Data from Santiment shows Cardano whales and sharks have been busy accumulating this year as they have added almost 406 million ADA to their holdings.

Cardano Whales And Sharks Have Been Accumulating Since The Start Of 2023

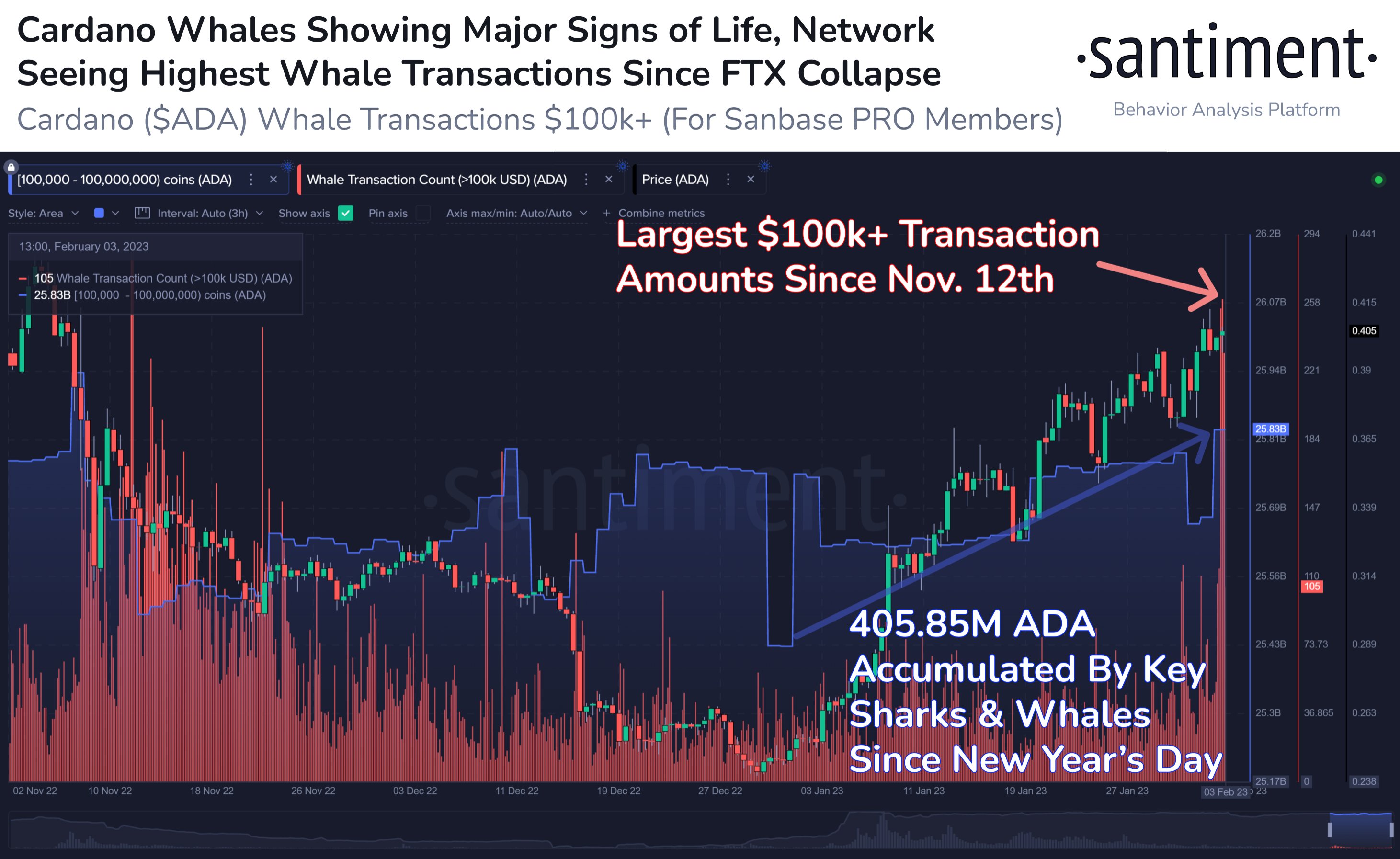

As per data from the on-chain analytics firm Santiment, whale transaction activity has recently been the highest for the coin since the collapse of the crypto exchange FTX. The relevant indicator here is the “ADA Supply Distribution,” which tells us what percentage of the total Cardano supply is being held by each of the cohorts in the market.

The cohorts here refer to wallet groups divided based on the number of coins that wallets belonging to them are currently holding. For example, the 1-10 coins group includes all addresses that are carrying at least 1 and at most 10 ADA right now.

The Supply Distribution metric for this cohort would then show the percentage of the total circulating ADA supply that wallets falling into this group combined contribute at the moment.

In the context of the current discussion, the relevant wallet groups are the ones falling inside the 100,000-100,000,000 coins range (“groups” in the plural as this range is made up by merging three different wallet groups).

The chart below shows the trend in the Supply Distribution for this range:

As displayed in the graph, the Cardano wallets with coins in the 100,000-100,000,000 range have seen their combined balances rise since the start of the year 2023. In total, investors with these addresses have accumulated an additional 405.85 million ADA (around $159 million at the current exchange rate).

Since the 100,000-100,000,000 coins range has bounds equal to $39,000 and $39,000,000 in USD, these wallets would only belong to the large investors in the market. More specifically, the range includes two very important cohorts for Cardano: the whales and sharks.

Because of the fact that the holdings of these groups are so large, their activity can sometimes have noticeable influences on the price of the cryptocurrency. So, selling and buying patterns from them can be something to watch for, as they may precede shifts in the value of the asset.

2023 has so far been great for Cardano as the coin has rallied almost 60% since the start of the year. As the whales and sharks have accumulated large amounts while this rally has taken place, it would appear that it has been the buying from these key cohorts that has driven the price surge.

The chart also includes data for the “whale transaction count,” which tells us the total number of transfers taking place on the blockchain that is at least $100,000 in value. This indicator has recently observed a very sharp spike and has hit the highest value since the FTX crash, showing that whale interest is pretty high in ADA right now.

ADA Price

At the time of writing, Cardano’s price floats around $0.39, up 3% in the last week.