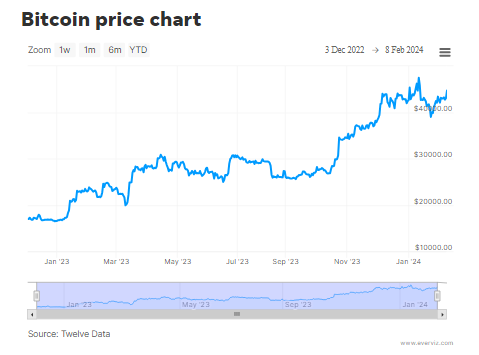

For the first time since the spot ETFs’ debut trade on January 11, Bitcoin (BTC) has surpassed $46,000. According to data from Coingecko, BTC had increased 3.4% in the previous day to $46,075 at the time of publication, maintaining a 6% increase over the previous seven days.

Bitcoin Flexes Muscles, Reclaims $46K Level

Despite the approval of several eagerly awaited exchange-traded funds that were meant to strengthen its institutional legitimacy, Bitcoin’s 2024 has had a rough start. However, things are improving as Bitcoin is now again trading above the $46k territory.

Laurent Ksiss, a specialist in crypto Exchange-Traded Products (ETPs) at CEC Capital, mentioned that if the current upward trend continues, breaking the $45,000 mark could bring early investors in the BTC ETF close to being profitable. He also suggested that this momentum might lead to some investors taking profits, potentially triggering a reversal and testing the $42,000 to $40,000 level.

Laurent Ksiss, a specialist in crypto Exchange-Traded Products (ETPs) at CEC Capital, mentioned that if the current upward trend continues, breaking the $45,000 mark could bring early investors in the BTC ETF close to being profitable. He also suggested that this momentum might lead to some investors taking profits, potentially triggering a reversal and testing the $42,000 to $40,000 level.

After the introduction of 10 ETFs in January, the price of BTC experienced an unanticipated decline. The value plunged after momentarily touching $49,000 when one of the funds, Grayscale, began transferring significant portions of their cryptocurrency to Coinbase.

This was due to the fact that, before Grayscale converted the Bitcoin Fund ETF to an open-ended fund, investors had to hold their shares for a minimum of six months before they could cash out. Many of the investors were eager to cash out and redeem their shares when it became an ETF in January.

Whale Appetite Up For BTC

As a result, Grayscale sold enormous quantities of Bitcoin, which dropped in price. It was trading below $39,000 at one point. However, it appears that the sell-off is ended, and Bitcoin is rising once more, partly due to large holders acquiring the asset.

Meanwhile, Markus Thielen, head of research at Matrixport and founder of 10x Research, says that Bitcoin (BTC) is headed towards $48,000 in the near future following its breakout driven by a solid track record of gains during the Chinese New Year festival.

Since bitcoin often rises by more than 10% around Chinese New Year, beginning on February 10, the following few days are extremely important statistically, according to Thielen’s research from Thursday.

Every time traders acquired bitcoin three days prior to the start of the Chinese New Year and sold it 10 days later, the price of bitcoin has increased during the previous nine years, according to Thielen.

Bitcoin Seen Hitting $50K

In a related development, LMAX Digital stated that it anticipates bitcoin to continue rising, maybe hitting the $50,000 mark.

According to LMAX Digital, technically speaking, bitcoin has broken out of a range and may be aiming for a surge to a new yearly high through $50,000.

Using Elliott Wave theory, a technical study that presupposes that prices move in repeating wave patterns, Thielen projected greater upside for bitcoin in the future.

The concept states that price trends evolve in five stages, with waves 1, 3, and 5 serving as “impulse waves” that indicate the primary trend. Retracements between the impulsive price movement occur in waves two and four.

Thielen said Bitcoin has started its final, fifth impulsive stage of its rally, aiming to reach $52,000 by mid-March, after completing its wave 4 retracement and correcting to $38,500.

Featured image from Adobe Stock, chart from TradingView