Quick Take

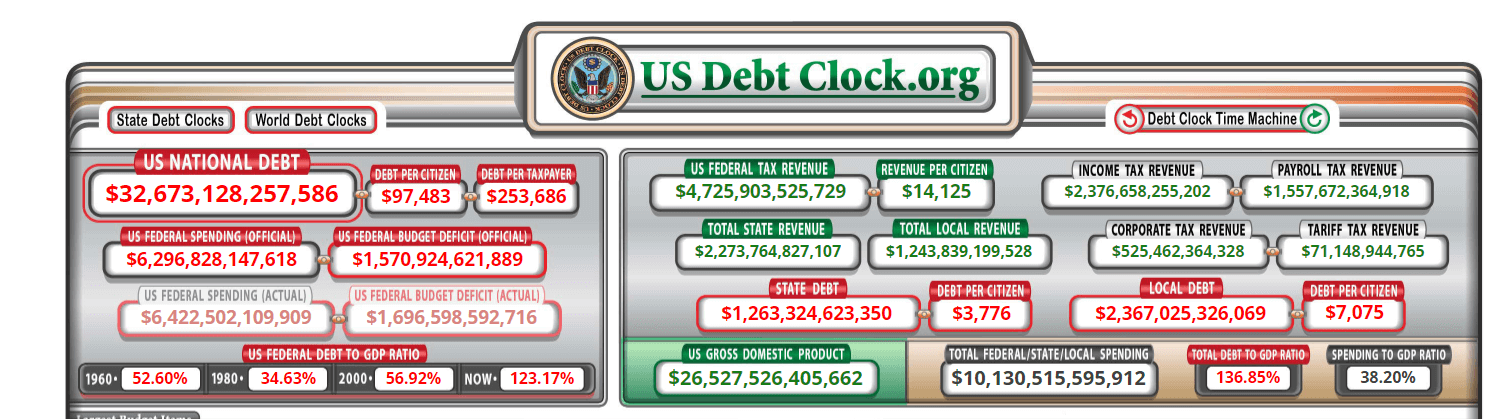

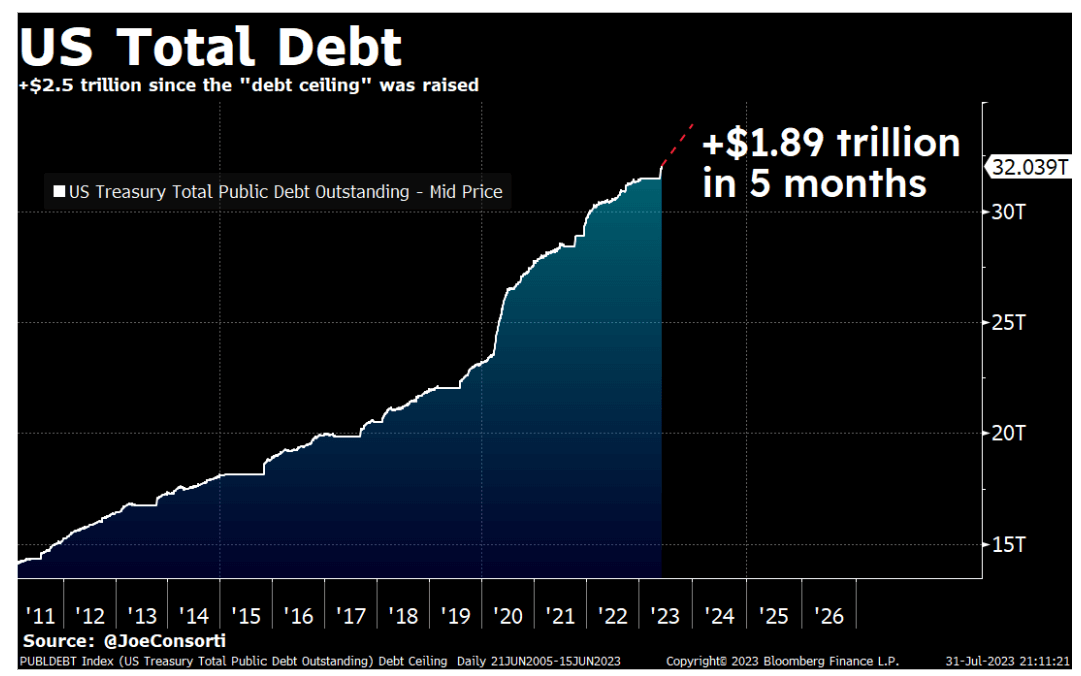

After the U.S. government’s decision to suspend the debt limit till 2025, the national debt has swelled to a staggering $32.6 trillion from nearly $32 trillion in June. With the Treasury’s new plan to borrow an additional $1.89 trillion in the latter half of 2023, the total borrowing since the debt ceiling hike could reach $2.5 trillion by year-end, according to Bitcoin Layer analyst Joe Consorti.

The U.S. government has been treading a precarious financial path since the suspension of the debt limit in June this year. The national debt has surged from nearing $32 trillion to an enormous $32.6 trillion in just over a month. According to Consorti, the Treasury plans to borrow an extra $1.89 trillion in the second half of 2023, further amplifying the debt profile.

As the U.S. government relies heavily on short-term funding, it faces the unenviable task of servicing significant debt and interest in the coming years. The government’s financial strategy seems to revolve around issuing new debt to settle old ones, which could lead to a continuous cycle of borrowing, thereby deepening the debt abyss.

The post U.S. debt ceiling hike: A gateway to exponential borrowing appeared first on CryptoSlate.