Shark Tank star Kevin O’Leary and billionaire hedge fund manager Bill Ackman have been slammed for stating that they believe Sam Bankman-Fried (SBF) was telling the truth that he “didn’t knowingly commingle funds.” The former CEO of the collapsed crypto exchange FTX also said he “wasn’t running Alameda,” so he “didn’t know exactly what was going on.”

Kevin O’Leary, Bill Ackman Defend Sam Bankman-Fried

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, and billionaire hedge fund manager Bill Ackman were slammed Thursday after they said they believe former FTX CEO Sam Bankman-Fried (SBF) was telling the truth during an interview at The New York Times’ Dealbook Summit, aired Wednesday evening. Crypto exchange FTX collapsed and filed for bankruptcy on Nov. 11. An estimated one million customers and investors lost billions of dollars in the exchange meltdown.

Bankman-Fried said during the interview that he “didn’t knowingly commingle funds.” He also shifted blame to Alameda Research, stating: “I wasn’t running Alameda … I didn’t know exactly what was going on.”

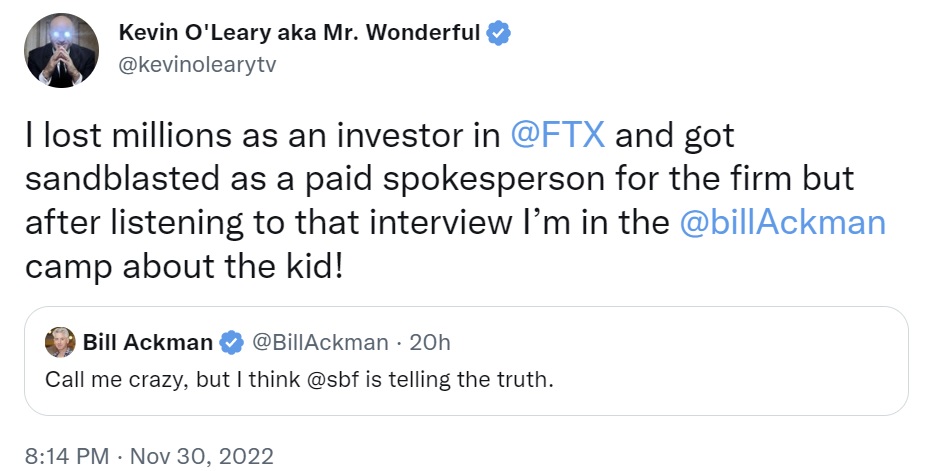

While most people in the crypto community do not believe Bankman-Fried’s story, at least two prominent people spoke up in favor of the former FTX CEO. Ackman, the CEO and portfolio manager of Pershing Square Capital Management, tweeted after the interview: “Call me crazy, but I think SBF is telling the truth.”

O’Leary quickly concurred, tweeting that he lost millions as an investor in FTX and got sandblasted as a paid spokesperson for the crypto exchange. However, he stressed that after listening to the interview, he agrees with Ackman “about the kid.”

Many people disagreed with O’Leary and Ackman. Some called them “morons,” “idiots,” and “scammers.” One wrote: “I’m a bit confused why people have this view on SBF as the really smart kid that screwed up. He is almost 31, which means he’s a grown man. This isn’t a 23-year-old fresh grad making a trading error on the desk. The narrative around this story shouldn’t really be that.”

“I imagine that if I was a public spokesperson for what turned out to be a Ponzi, I’d probably hope the leader got off without criminal charges as well (less likely criminal charges would be brought against me). Just saying, look at the incentives,” another commented.

A third opined: “Think I understand now. All of these statements are a form of legal protection and that interview was crafted in a very deliberate manner. Better to be a spokesperson for something that failed than something that committed mass fraud. Blatantly obvious the latter is true.” A fourth said: “You gave millions to a fraudster who didn’t know the first thing about running an exchange or a hedge fund or how to protect investor assets and who likely absconded with your money due to complete incompetence but sure he’s innocent.”

Following the collapse of FTX, O’Leary said that he would support Bankman-Fried again if he has another venture, noting that SBF is one of the best traders in the crypto space. Mr. Wonderful also recently revealed that he and Bankman-Fried almost raised $8 billion to rescue FTX before it collapsed.

What do you think about Kevin O’Leary and Bill Ackman believing that SBF didn’t know what he was doing when he commingled funds? Let us know in the comments section below.