The CEO of the world’s largest asset manager, Blackrock, has warned that the United States is jeopardizing the U.S. dollar’s reserve currency status. He noted that the debt ceiling debate, risk of national default, and possible credit rating downgrades are “destabilizing” factors for the USD. He also predicted that the Federal Reserve will hike interest rates at least two more times.

Larry Fink on Rate Hikes and Inflation

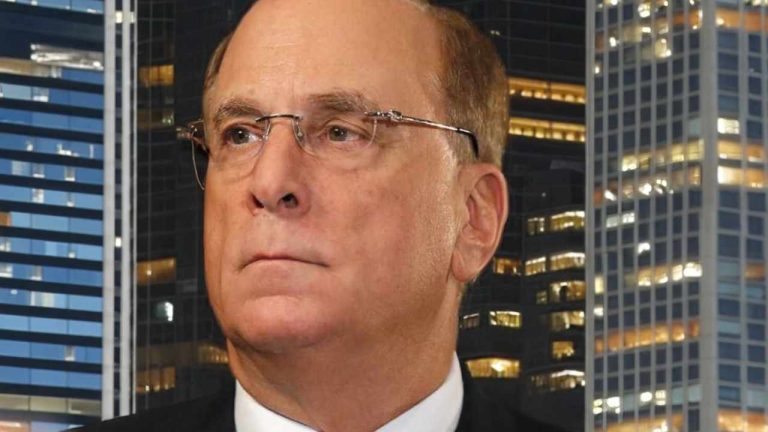

Larry Fink, CEO of Blackrock, the world’s largest asset manager, shared his view on the U.S. economy, future interest rate hikes, and the U.S. dollar’s reserve currency status at a Deutsche Bank financial services conference Wednesday.

The executive expects the Federal Reserve to hike interest rates at least two more times, emphasizing:

The Fed is not finished … Inflation is still too strong, too sticky.

“The Fed is going to have to be more vigilant,” Fink said, noting that while “The economy is more resilient than the market realizes,” there are “pockets of problems,” such as the commercial real estate sector. Last month, Federal Reserve Chair Jerome Powell hinted that the Fed may pause raising interest rates this month.

“I just don’t see evidence of a reduction in inflation, or I don’t see evidence that we’re going to have a hard landing,” the Blackrock executive opined.

However, he downplayed the risk of a U.S. recession, noting that if it were to occur, it would likely be modest.

Risks to U.S. Dollar’s Reserve Currency Status

The Blackrock boss warned that the “drama” surrounding the debt ceiling has eroded trust in the U.S. dollar as the world’s reserve currency. He cautioned:

I believe we’ll have a resolution, but let’s be clear, the United States is jeopardizing its reserve currency status.

He explained that the debate around the debt ceiling, the risk of the U.S. defaulting on its debt obligations, and possible credit rating downgrades were all “destabilizing” factors for the U.S. dollar. “We are eroding some of that trust, which in the long run we need to rectify and rebuild,” he further said.

Last week, Fitch Ratings said the U.S. “AAA” credit rating remains on negative watch despite the recent debt limit agreement. Prior to Congress reaching the debt ceiling deal, Moody’s said: “The greatest near-term danger to the dollar’s position stems from the risk of confidence-sapping policy mistakes by the U.S. authorities themselves.”

On Saturday, President Joe Biden signed a bill that suspends the U.S. government’s $31.4 trillion debt ceiling, averting a possible U.S. default. Treasury Secretary Janet Yellen previously warned that the Treasury would be unable to pay all of the government’s bills on June 5 if Congress had not acted by then.

Do you agree with Blackrock CEO Larry Fink? Let us know in the comments section below.