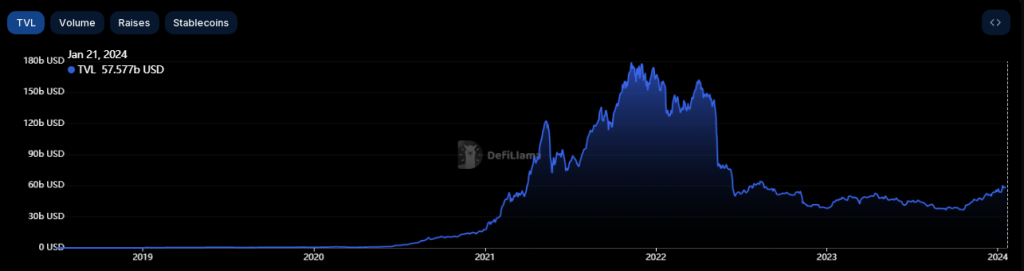

The Q4 report from Tron reveals a significant contrast between its thriving DeFi sector and subdued core network activity. Despite a remarkable 41% increase in Total Value Locked (TVL) in Tron’s DeFi space, securing the second position after Ethereum, the network experienced a slowdown in user growth.

At the time of writing, TRX was trading at $0.1108 up 0.9% in the last 24 hours, and tallying a 3.6% increase in the last seven days, data from Coingecko shows.

Tron User Engagement Stalls Amid Market Upturn

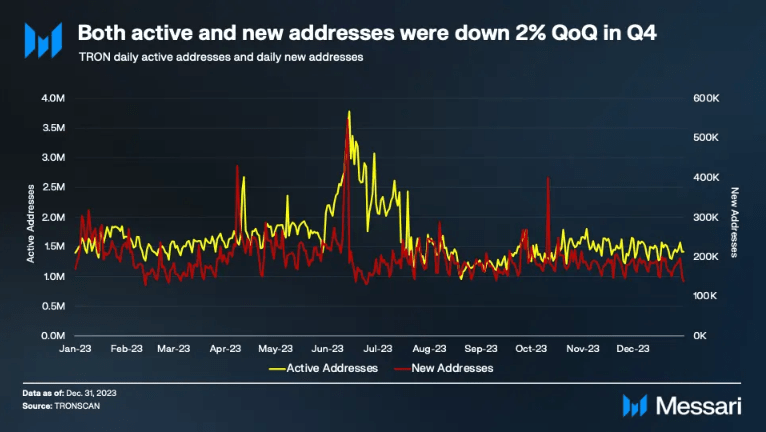

In contrast to the broader crypto market rally, Tron faced a peculiar deceleration in user expansion. Daily active addresses and new user creations both declined by 2%, raising concerns about Tron’s ability to attract and retain users during favorable market conditions. The number of new addresses created on Tron also fell by 2% to 185,000, intensifying worries about user engagement.

Transaction Decline

The decrease in user activity resulted in a 2.4% drop in transactions, averaging at 4.9 million daily. Messari, the on-chain analytics firm behind the report, attributed this decline to reduced “staking/unstaking” and “other” activities, indicating a slowdown in core network operations. Consequently, transaction fees experienced a 6% decrease compared to Q3.

Source: Messari

DeFi Flourishes

Despite the subdued user activity, Tron’s DeFi sector witnessed substantial growth. The Total Value Locked (TVL) surged by 20%, solidifying Tron’s status as a major DeFi hub. This remarkable leap positioned Tron with more than double the TVL of its closest competitor, BNB Chain.

DEXes Gain Momentum

In addition to the DeFi success, decentralized exchange (DEX) trading volume within Tron saw a remarkable 42% increase, breaking a trend of three consecutive quarters of decline. This surge suggests a rising adoption of Tron’s native DEXes, potentially fueled by the DeFi boom.

Assessing Tron’s Q4

Tron’s Q4 presents a puzzling scenario with the coexistence of a thriving DeFi sector and sluggish user activity. The reasons behind this user apathy, along with the decline in new address creations, warrant further investigation as they may hold the key to unlocking Tron’s full potential.

Tron’s Q4 reflects a dual narrative – a flourishing DeFi metropolis alongside a less active user environment. The network’s ability to bridge this gap and leverage its DeFi momentum to rekindle user engagement remains uncertain.

The upcoming quarters will reveal whether Tron can overcome this disparity and establish a unified narrative of success.

Featured image from Pexels