Behind AI tokens, the meme coin Shiba Inu has been one of the biggest winners on the crypto market over the past seven days. With a price increase of 24% within this period, SHIB has put on a fabulous rally defying the sentiment in the broad crypto market.

On Saturday, SHIB posted an intraday rally of more than 25% before the price bounced off the $0.000016 technical resistance zone. At press time, Shiba Inu was trading at $0.00001435, defending half of its price appreciation.

With the weekend’s move, SHIB broke through the resistance zone at 0.00001290. Thus, SHIB bulls defended their territory in an impressive manner, showing relative strength after the price was at a crucial inflection point. As reported, SHIB found support at the 200-day EMA, laying the foundation for the upside move.

With the rise up to $0.00001591, the Shiba Inu price also managed to break the October 29 high at $0.00001519 before the corrective leg came. A sustained rise above this high and break above the resistance zone between $0.00001600 and $0.00001640 could mark the final return of the SHIB bulls.

However, a correction and thus a breather might be overdue as the RSI in the daily chart is still in the overbought zone at 76.

Shiba Inu On-Chain Data Confirms Crucial Moment

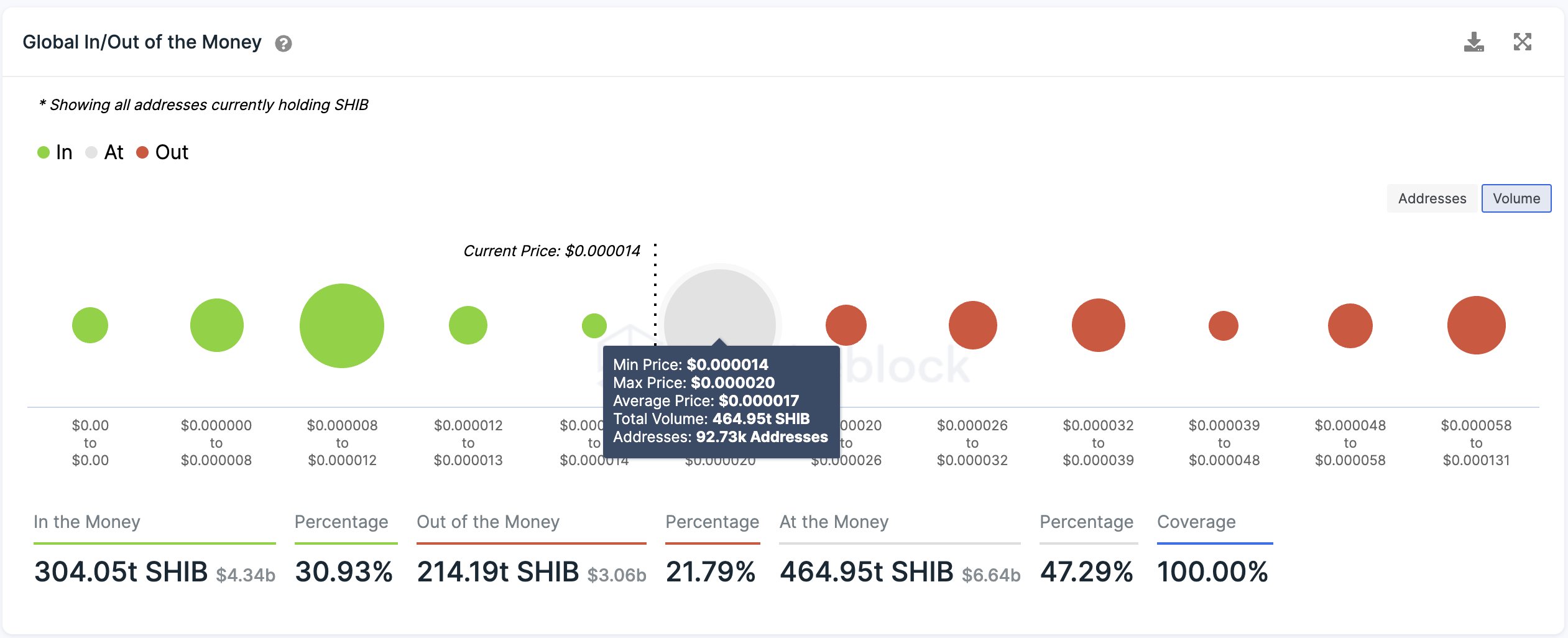

From an on-chain analysis perspective, there could also be stubborn resistance hiding at $0.000017, as pointed out by analyst Ali Martinez in reference to data from IntoTheBlock. According to the data presented by Martinez, there is a concentration of buyers at this price level.

Some 93,000 addresses have bought 465 trillion SHIB at an average price of $0.000017 and may want to take profits given the macroeconomic outlook. However, beyond that, it could mean a clear path for the bulls, which is also in line with technical analysis.

“Once SHIB clears this supply barrier, it will be positioned to climb higher as IntoTheBlock’s GIOM (Global In/Out Of The Money indicator) shows no other major resistance ahead,” Martinez says in reference to the following chart.

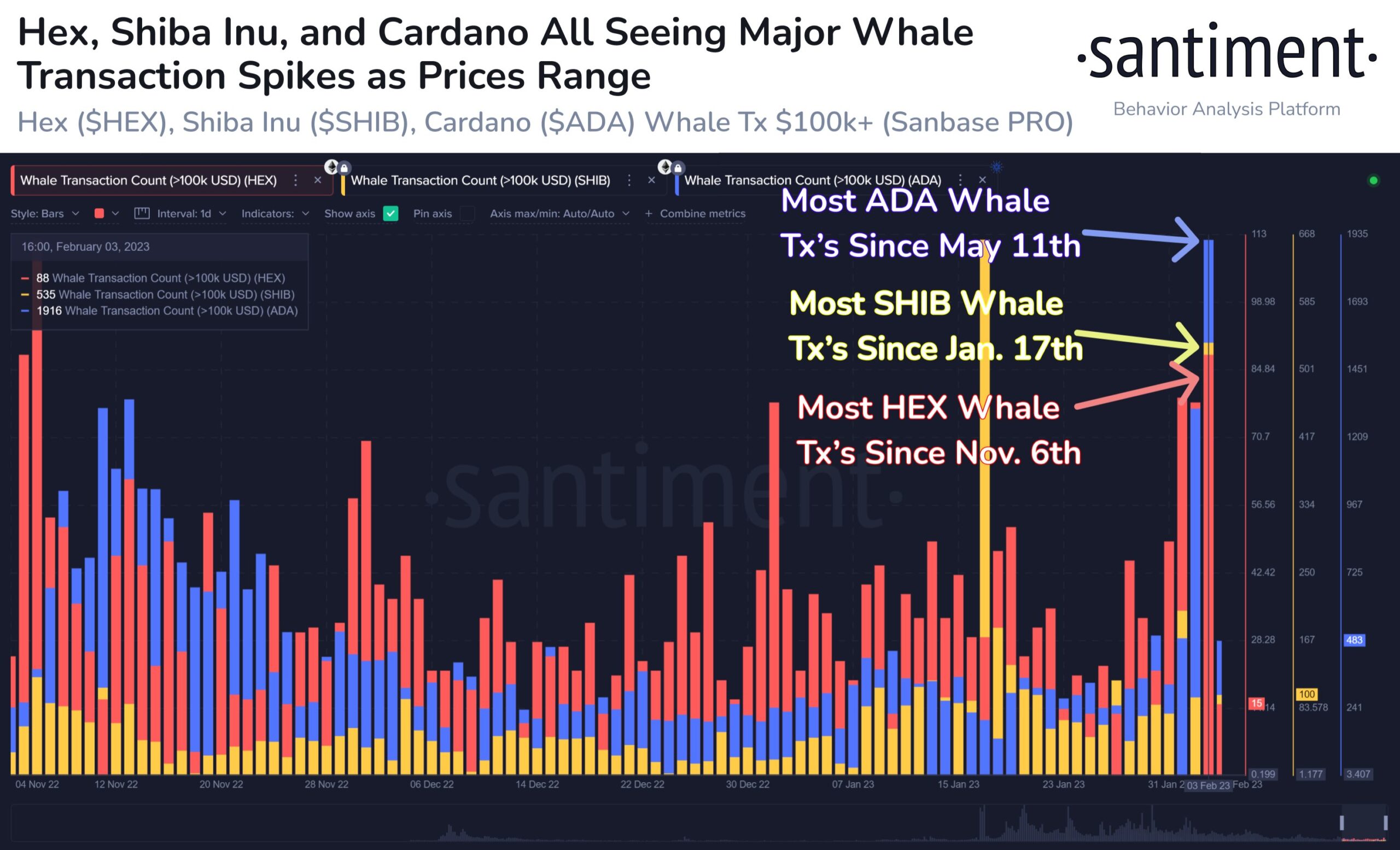

It is worth noting that the last time SHIB traded above $0.000017 was in May last year, before the Terra collapse. The recent move was also preceded by the largest whale activity since January 17. On Sunday, yesterday, the on-chain analysis service provider Santiment wrote:

Three of the more polarizing assets in #crypto, #Cardano, #Shiba Inu, and #Hex are seeing big spikes in large whale transactions. When $100k+ transactions spike on a network, it historically is associated with upcoming price shifts. Monitor closely.

For the coming days, it may therefore be important to continue to monitor the whale activity, especially with regard to the crucial moment the SHIB price is facing.