The CEO of Medici, Edward Boyle, has raised concerns about the low liquidity of Bitcoin (BTC) across leading spot cryptocurrency exchanges like Binance and Coinbase.

Boyle believes this could pose challenges for Bitcoin exchange-traded funds (ETFs) providers, especially when they launch in the United States in the coming weeks, subject to the Securities and Exchange Commission (SEC) approval.

Bitcoin Liquidity On Spot Exchanges Low After FTX Collapse

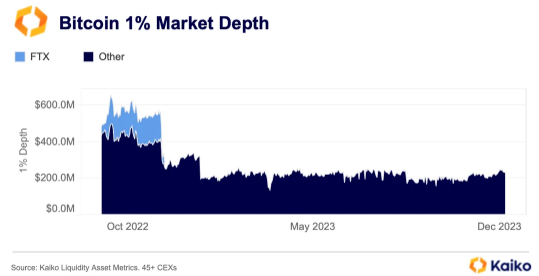

In a post on December 12, Boyle cites Kaiko data that shows that there is generally only $200 million in Bitcoin trading volume within 1% of the spot price. Accordingly, this data means that if a large buyer or seller wants to execute a significant trade, they could impact Bitcoin prices.

However, for those wishing to liquidate or buy “a few million worth of Bitcoin,” the current liquidity would instantly absorb it.

Looking at existing liquidity data from Kaiko, the CEO seems to suggest that the collapse of FTX, once a prominent exchange valued at over $20 billion at its peak, severely exacerbated the liquidity problem. The bankruptcy of FTX meant the exit of what was once one of the largest market makers in crypto.

Related Reading: When Is The Bitcoin Top? Cycle Analyst’s Cheat Sheet Answers

Accordingly, their collapse meant the withdrawal of more liquidity. The free-falling crypto assets, especially Solana (SOL), following the bankruptcy news of FTX, also forced players out of the market as fear, uncertainty, and doubt (FUD) set in.

Will This Be A Challenge For BTC ETF Providers Like BlackRock?

Factoring in these factors, Boyle believes that spot Bitcoin ETFs, including BlackRock, Fidelity, and VanEck, for instance, may struggle to buy Bitcoin without significantly impacting the price via spot exchanges, including Coinbase. The more providers, through their partners, have to buy Bitcoin stealthily on crypto exchanges, will likely slow down the uptake of spot ETFs.

At the same time, since more time is taken when buying, spot Bitcoin ETF providers would likely have to rake in more fees.

Even so, while spot Bitcoin ETF providers might struggle to get their hands on a BTC, the approval of these complex derivatives would gradually improve the overall liquidity in the spot Bitcoin market to pre-FTX collapse levels or better.

This is because ETFs could attract new institutional investors to the market, increasing the overall trading volume and reducing the impact of individual trades.

Thus far, Bitcoin is firm above $43,000 and in an uptrend. Optimists expect the coin to easily breeze above $45,000 and even $69,000 in the coming sessions catalyzed by the SEC authorizing the first spot Bitcoin ETF in the U.S.