The anticipation of the first spot Bitcoin ETFs in the U.S. fueled Bitcoin to a 21-month high of $49,000. However, the high it reached on Jan. 10 was short-lived, as the price dropped swiftly and sharply to a low of $39,450 on Jan. 21. This sharp decline, which many deemed a classic case of “buy the rumor, sell the news,” was significant but not as catastrophic as it could have been. By Jan. 24, Bitcoin had bounced back, regaining the critical $40,000 level.

CryptoSlate’s previous analysis shed light on the market’s robustness in the face of this volatility. The market demonstrated an impressive capacity to absorb considerable selling pressures, effectively curbing additional liquidations and providing a buffer against further price decline.

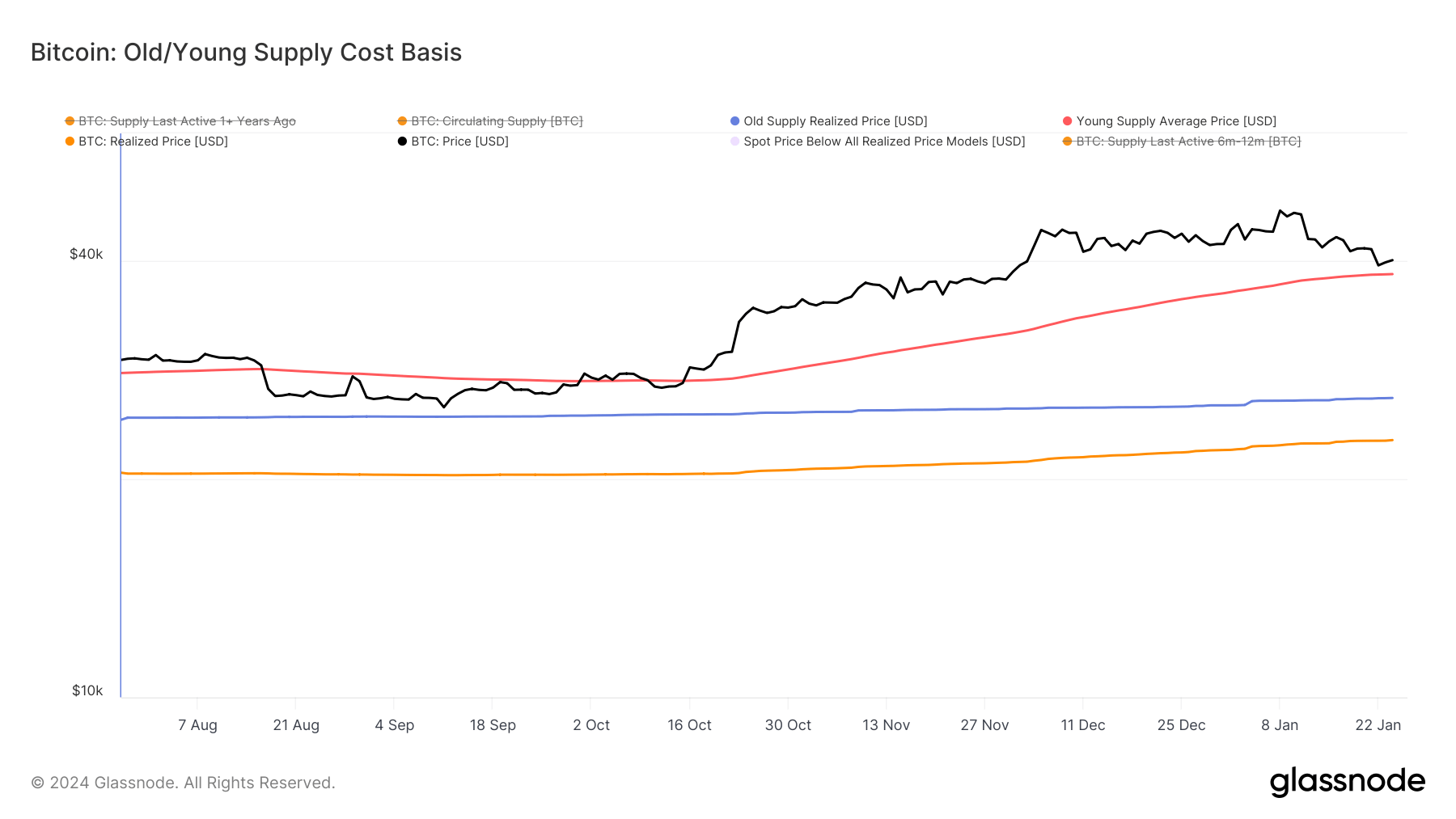

Another pivotal element that helped maintain Bitcoin’s price above $39,000 has been the realized price. The realized price indicates the aggregate price at which each coin was last moved on-chain. This metric is crucial in on-chain analysis, as it shows the average acquisition price of Bitcoin across different investor cohorts. By analyzing this, we can see the average cost basis of Bitcoin holders and estimate potential support and resistance levels.

However, a general assessment of Bitcoin’s cost basis offers limited insights. The realized price of the young supply – coins that have moved within the last six months – provides a more accurate reflection of the market sentiment. The young supply realized price, utilizing a 120-day exponential moving average, is a much better indicator of short-term holder behavior.

Data from Glassnode puts the realized supply of young supply at $38,370, significantly higher than the old supply’s realized price of $25,886. The realized price for young supply saw a relatively small increase between Jan. 10 and Jan. 25, while the realized price for old supply remained stable.

The lack of significant movement in the realized price for young supply created robust support for Bitcoin’s price at $39,000. Young supply, also referred to as short-term holders, react quickly and aggressively to price swings, and periods, where Bitcoin’s spot price fell below its cost basis, have often triggered a prolonged downward trend. The fact that Bitcoin’s price drop stopped at 16% could be attributed to the support created by the young supply’s realized price.

It serves as a very rough estimate of the price level recent investors are likely to defend and a level below which they could begin to capitulate.

The post Bitcoin’s realized price by ‘young supply’ underpins recent price support appeared first on CryptoSlate.