Quick Take

As Bitcoin’s value teeters slightly over $40,000, the market undergoes significant sell pressure, partly attributable to GBTC outflows and an intriguing profit-taking trend. This trend, which CryptoSlate closely monitors, reveals long-term holders and short-term holders engaging in profit-taking at levels not witnessed in years.

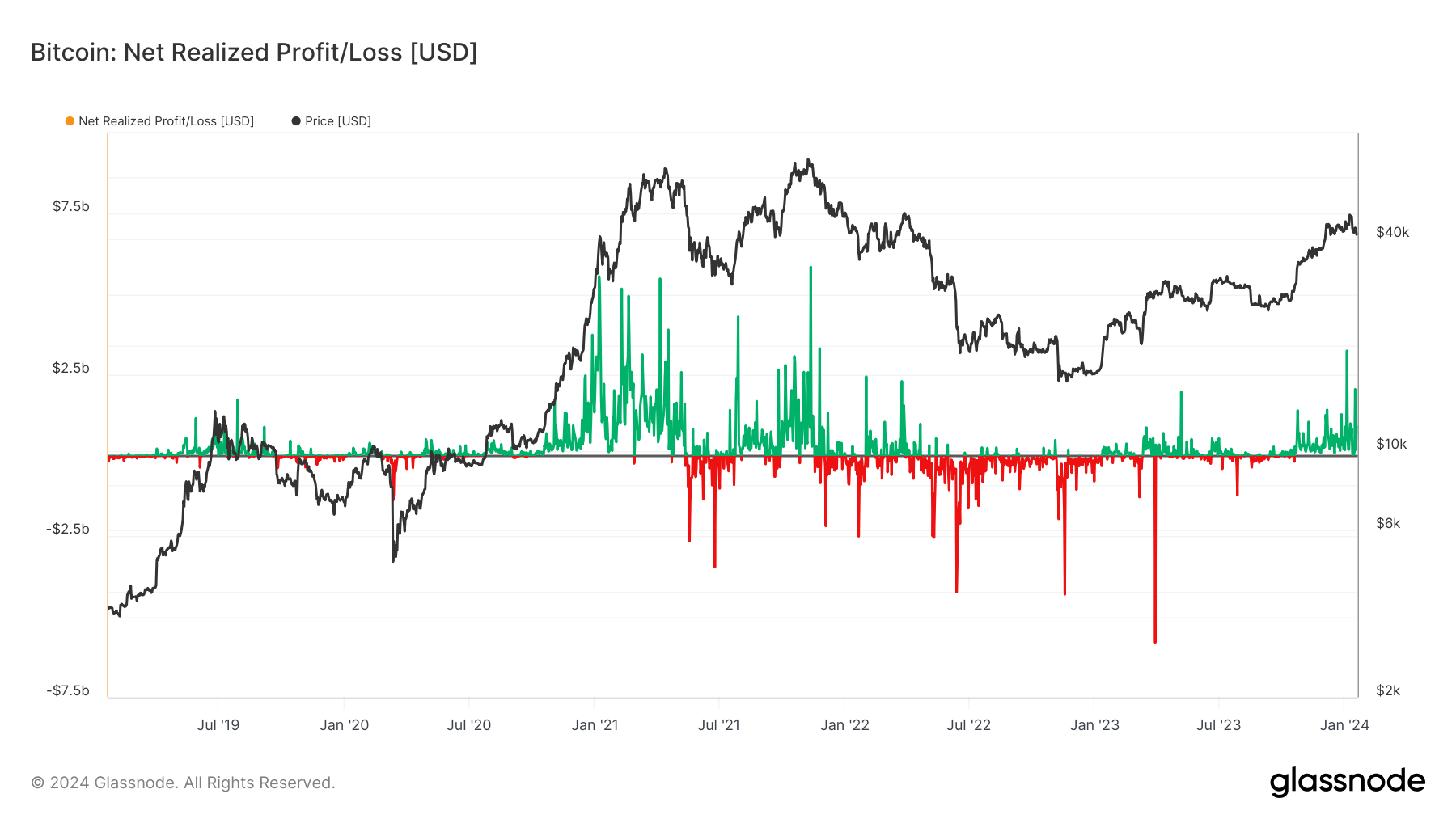

From Oct. 20, 2023, onwards, daily profit-taking has become a mainstay, mirroring the pattern seen during the bullish run from Sept. 2020 to Jan. 2021. As Bitcoin’s price escalated, profit-taking followed suit with minimal realized losses.

The phenomenon continues to escalate. Yesterday, Jan. 18, the market saw a staggering $900 million worth of profit-taking, indicating investors’ tendency to cash in on their earnings. This comes in the wake of Bitcoin’s impressive price climb from $25,000 to $49,000 in Jan. 2024, outlinging the pivotal role of profit-taking in shaping Bitcoin’s price trends.

The post 91 days of historical profit-taking emerges in Bitcoin appeared first on CryptoSlate.