A few weeks have passed since the Bitcoin ETFs have gone live on trading. Here’s how much of the asset’s circulating supply these funds hold now.

Bitcoin Spot ETFs Now Carry This Much Of The Cryptocurrency’s Supply

On January 10, the much-anticipated spot ETFs gained approval for Bitcoin from the US Securities and Exchange Commission (SEC). The next day, January 11th, these ETFs went live on trading, marking a historic day for the cryptocurrency.

Exchange-traded funds (ETFs) refer to financial instruments that allow investors to gain exposure to a commodity without actually owning said asset. In the case of BTC, ETFs can be a more appealing way to invest in the coin for traders who aren’t well-versed in how cryptocurrencies work.

The spot ETFs trade on traditional exchanges, so such investors, who may already be familiar with the traditional mode of trading, won’t have to learn how to navigate digital asset exchanges and wallets.

In order to provide this indirect exposure to the investors, the funds themselves buy and hold Bitcoin. CryptoQuant Netherlands community manager Maartunn has shared some quick numbers related to the current holdings of the spot ETFs in a new post on X.

First, here is a chart that shows the holdings of the older BTC funds, including the Grayscale Bitcoin Trust (GBTC):

From the graph, it’s visible that the holdings of these funds have plunged recently. This is due to the massive outflows that GBTC has observed following its conversion to a spot ETF. In total, these funds now carry 564,402 BTC.

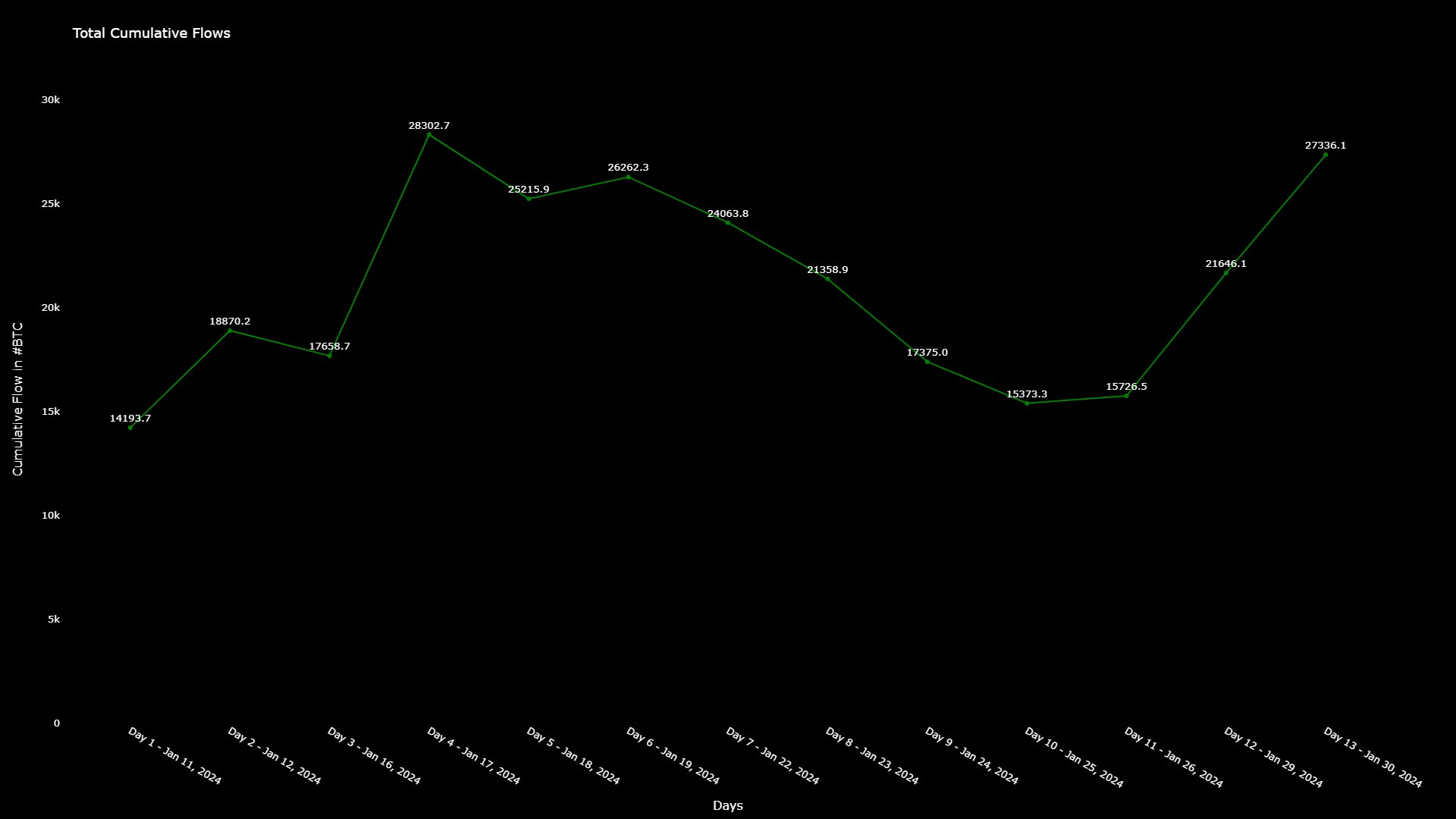

Now, below is a chart that displays the cumulative flows that the new spot ETFs as a whole have witnessed since they have gone live.

As is apparent from the graph, the new spot ETFs have seen net inflows of 27,336 BTC. Adding this amount to the other metric, these funds hold a total of 591,738 BTC. In terms of the US Dollar, this is equivalent to a whopping $25.5 billion at the current exchange rate of the asset.

The current total circulating supply of the cryptocurrency is equal to 19,615,950 BTC, which means that the total amount held by these funds corresponds to about 3% of this figure.

Something to note, though, is that the cumulative flows would also include the GBTC outflows, so this percentage isn’t perfectly correct. When accounting for this correction, the figure rises to about 3.3%.

BTC Price

Although the approval of the Bitcoin spot ETFs was something looked forward to among the investors in the cryptocurrency sector as a whole, the event turned out to be a sell-the-news one in the end.

This event started an extended downtrend for the asset, from which the price has only just begun to make some recovery. The below chart shows how the cryptocurrency has performed over the past month.

Bitcoin is trading around $43,000 right now, meaning that the cryptocurrency is yet to make a recovery to the levels it was at during the days surrounding the spot ETF approval.