Quick Take

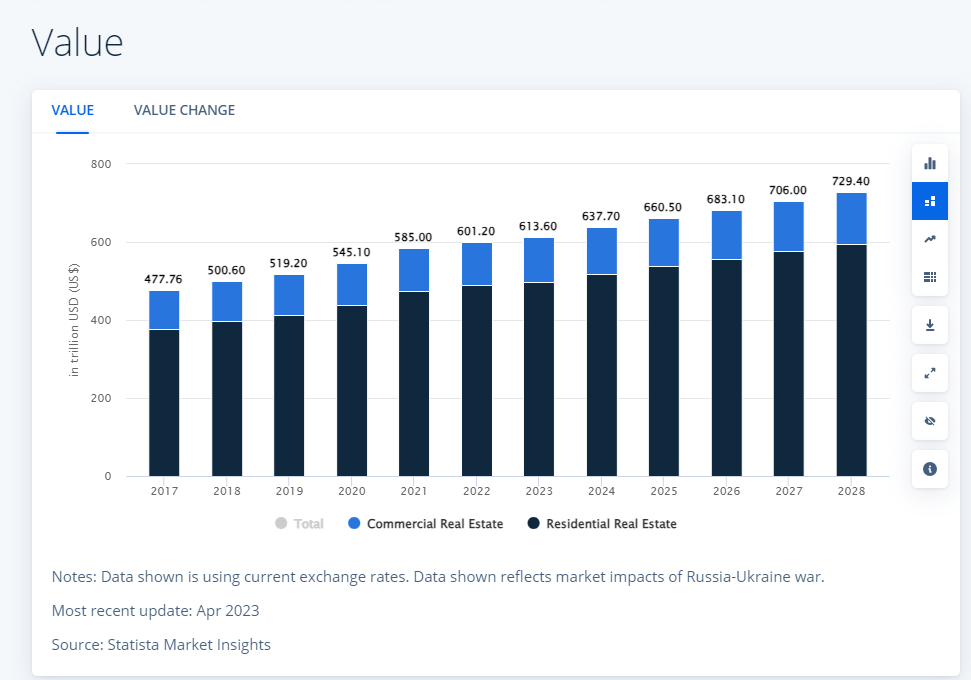

As one of the largest global wealth sources, the real estate sector continues to demonstrate tremendous growth. According to Statista, it’s projected to hit a whopping $613 trillion in 2023 and potentially reach $700 trillion by 2027. Much of this wealth is concentrated in China, the world’s largest real estate asset class, with an estimated value of $131 trillion in 2023, according to Statista. Yet, a financial storm brews on the horizon for China, as discussed previously by CryptoSlate, with the country grappling with deflation and currency issues.

Simultaneously, a dramatic shift is occurring in the Western markets. As reported by The Kobessi Letter, the rates and yields are on a steady upward climb, with the 30-year mortgage rates touching a 21-year high of 7.5%. This rise indicates more capital being funneled into servicing housing loans, leaving less for economic circulation. Additionally, as properties often represent a significant portion of people’s net worth, the resulting decrease in property values due to rising rates could trigger a reverse wealth effect.

The post China’s real estate wealth meets financial storm while Western markets see mortgage rate spike appeared first on CryptoSlate.