A Taproot Wizard jpeg was mined into the Bitcoin blockchain on Feb. 1, sparking debate on the appropriate use of network resources, particularly inefficiencies due to increased block size.

This was possible thanks to the Ordinals protocol, which enables the storage of jpegs, videos, and other such data directly on the blockchain via Bitcoin-native digital artifacts, otherwise known as “Inscriptions.”

CryptoSlate staff members Liam Wright, James Van Straten, and CommerceBlock CEO Nicholas Gregory discussed the matter, covering what this could mean for scaling and efficiency, during a recent episode of BitTalk.

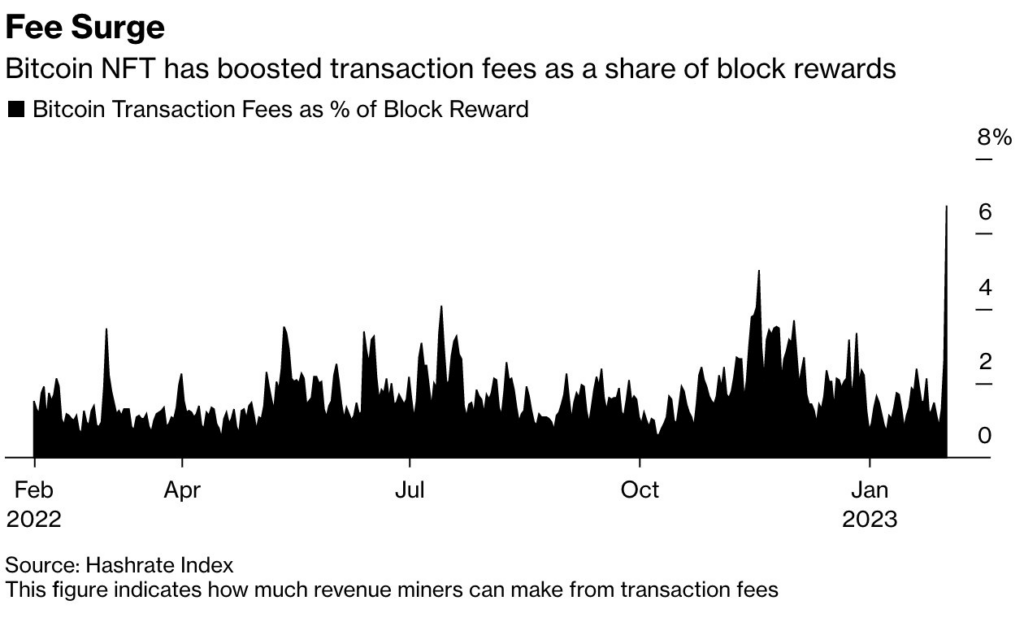

Using Glassnode data, CryptoSlate noted that Taproot Inscriptions activity had skyrocketed recently, which coincided with a spike in fees.

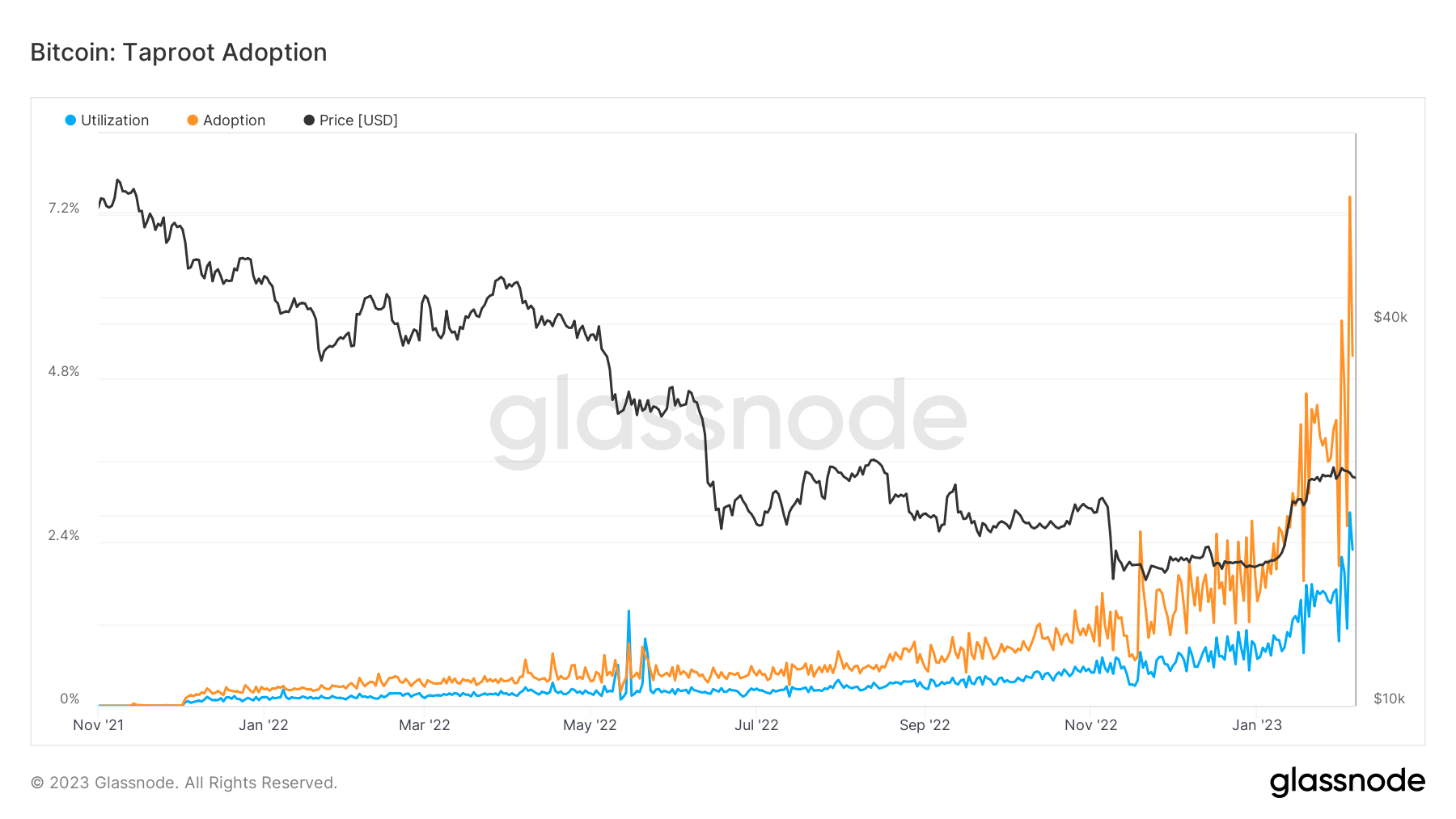

Bitcoin Taproot adoption

The Taproot soft fork went live in November 2021, enabling executable commands and specific new scripts, among other updates. In essence, the upgrade laid the foundation for smart contracts and dApps.

Taproot adoption refers to the number of transactions that spend at least one Taproot input against the overall number of transactions. At the same time, utilization refers to the number of spent Taproot inputs against the overall number of spent inputs.

The chart below shows a gradual increase in both adoption and utilization rates, leading to an explosion around November 2022. Both adoption and utilization have reached all-time highs, at 7.5% and 2.8%, respectively.

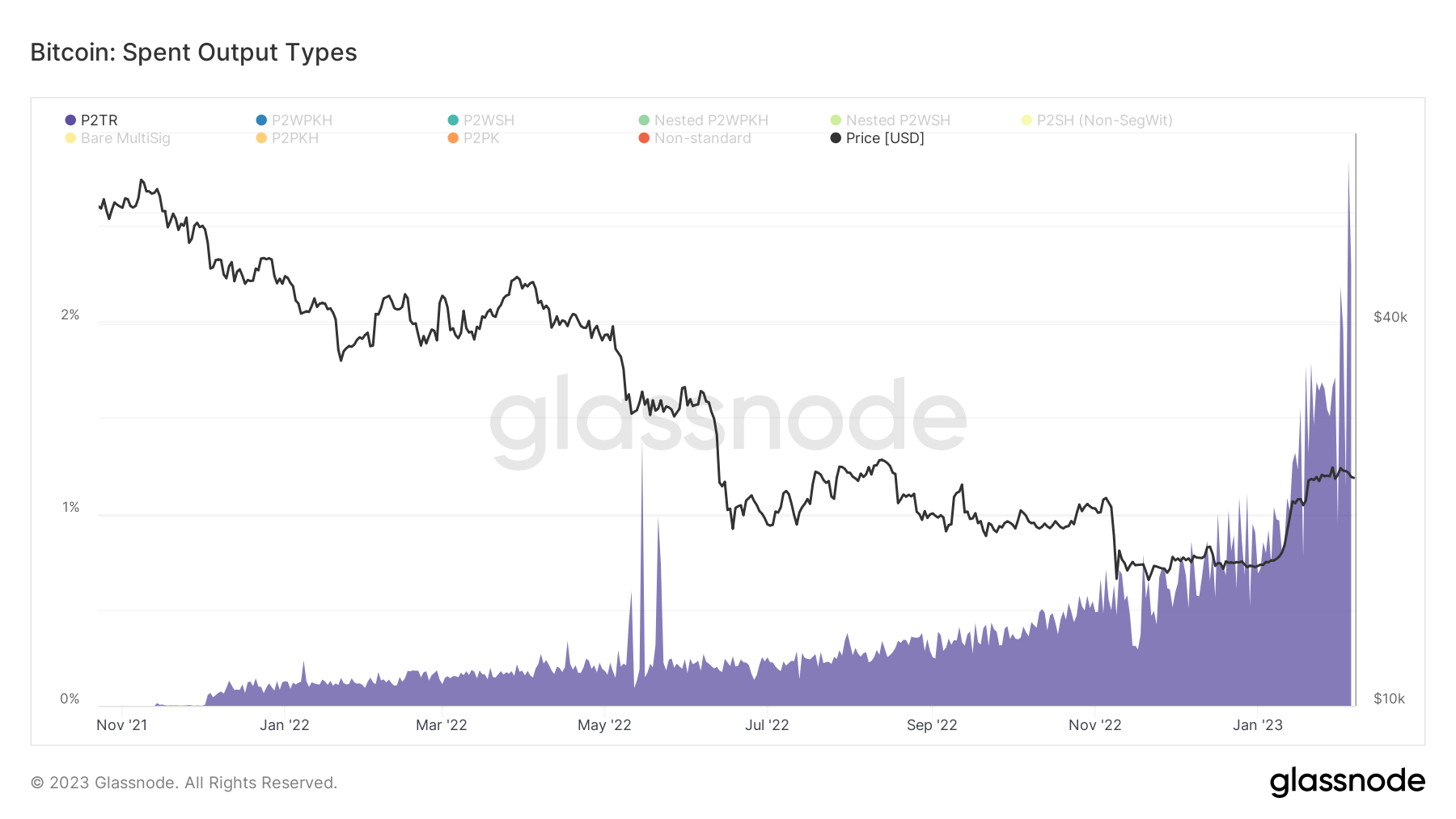

Spent outputs

An unspent transaction output (UTXO) refers to the amount of digital currency that remains following a transaction. It is a type of accounting that keeps track of who owns what.

Following the Taproot soft fork, a new type of spent output was introduced – P2TR (Pay to Taproot,) which can be thought of as a new script method to handle the sending of Bitcoin either through either Schnorr signatures or Merkelized Alternative Script Treesroot (MAST.)

The chart below shows P2TR outputs gradually building since their introduction in November 2021. Late January sees a significant jump in activity, taking the current total number of Taproot spent outputs to 2.8%, compared to just 1% two weeks prior.

Recent coverage of the Ordinals controversy has likely given rise to the acceleration of Taproot activity on the chain. However, on-chain metrics only suggest a further acceleration of Taproot activity and cannot answer where this trend may lead.

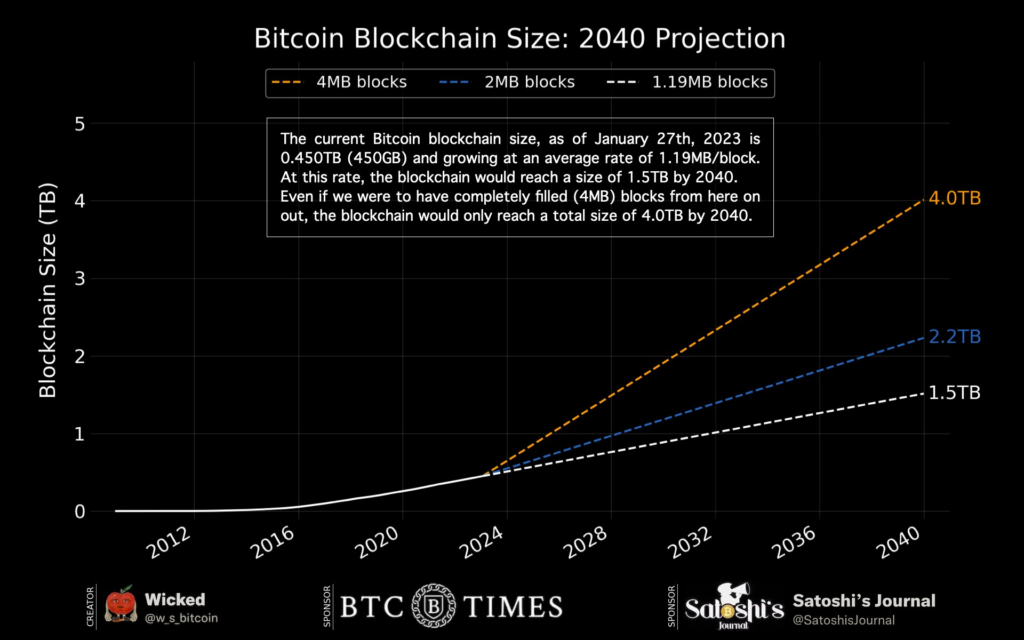

The CEO of Instasize, Hector Lopez, pointed out that the Taproot Wizard block was the biggest to date, at 3.96 MB, which is taking up space and limiting the number of financial transactions.

Following this train of thought, a possible future scenario may see fees increase, potentially leading to competition between financial transactions and jpegs, driving fees even higher. Also, bigger block sizes will increase chain bloat.

Data from Hashrate Index shows that Taproot activity has coincided with an increase in transaction fees as they pertain to block rewards.

Further, if each proceeding block were to be completely filled to the 4 MB limit, projections put a 4 TB size on the blockchain by 2040. This point reiterates what others have said regarding the inappropriate use of network resources.

Commenting on the issue, Gregory said a potential solution lies in filtering out the jpegs, so the nodes do not store that data. Anyone wishing to view the complete chain can do so via specific software designed for that purpose.

“We have to accept that a permissonless system can have any sort of data thrown in.”

The post Data on Taproot Ordinals points to higher Bitcoin fees, chain bloat appeared first on CryptoSlate.