Artificial intelligence, or AI, is a technology that has seen a momentous rise in utility ever since the idea of machine learning went mainstream. According to 2021 statistics, global funding for AI ballooned to $66.8 billion. With major companies like Google pouring big money into AI projects, there is merit for AI and the world of crypto to merge, bringing value to the space.

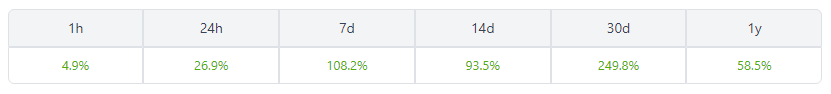

Fetch.ai, a Binance-based blockchain project, is doing exactly that; bringing the power of both AI and blockchain technology together. FET, the project’s utility token, has reacted to recent developments on-chain positively. According to Coingecko, the token grew 250% in the monthly time frame which is in line with the crypto market boom that started last month.

How Does Fetch.ai Work?

According to their website, the network works through the use of a Multi-Agent System. This is a method of using multiple independent AI agents to solve a single problem which, in the case of Fetch, is the automation of a blockchain ecosystem.

They claim that because of their use of AI, the machine-to-machine ecosystem has reduced fees which makes it more efficient compared to other networks. With machine learning and AI being a big part of today’s technology, Fetch’s rise is inevitable.

Just this week, the network surpassed 5 million transitions in their mainnet which signifies a strong use of Fetch’s infrastructure. This attracted the attention of whales, making the platform’s smart contracts the most used by the whales, according to WhaleStat’s recent tweets.

JUST IN: $FET @fetch_ai one of the MOST USED smart contracts among top 100 #ETH whales in the last 24hrs

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#FET #whalestats #babywhale #BBW pic.twitter.com/j1tGtq1IYi

— WhaleStats (tracking crypto whales) (@WhaleStats) February 4, 2023

Is AI Crypto FET A Great Investment Right Now?

The network’s native token is currently at $0.5705 with support at $0.4746 and $0.2592 price ranges. FET bulls seem to be exhausted as the token hit resistance at $0.4746 which might place the token in a precarious situation. With FET’s current support being weak, we might see the token revert back to its $0.3187 support range.

However, with the whales entering the scene, we might be able to see more demand for the token in the long term. Its use of AI tech should also draw attention from outside the crypto space.

In the long term, bulls should be able to target the token’s $0.6482 resistance to regain December 2021 levels. However, this comes at the cost of short term pain in the form of temporarily reverting back to $0.3187 support with a slight possibility for the bears to claw back to $0.2592 support.

Investors and traders should then be careful of the short to medium term prospect of the token.

Featured image from MEXC Blog