On-chain data shows that mid to large Bitcoin holders have purchased almost $2 billion in the asset during the past six weeks.

Bitcoin Holders With 1 To 10,000 BTC Have Neared All-Time High Holdings

According to data from the on-chain analytics firm Santiment, the mid to large-sized BTC addresses have added 71,555 BTC to their holdings recently. The relevant indicator here is the “BTC Supply Distribution,” which keeps track of the total amount of Bitcoin that each holder group in the market is holding right now.

The investors or addresses are divided into these cohorts based on the total number of tokens that they are currently carrying. The 1-10 coins group, for instance, includes all holders who own at least 1 and at most 10 BTC.

If the Supply Distribution is applied to this specific cohort, it would tell us about the total amount of the asset that the addresses on the network fulfilling this condition are currently holding as a whole.

In the context of the current discussion, the mid and large-sized investors in the market are of interest. Typically, these are the addresses ranging between 1 and 10,000 BTC.

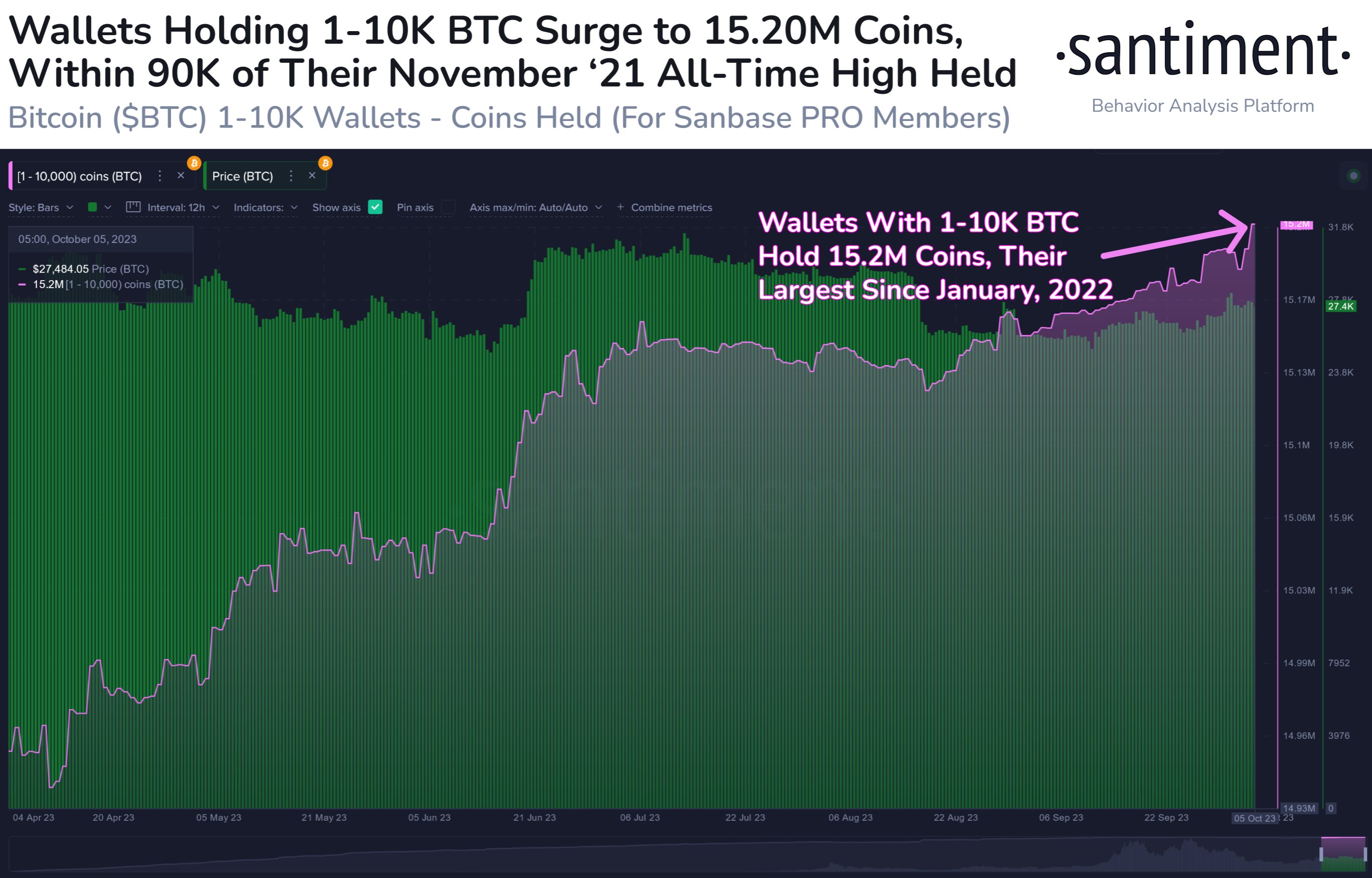

Here is a chart that shows the trend in the combined Bitcoin Supply Distribution for all the cohorts falling inside this particular coin range over the past few months:

This wallet range covers a variety of groups, with the two most notable being the sharks and whales. The sharks are generally the entities with 100-1,000 BTC, while the whales are those with 1,000-10,000 BTC.

Both of these cohorts carry some power in the sector, because of the sheer size of their holdings. The whales, however, carry significantly more influence than the sharks, a natural consequence of their balances being much larger.

The rest of the investors inside this range (those with 1-100 BTC) are considered mid-sized holders, who may not be relevant individually, but as a whole, they can have a notable presence in the market.

From the graph, it’s visible that the combined holdings of all these groups have been heading up recently, implying that buying has been taking place. During the past six weeks alone, these investors have purchased a total of 71,155 BTC, which is equivalent to about $1.97 billion at the current exchange rate.

With this latest accumulation spree, the total holdings of these Bitcoin investors have hit about 15.2 million BTC, which is the largest amount that they have held since January 2022.

Not just that, their current holdings are also just 90,000 BTC shy from their all-time high back in November 2021, where they owned about 15.29 million tokens of the asset.

As is visible from the chart, the indicator has observed some particularly sharp growth during the past week or so, suggesting that these holders believe the current prices are worth buying at.

BTC Price

Bitcoin hasn’t moved much since its pullback a few days ago as its price is still trading around the $27,700 mark.