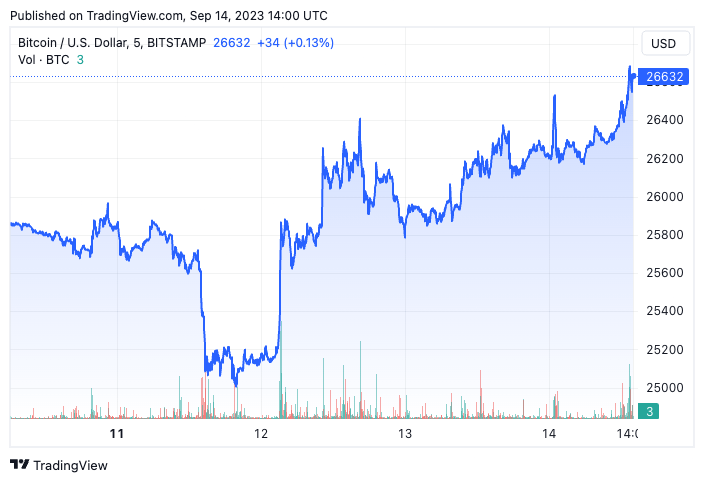

On Sep. 12, Bitcoin surpassed the $26,000 mark after stagnating around $25,000 for an extended period. Though this price movement has brought a hint of optimism to the market, an analysis of the behavior of long-term holders is crucial for a comprehensive understanding.

Long-term holders (LTHs) are investors who retain their Bitcoin for over six months. Their holding or selling patterns are pivotal in determining market sentiment. The actions of this group offer insights into the overall confidence level in the market and potential price movements.

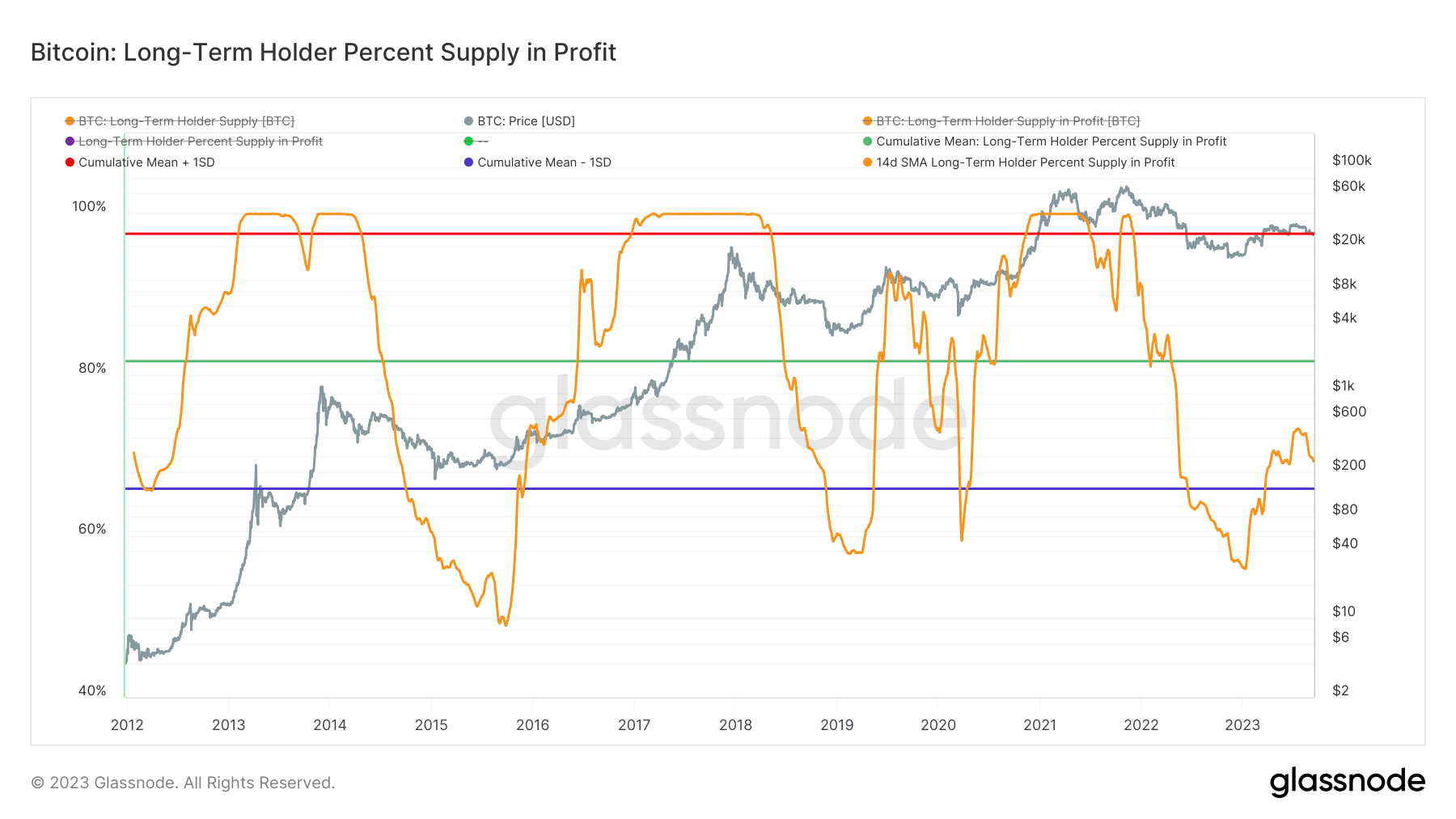

Recent data from Glassnode paints an interesting picture of LTH profitability. While the recent price increase has reflected positively on some LTHs, only 69.28% of the LTH supply is in profit, contrasting sharply with the all-time mean of 81.7%. This data implies that over 30% of the LTHs have not yet reached a profitable state relative to their initial acquisition price.

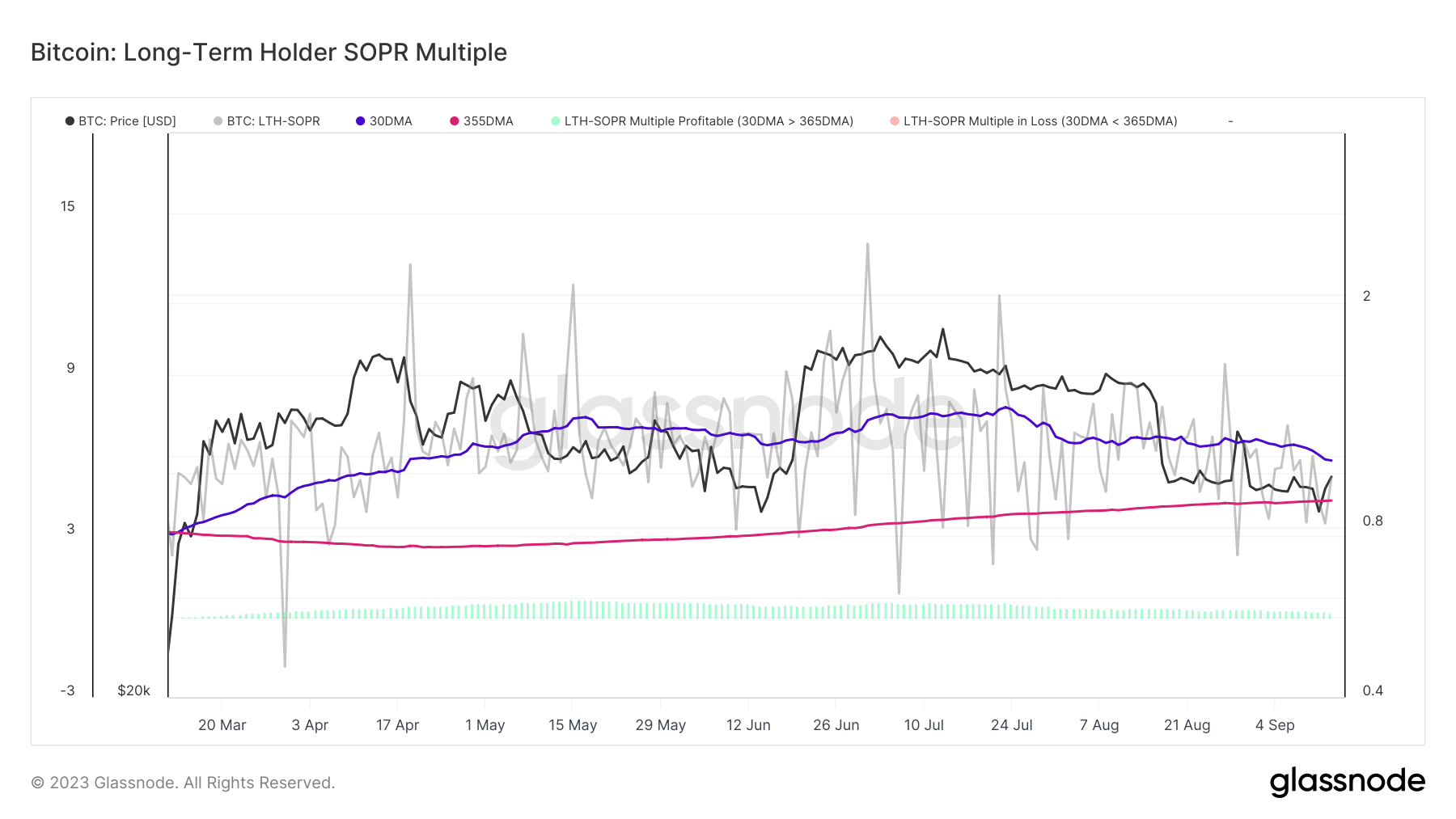

To further evaluate the LTHs’ sentiment, we turn to the LTH-SOPR (Spent Output Profit Ratio) multiple. In essence, the LTH-SOPR measures the average profit (values greater than 1) or loss (values less than 1) realized by LTHs when transacting their coins. A key point of interest is the 30-day Moving Average (30DMA) of the LTH-SOPR, which has seen a downtrend since July 23, shifting from 1.30 to 1.05 on Sep. 12. Moreover, the difference between the yearly 365-day Moving Average (365DMA) and the 30DMA is the smallest it’s been since March.

When the LTH-SOPR 30-DMA exceeds the 365-DMA, it indicates that LTH profitability is higher than the yearly average. While the LTH-SOPR Multiple remains positive, it has trended downwards since July 23. This means that the profitability of LTHs, while still positive, is diminishing relative to its yearly average.

While Bitcoin’s recent price action provides a reason for short-term optimism, the reduced profitability among LTHs suggests caution. The decline in the LTH-SOPR Multiple could hint at potential market adjustments in the near future.

The post Bitcoin passes $26,000 but 30% of long-term holders remain in loss appeared first on CryptoSlate.