Quick Take

The present overview of global economics reflects a complex landscape of central banking decisions and policies, largely centered around inflation and employment rates. Evidence indicates that central banks worldwide are on the cusp of peak rate cycles. For instance, the European Central Bank, with a rate of 4%, believes its approach is sufficiently restrictive. Simultaneously, the Bank of England finds itself divided over a potential final 25bps rate hike as inflation came in lower than expected this morning but still over three times the central bank’s target.

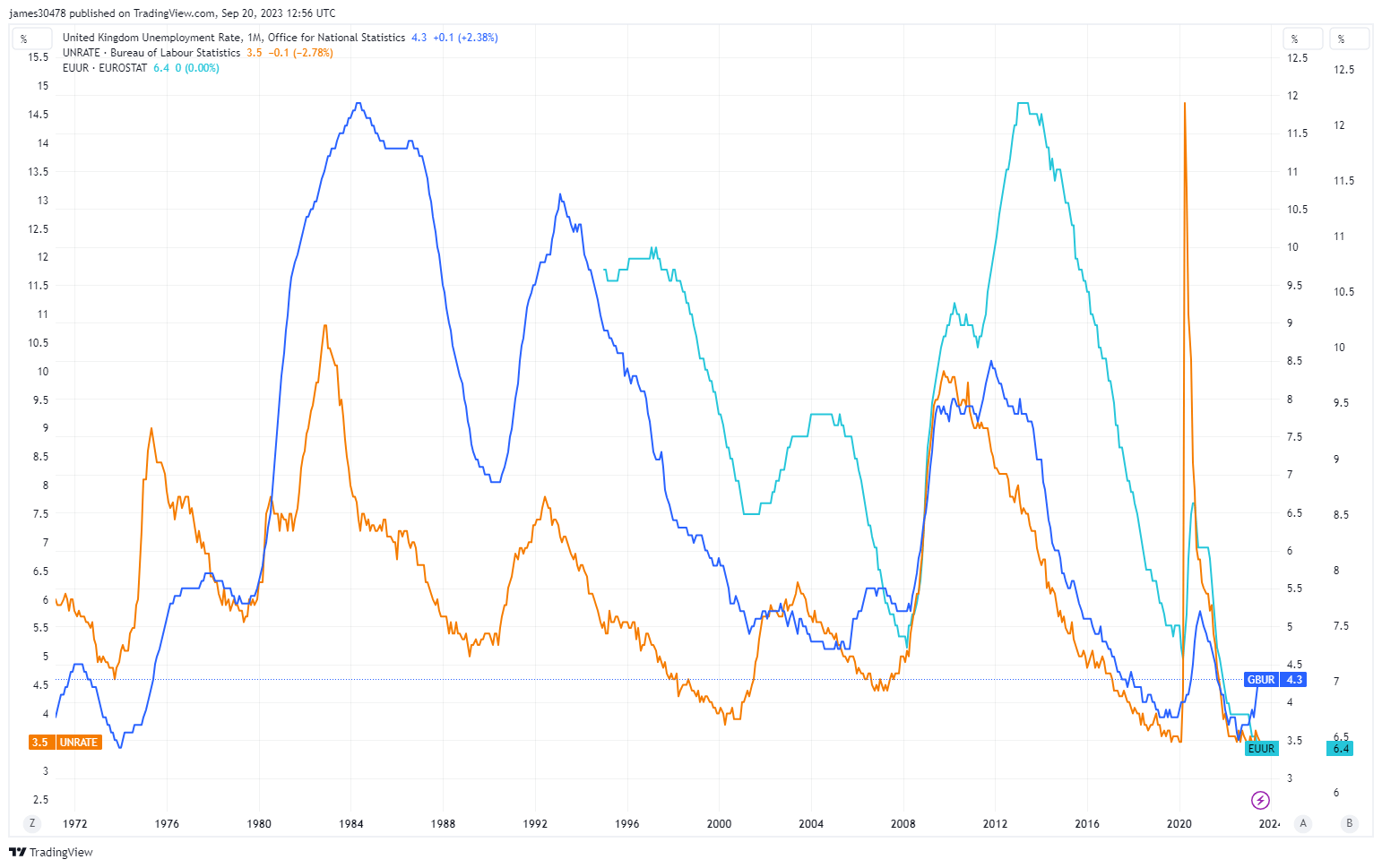

In the U.S., despite an anticipated pause by the Federal Reserve, the reality of inflation remains distant from the 2% target. Adding more complexity is Canada’s experience of inflation acceleration, akin to the U.S., concurrently with record low unemployment rates. These secular lows across all regions, as highlighted by Bob Elliott, CIO at Unlimited Fnds, underline a significant economic contradiction. Regions continue to maintain their base rate lower than inflation, with the U.S. barely managing a restrictive stance.

This data raises a critical question: Are central banks globally acting prematurely in their declaration of victory over inflation, especially against the backdrop of low unemployment? A comprehensive understanding of these dynamics could influence the future of global financial stability.

The post Are global banks claiming premature victory against inflation? appeared first on CryptoSlate.