stages per cycle: first bounce, accumulation, parabolic climb, then blow‑off top.

Triangle Breakout Signals Growth

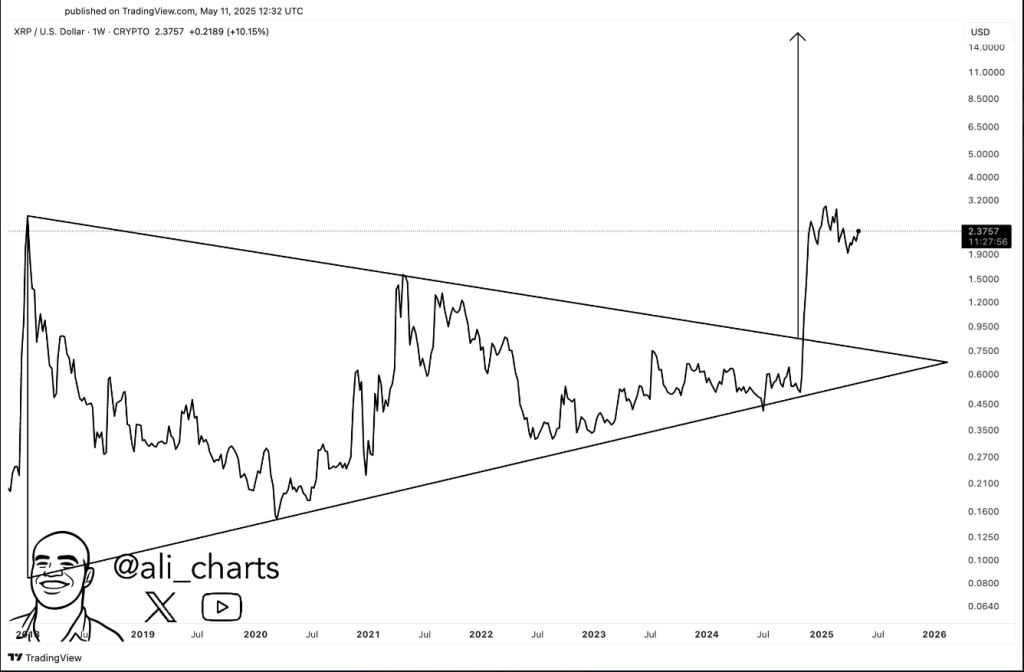

Based on reports from analyst Ali Martinez, there’s another setup in play. He points to a multi‑year symmetrical triangle that ran from January 2018 to November 2024. XRP broke out of that pattern when it surged toward $2 after the US elections last year.

If the governing pattern behind $XRP is this symmetrical triangle, the target could be $15. pic.twitter.com/zFICoLyu2x

— Ali (@ali_charts) May 11, 2025

Martinez figures the measured move from the triangle could push XRP to $15. That would be a 520% jump from $2.40. He adds that the current pullback may simply be the consolidation phase after the breakout.

XRP: From $0.0028 To $3.92—And Bullish Now

XRP’s biggest peak, according to CoinCodex, came on January 4, 2018, when it hit $3.92, and its deepest drop was on July 7, 2014, at just $0.002802. After that all-time high, the token fell to a cycle low of $0.113268 before climbing back up to a cycle high of $3.38. Right now, most price forecasts for XRP are upbeat, and the market’s Fear & Greed Index sits at 70—solidly in the “Greed” zone.

Featured image from Unsplash, chart from TradingView