According to analytics firm Santiment, Artificial Intelligence (AI) and Real-World Assets (RWA) could be future drivers for the crypto market.

AI And RWA Crypto Tokens Have Seen High Interest Recently

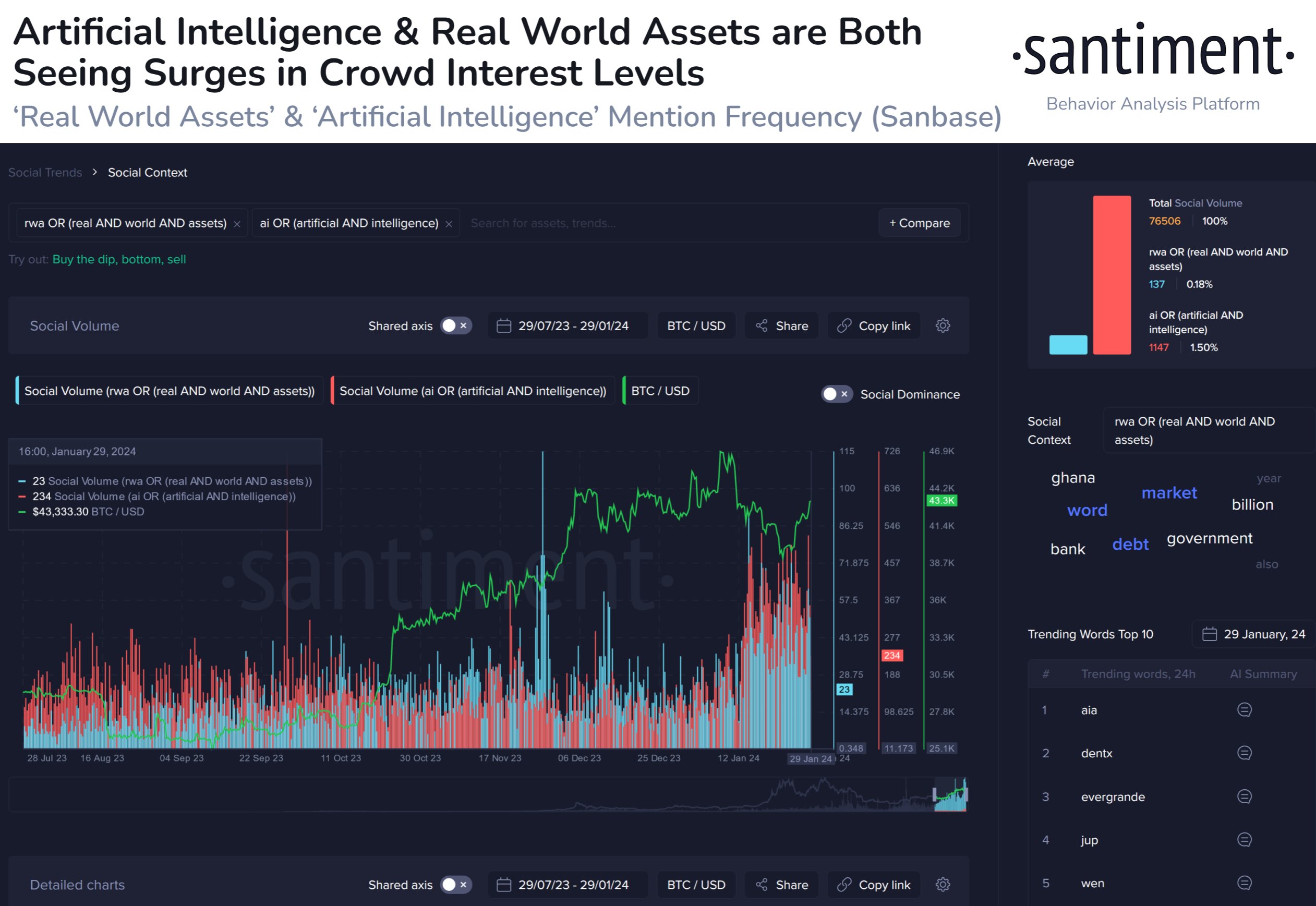

As explained by Santiment in a new post on X, topics like AI and RWA have recently seen a surge in interest. The indicator of relevance here is the “Social Volume,” which keeps track of the amount of discussion related to any given topic or term occurring on social media platforms.

This metric makes this measurement by counting the number of unique posts/threads/messages that mention at least one topic in question. The indicator measures the number of posts rather than the number of mentions themselves because the latter can provide a skewed picture.

Consider a situation where many mentions are occurring on these platforms but are limited to only a few posts. Discussion around the topic is happening for sure. Still, the fact that only some users are engaging in it could imply that the average user may not have any interest in the topic.

A large number of posts being made around the topic, on the other hand, would imply discussion is happening across social media, and hence, there has to be some interest outside niche circles.

Now, here is a chart that shows the trend in the social volume of AI and RWA over the last few months:

As displayed in the above graph, the Social Volume for these two topics has been at notable levels recently, implying that the crowd has been paying attention to them. Based on this increased interest, Santiment believes these topics are “projecting to be future crypto market drivers.”

“In the ever-changing climate of trader interests over the years, such as DeFi, NFT‘s, memecoins, or staking, these more recent topics have been a major focus, and many related tokens have taken turns benefiting from market decouplings,” notes the analytics firm.

Santiment has also listed some cryptos that connect with these topics. For the AI side, there is The Graph (GRT), Fetch.ai (FET), SingularityNET (AGIX), Ocean Protocol (OCEAN), and Bittensor (TAO).

Meanwhile, for RWA, the analytics firm has pointed out cryptos like Avalanche (AVAX), Chainlink (LINK), Internet Computer (ICP), and Maker (MKR). Given the high interest backing both these topics, it’s possible these assets could be ones to keep an eye on in the future.

Avalanche Price

Avalanche has observed a strong surge during the past week as the asset’s price has shot up almost 30%. Following this surge, the crypto has cleared the $35 level.

The chart below shows how AVAX has performed recently.