Shiba Inu (SHIB) has been experiencing a sustained downtrend, coinciding with the broader weakening of the market in recent times. In the past 24 hours, the meme-coin has seen a decline of nearly 4% on its chart. Looking at the weekly chart, SHIB has depreciated by 6%.

The technical analysis of SHIB reflects a prevailing bearish sentiment, with a decrease in demand and accumulation observed on the chart. As Bitcoin has demonstrated high volatility, SHIB has struggled to surpass its immediate resistance level.

However, if Bitcoin manages to maintain its recovery following a significant price plunge, there is a possibility of SHIB making a price comeback. This would require a decline in selling pressure over the subsequent trading sessions.

To further confirm the negative price action, SHIB has broken below a formation that indicates bearish strength in the market. The market capitalization of SHIB has declined, indicating low buying strength on the one-day chart.

Shiba Inu Price Analysis: One-Day Chart

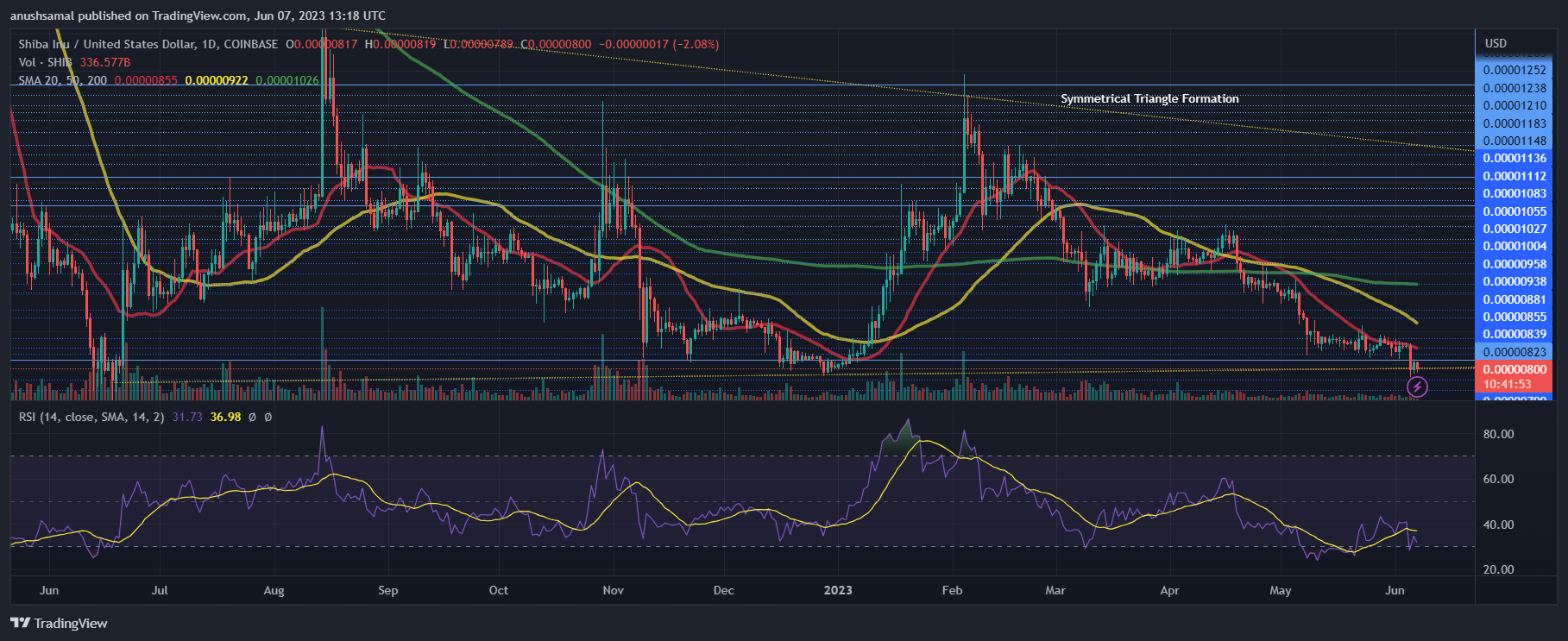

At the time of writing, SHIB was trading at $0.0000080. However, the bulls encountered resistance at $0.0000083, leading to a continuation of the coin’s downtrend. The immediate overhead resistance for SHIB is located at $0.0000083, followed by another resistance level at $0.0000087.

If the price manages to surpass the $0.0000087 mark, it could potentially approach the $0.0000090 resistance level. Conversely, if the price falls from its current level, it may drop below $0.0000079, and a further decline could bring SHIB to $0.0000074.

Notably, SHIB had formed a symmetrical triangle pattern, and the recent price movement saw it breaking below the triangle, indicating a continuation of the bearish sentiment on the chart. Additionally, the trading volume of SHIB in the last session was low, suggesting a lack of buying strength in the market.

Technical Analysis

Throughout the month of May and the beginning of June, SHIB faced a decline in buyers’ confidence, resulting in a decrease in demand for the altcoin.

The Relative Strength Index (RSI) remained below the half-line, indicating that sellers held the upper hand in the market.

Furthermore, SHIB moved below the 20-Simple Moving Average, which confirmed the downward price action and suggested that sellers were driving the price momentum in the market.

In line with the technical indicators, SHIB displayed sell signals on the chart. The Moving Average Convergence Divergence (MACD), which indicates price momentum and shifts, formed red histograms associated with the sell signal for the coin.

This suggested a bearish outlook for SHIB. Additionally, the Bollinger Bands, which indicate price volatility and the likelihood of price fluctuations, had previously narrowed down.

However, at the time of the press, the bands began to diverge, indicating a potential increase in price volatility in the upcoming trading sessions.