Data from Santiment suggests that the latest Bitcoin rebound took place after most investors had given up on the idea of it happening.

Bitcoin Observes Rebound After “Buy The Dip” Crowd Goes Silent

According to data from the on-chain analytics firm Santiment, calls for buying the dip had mostly disappeared right before the actual rebound. The indicator of interest here is the “social volume,” which measures the total number of social media text documents that mention a given topic or term.

The text documents here refer to a collection of posts/threads derived from various social media platforms like Reddit, Twitter, Telegram, and 4chan. Note that the metric only cares about whether such posts make at least one mention of the given term, and not exactly how many times they do it.

This means that even if a thread mentions the topic several times, its contribution to the social volume still remains one unit. The benefit of this restriction is that it provides a better picture about the trend being followed in the whole sector, as only a few posts with a lot of discussion can’t skew the total in their favor this way.

Now, in the context of the current discussion, cryptocurrency-related talks where users call out to “buy the dip” are of relevance. So, Santiment has taken the social volume of the entire digital asset sector and has then filtered it specifically using terms related to “buy” and “dip.”

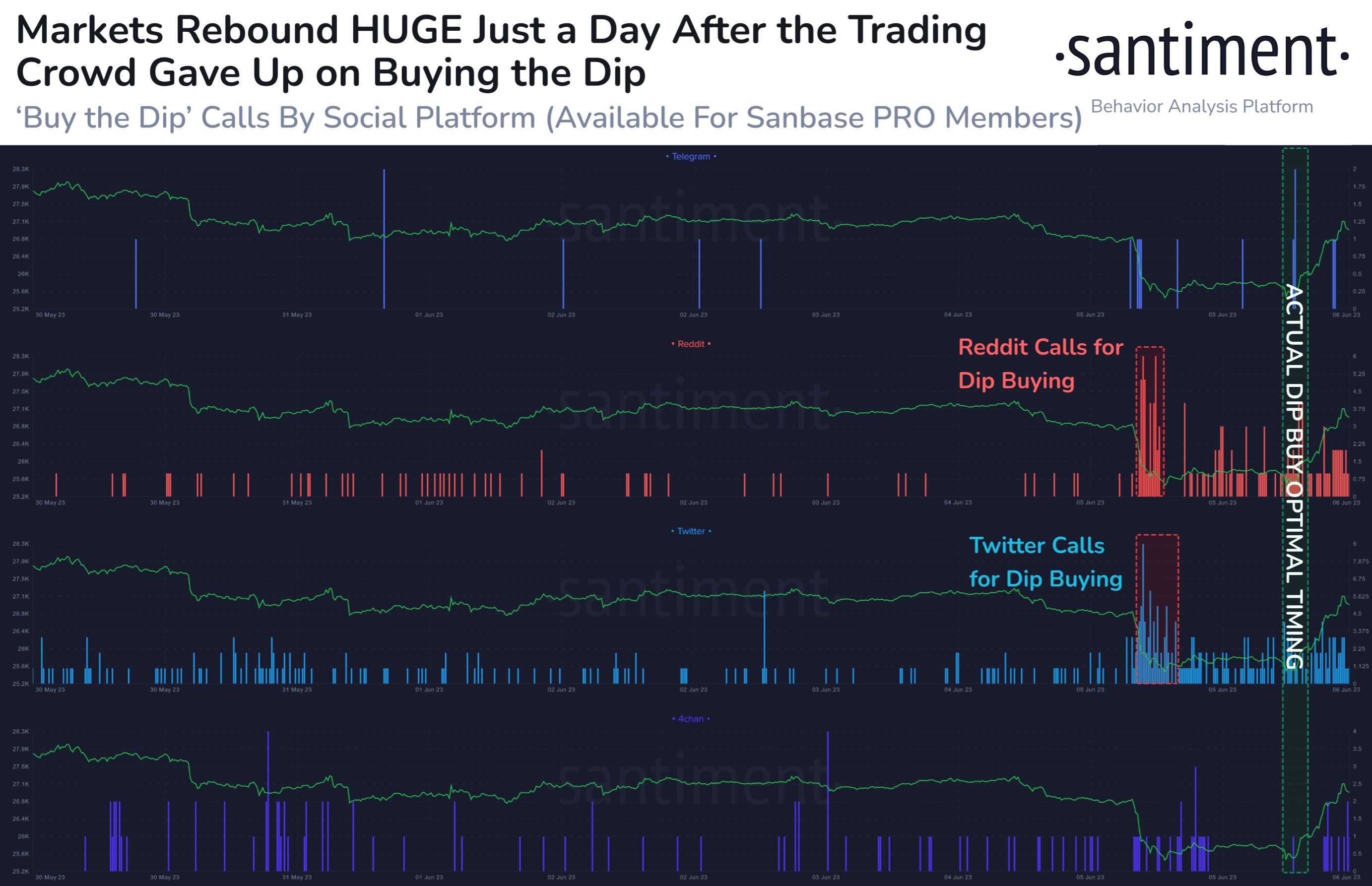

Here is a chart that shows the social volume related to this topic broken down for each of the major social media platforms:

As displayed in the above graph, right after Bitcoin and the rest of the market had crashed due to the news of SEC suing Binance breaking out, the social volume for discussions related to these terms had observed a large spike on Reddit and Twitter.

This would imply that users had become hyped and had started calling for buying the dip as soon as the price plunge had occurred. As it turned out, however, there wasn’t any price rebound just yet, and BTC rather continued to go down after the market had become excited.

As the coin continued to move mostly sideways over the next day, though, the discussions related to buying the dip started to die out. That’s when the actual rebound in the asset’s price took place, seemingly catching the mainstream crowd off guard.

Historically, Bitcoin and other assets have usually been more likely to show moves in a direction opposite to the majority’s view. The more lopsided the crowd gets toward one direction, the more probable the market becomes to show the reverse kind of move.

Because of this reason, the followers of “contrarian investing” believe that it’s best to buy whenever the crowd is fearful and ideal to sell when greed is king in the market. It seems like this Bitcoin rebound would have worked into the favor of these contrarian traders.

BTC Price

At the time of writing, Bitcoin is trading around $26,600, down 2% in the last week.