The state of Bitcoin (BTC) price action across multiple time frames has analysts at the edge of their seats. As of February 7, various technical formations suggest that the leading crypto appears poised for a critical breakout from the current consolidation.

Is Bitcoin Preparing For A Big Move?

Taking to X, Mags thinks Bitcoin is in for a “big move,” considering the candlestick arrangement in the weekly chart. The analyst notes that prices have been moving horizontally in the past nine weeks, falling within the expected range.

The Bitcoin market has ranged between 8 and 30 weeks in the past. So far, the current consolidation has lasted for nine weeks. Amid this, Bitcoin prices have tested both sides of the range with notable “fake-outs.”

In light of the current state of affairs in the Bitcoin market, Mags is confident that the prolonged consolidation suggests that the coin, guided by history, could edge higher.

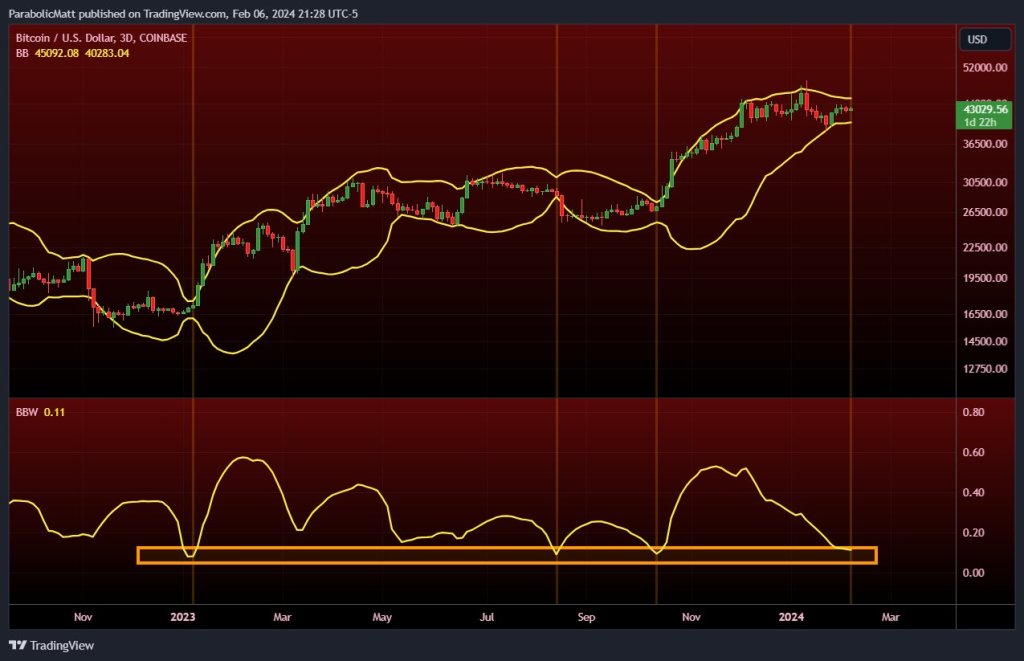

Beyond the ranging market, another analyst notes that the Bitcoin 3-day Bollinger Bands, a technical indicator that measures volatility, is narrowing. The squeeze, the trader notes, is at historical levels, often followed by a breakout. However, as it is, how prices will evolve in the weeks and months ahead remains uncertain.

Adding to the intrigue, Jason Goepfert on X points out that the S&P 500, a stock market index, is currently within 0.35% of its 3-year high. The uptrend is clear even though less than half of all stocks constituting the index are trading above their 10-day moving average.

At the same time, less than 60% are above their 50-day moving average, and fewer than 70% are above their 200-day moving average. This rare confluence suggests that the financial market could be at a critical turning point, possibly impacting crypto.

Eyes On Spot ETF Issuers And United States Federal Reserve

Only time will tell whether Bitcoin will rally or tank from spot rates. However, what’s evident is that the Bitcoin uptrend remains clear, with fundamentals aligning to support optimistic bulls. To illustrate, spot Bitcoin ETF issuers are buying more coins from the market. At the same time, the excitement around the upcoming Bitcoin halving event is adding fuel to the optimism.

The broader market is also watching the United States Federal Reserve. Market consensus is that the central bank will slash interest rates in March 2024 and embark on quantitative easing. With more money circulating, some will find their way to Bitcoin, driving prices to record highs of $69,000 or beyond in the coming months.