Quick Take

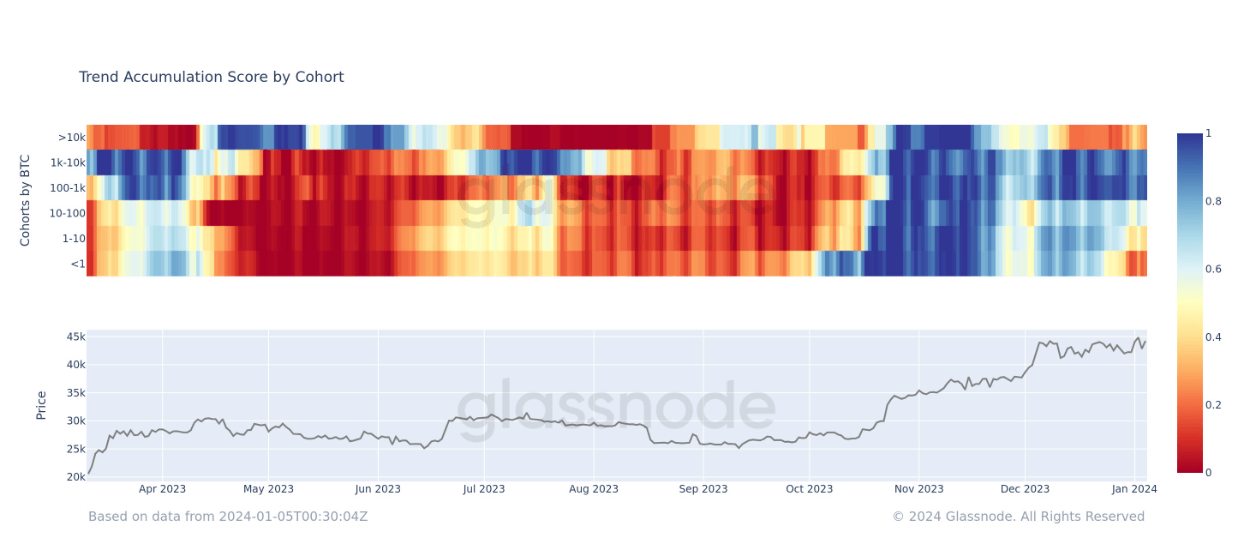

An in-depth analysis of Accumulation Trend Score offers a detailed portrayal of the digital asset market’s varying behavior, largely segmented by wallet cohorts. The aggregation of this metric is driven by the size of the entities and the number of coins acquired over a specific period, providing an insightful index of accumulation strength. Participants with a score near 1 are actively accumulating coins, while those closer to 0 are distributing.

Recent data illustrates a shift towards distribution among entities holding less than 1 Bitcoin, a trend persisting since Dec. 25. Similarly, the 1-10 Bitcoin holders’ cohort, who have been exhibiting a reduced accumulation trend with a score hovering around 0.5, deviating from their earlier habits. The 10-100 Bitcoin holders, however, still exhibit a light accumulation trend, albeit with a relatively diminished intensity.

Interestingly, the 100-1000 and 1000-10,000 Bitcoin holders’ cohorts are currently in a phase of aggressive accumulation, contrasting the distribution trend of large-scale holders or ‘whales’ (10,000+ Bitcoin holders), who have maintained a steady distribution pattern since the previous December.

This distribution and accumulation trend analysis, excluding exchanges and miners, offers nuanced insights into the current digital asset market dynamics, highlighting the divergent strategies of various wallet cohorts.

The post Shift in digital asset market as smaller wallets sell off, while mid-tier investors continue to accumulate appeared first on CryptoSlate.