‘s difficulty has risen by 4.68% in the second largest positive adjustment in a year to reach a new all-time high. The blockchain’s difficulty is set automatically within Bitcoin’s core code based on mining activity on the network.

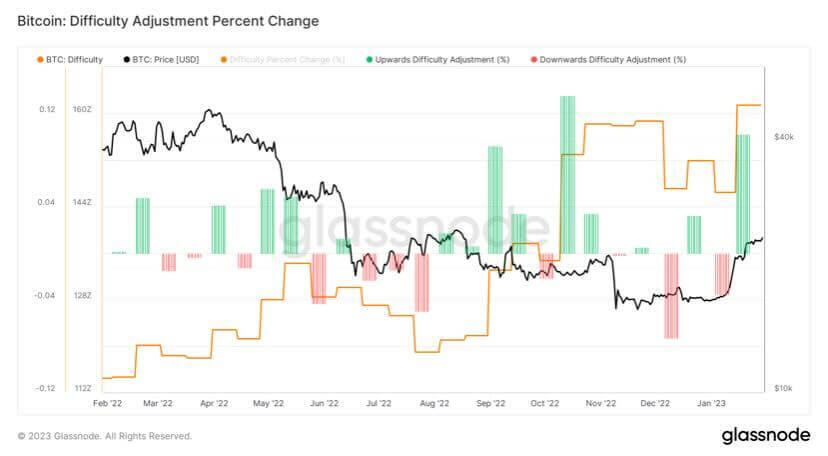

The below chart illustrates the most significant adjustments, both positive (green) and negative (red.) Over the past twelve months, the change in difficulty can be seen to have little correlation with Bitcoin’s price.

Higher difficulty means a more secure blockchain as it becomes more energy intensive to attempt to attack the network. In addition, it becomes harder to mine new blocks as the difficulty increases about the global hashrate.

The difficulty adjusts relative to the miners’ hashrate to keep the time to create a new block to a consistent 10 minutes. Thus, should a ‘bad actor’ onboard miners onto the network to attack it, the difficulty would continue you increase along with the hashrate. The difficulty adjusts every 2,016 blocks meaning an attack would have under two weeks before the new miners would cause the network to adapt to reduce their impact and control of the network.

Further, an increase in difficulty means more consistency in block times. The time to mine a new block becomes more reliable with a greater difficulty due to increased competition among miners.

However, the increase in difficulty puts further stress on the mining industry. More computing power is required to earn equivalent rewards, making the ROI on mining hardware less favorable.

The rise in Bitcoin’s price in recent weeks will have alleviated many miners’ worst fears as Bitcoin rewards are worth more in dollar terms. Following several miners filing for bankruptcy or restructuring during the bear market, the price rally is a much-needed respite for miners.

The post Bitcoin difficulty hits new ATH rising by 4.68%, further securing the network appeared first on CryptoSlate.