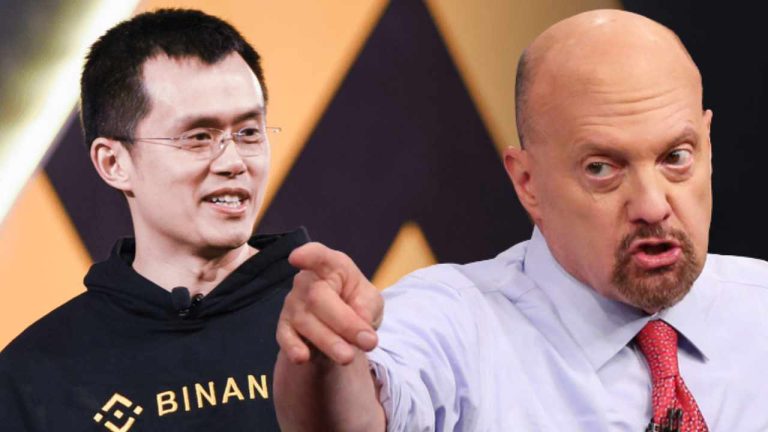

The host of Mad Money, Jim Cramer, has warned investors about using cryptocurrency exchange Binance, stating that the crypto trading platform is “way too sketchy.” Cramer cited former regulator Timothy Massad, who previously served as chairman of the U.S. Commodity Futures Trading Commission (CFTC). The regulatory agency recently took action against Binance and its CEO, Changpeng Zhao (CZ).

Jim Cramer Warns About Binance

The host of CNBC’s Mad Money show, Jim Cramer, cautioned investors about using cryptocurrency exchange Binance on Friday. Cramer is a former hedge fund manager who co-founded Thestreet.com, a financial news and literacy website. He tweeted:

After listening to Tim Massad on last night’s show (former head of the CFTC), I would not do business with Binance. Just way too sketchy.

Massad, who served as chairman of the U.S. Commodity Futures Trading Commission (CFTC) from 2014-2017, has been an advocate of stronger cryptocurrency regulations for years. Explaining the charges the CFTC filed against Binance and its CEO, Changpeng Zhao (CZ), Massad described that the crypto trading platform engaged in a “systematic effort to cultivate U.S. business.” He added that Binance allegedly helped “U.S. persons get around restrictions” and failed to comply with know-your-customer (KYC) regulations.

Many people on social media are entertained by Cramer’s tweet. Some ridiculed the Mad Money host for frequently making wrong predictions and took his negative comment about Binance as a bullish signal for the crypto exchange. Before the collapse of Silicon Valley Bank and Signature Bank, Cramer recommended investors purchase stocks in the two banks.

This was not the first time Cramer has cautioned against Binance. In December last year, he said he would trust his money more in fantasy sports betting platform Draftkings than he would Binance.

Cramer has also been warning investors about investing in cryptocurrencies. Earlier this month, when the price of BTC soared, the Mad Money host said he would sell his bitcoin “right into this rally.” He firmly believes that crypto prices are being manipulated up. Prior to the BTC rally, he advised investors to get out of the crypto. Cramer also expects the U.S. Securities and Exchange Commission (SEC) to “do a roundup” of uncompliant crypto firms.

Do you agree with Mad Money host Jim Cramer that Binance is “way too sketchy”? Let us know in the comments section below.