Bitcoin ETFs in the U.S. saw inflows of around $409 million yesterday as BlackRock recorded a purchase of roughly $160 million Bitcoin by adding a further 4,080 coins to its balance.

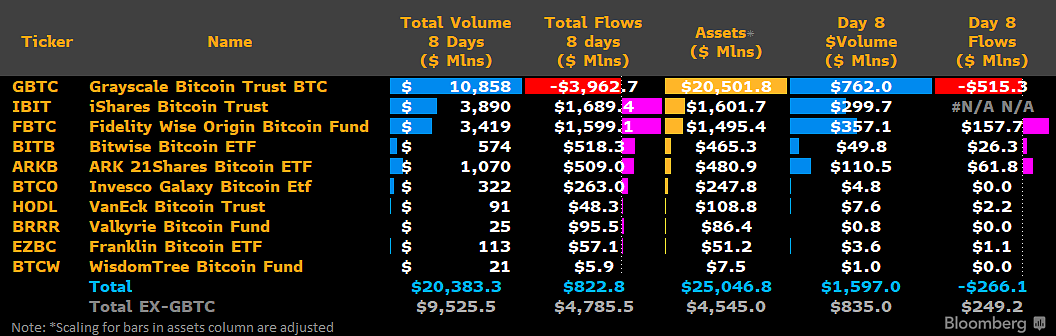

Data shared by Bloomberg analyst James Seyffart last night, Jan. 23, revealed $515 million in outflows for Grayscale with $249 million inflow from the other Newborn Nine ETFs. Given the now-released BlackRock data, this confirms that Jan. 23 was a net outflow day for Bitcoin ETFs of around $100 million.

CryptoSlate data below shows the inflows for BlackRock since inception, with 4,080 BTC added on Jan. 23. This brings its total assets under management to around $1.72 billion.

| Day | Date | NAV per Share | Shares Outstanding | New shares | New Shares by NAV | BTC | BRRNY | AUM by BRRNY | New BTC | Inflow by BRRNY Value |

|---|---|---|---|---|---|---|---|---|---|---|

| Day 8 | Jan 23, 2024 | $22.36 | 70,080,000 | 11,400,000 | $260,533,122 | 44,004 | $39,238 | $1,726,649,838.8 | 4,080 | $160,072,689 |

| Day 7 | Jan 22, 2024 | $22.86 | 58,680,000 | 8,440,000 | $201,471,535 | 39,925 | $40,116 | $1,601,631,300.0 | 6,494 | $260,513,304 |

| Day 6 | Jan 19, 2024 | $23.87 | 50,240,000 | 6,240,000 | $145,525,087 | 33,431 | $41,898 | $1,400,692,038.0 | 4,809 | $201,487,482 |

| Day 5 | Jan 18, 2024 | $23.32 | 44,000,000 | 15,280,000 | $371,435,072 | 28,622 | $40,933 | $1,171,584,326.0 | 3,555 | $145,516,815 |

| Day 4 | Jan 17, 2024 | $24.31 | 28,720,000 | 8,640,000 | $212,704,652 | 25,067 | $42,666 | $ 1,069,508,622.0 | 8,705 | $371,407,530 |

| Day 3 | Jan 16, 2024 | $24.62 | 20,080,000 | 15,480,000 | $386,031,927 | 16,362 | $43,210 | $707,002,020.0 | 4,923 | $212,722,830 |

| Day 2 | Jan 12, 2024 | $24.94 | 4,600,000 | 4,200,000 | $111,668,718 | 11,439 | $43,770 | $500,685,030.0 | 8,818 | $385,963,860 |

| Day 1 | Jan 11, 2024 | $26.59 | 400,000 | 400,000 | $10,449,833 | 2,621 | $46,666 | $122,311,586.0 | 2,393 | $111,671,738 |

| Seed | $26.12 | 228 | $10,000,000.0 | 228 | $10,000,000 |

The post Bitcoin ETFs see minor net outflows of $100 million as BlackRock acquires 4,080 more Bitcoin appeared first on CryptoSlate.