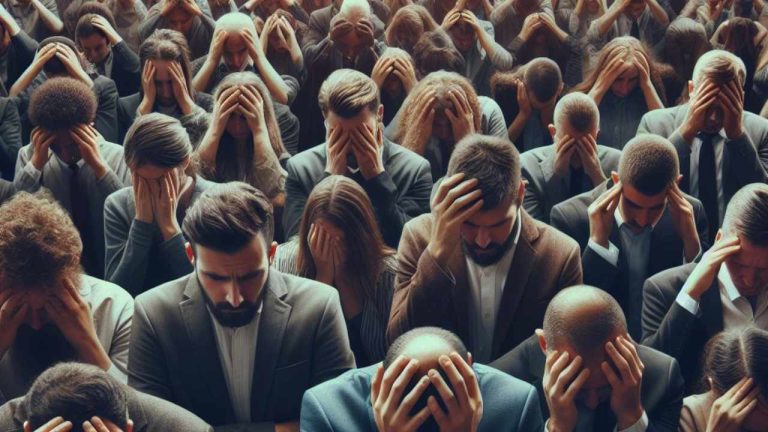

The U.S. Securities and Exchange Commission’s former head of internet enforcement has warned about investing in spot bitcoin exchange-traded funds (ETFs), which the SEC is expected to approve on Wednesday. He cautioned that spot bitcoin applicants are “nothing more than an opportunistic cartel of fee-sucking billionaire financial behemoths who have the audacity to design and manufacture a product to allow more investors to experience financial ruin and incalculable risk – just so they can once again line their pockets with fiat.”

Stark’s Spot Bitcoin ETF Warnings

Former U.S. Securities and Exchange Commission (SEC) official John Reed Stark, blasted spot bitcoin exchange-traded funds (ETFs) in a lengthy post on social media platform X Sunday. Stark is currently president of cybersecurity firm John Reed Stark Consulting. He founded and served as chief of the SEC Office of Internet Enforcement for 11 years. He was also an SEC enforcement attorney for 15 years.

“Amid a horrifically corrupt and criminal global crypto-marketplace and a crypto-ecosystem formulated into a toxic speculative cocktail of mathematical computational blather, affinity fraud and the ‘Greater Fool Theory,’ the SEC will reportedly approve the offering and inception of a bitcoin spot ETF. What a crock,” the former SEC official opined.

He preceded to highlight “the cataclysm of a bitcoin spot ETF.” Firstly, he stressed that a spot bitcoin ETF is yet another “fee-suck,” emphasizing:

Bitcoin spot ETF applicants are nothing more than an opportunistic cartel of fee-sucking billionaire financial behemoths who have the audacity to design and manufacture a product to allow more investors to experience financial ruin and incalculable risk – just so they can once again line their pockets with fiat (and more fiat).

He further warned that cryptocurrency is “one mammoth Ponzi scheme,” noting that crypto is “more expensive, more complex, and more risky than mainstream finance.”

In addition, Stark claimed that “crypto fails as a ‘financial panacea for the unbanked’ because it’s just another exemplar of ‘Predatory Inclusion’ and affinity fraud, sadly peddled to dupe the disadvantaged and disaffected.”

The former SEC official also mentioned the myriad of major crypto bankruptcies of the past several years as well as Tether minting. He also referenced the letter by Better Markets to the SEC warning of financial carnage and massive investor loss if spot bitcoin ETFs are approved.

The ex-SEC’s internet enforcement chief additionally described: “Bitcoin spot ETF promoters shill their empty-headed financial product as a means to usher in a new era of technological innovation.” Moreover, he stressed: “The very idea of a bitcoin spot ETF remains a laughable concept, not only because it will create yet another Wall Street investor scam and fee-suck of epic proportions, but also because a bitcoin spot ETF is perhaps the most ‘centralized’ crypto contraption conceivable.” He added:

In the cryptoverse, market manipulation is not only rampant and tolerated, but also encouraged. Fraud is not only rewarded, but also taught.

What do you think about the warnings by former SEC internet enforcement chief John Reed Stark regarding spot bitcoin ETFs? Let us know in the comments section below.